General Department of Taxation issued a document urging tax collection on mutant orchid business

Before the news of mutant orchids being sold for hundreds of billions of dong, the General Department of Taxation issued a document urging local tax departments to strengthen their grasp of the situation of transactions of this product. In case of trading mutant orchids, they must pay taxes.

In recent times, issues related tomutant orchidshas been causing a stir in public opinion. In particular, public opinion is very interested in how the Tax Department will manage the collection of taxes on the business of mutant orchids.

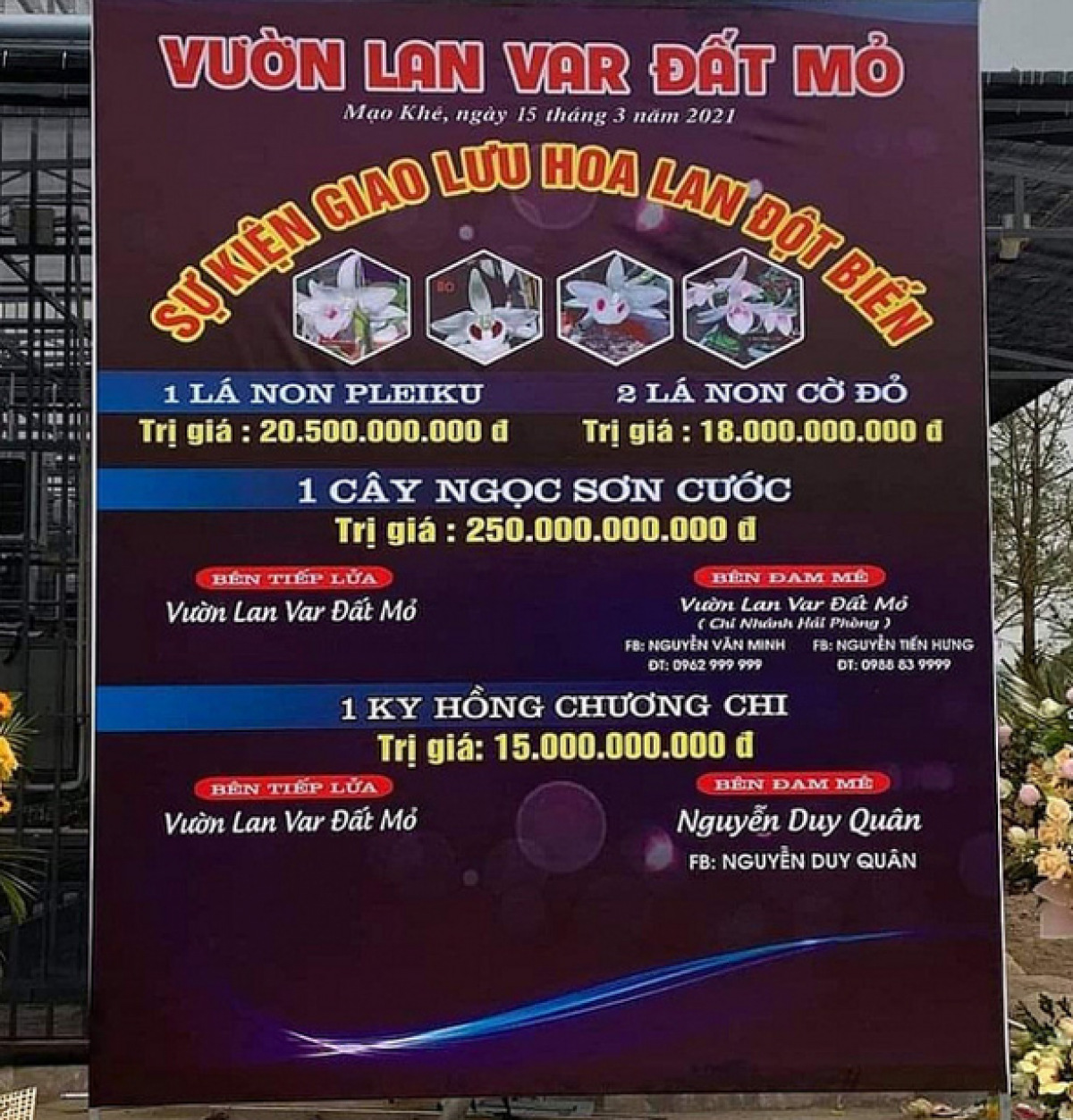

In a press release sent to the press on the afternoon of March 26, the General Department of Taxation said that recently, the mass media has reported on transactions of buying and selling mutated orchids worth hundreds of billions of dong in Ha Nam and Quang Ninh.

Therefore,General Department of TaxationRequire local tax departments to grasp the situation of orchid transactions and coordinate with specialized agencies to verify the reality and collect taxes according to regulations.

|

| The 250 billion VND mutant orchid sale deal in Quang Ninh stirred up the online community in mid-March. Photo: Internet |

The General Department of Taxation has issued many instructions to tax authorities to strengthen tax management of business activities related to mutant orchids. On March 25, 2021, the General Department of Taxation continued to issue Official Dispatch No. 833/TCT-DNNCN to the Tax Departments of provinces and centrally run cities.

To strengthen the direction of tax management for mutant orchids, the General Department of Taxation requests the Tax Departments of provinces and centrally-run cities to grasp the situation of mutant orchid trading transactions in the area, and coordinate with specialized agencies to verify the reality and handle tax management in accordance with the provisions of law on Tax Management, Value Added Tax (VAT), Corporate Income Tax (CIT) and Personal Income Tax (PIT). Specifically as follows:

In case of purchase and sale transactions of organizations

On VAT policy:

- In case of "Mutant orchids" grown and sold by enterprises and organizations, they are not subject to VAT;

- In case of "Mutant orchids" sold by enterprises and cooperatives paying VAT under the deduction method to enterprises and cooperatives in the commercial business stage, they do not have to declare and pay VAT;

- In case of "Mutant Orchids" sold by enterprises and cooperatives paying VAT under the deduction method to households, business individuals and other organizations and individuals in the commercial business stage, they must declare and pay VAT at the tax rate of 5%.

|

| Illustration photo |

- In case of "Mutated Orchids" by enterprises, cooperatives and other economic organizations paying VAT according to the direct calculation method on VAT sold in the commercial business stage, they must declare and pay VAT at a rate of 1% on revenue.

On corporate income tax policy:

In case an organization or enterprise has income from selling "mutant orchids", it is subject to corporate income tax according to regulations. In case an organization or enterprise has income from selling "mutant orchids" that meets the provisions in Clause 1, Article 4 of the Corporate Income Tax Law No. 14/2008/QH12 dated June 3, 2008 (amended in Clause 2, Article 1 of Law No. 71/2014/QH13 amending and supplementing a number of articles of the Laws on tax), it is exempt from corporate income tax according to regulations.

In case of purchase and sale transactions between households and individuals

- Business households and individuals that have transactions of buying and selling "Mutated Orchids" are subject to VAT and Personal Income Tax according to regulations on business activities with VAT rate of 1% and Personal Income Tax rate of 0.5%.

- For households and individuals directly involved in agricultural production activities (cultivation) that have not been processed into other products, agricultural products in this case are not subject to VAT according to the provisions of Clause 1, Article 1 of Law No. 106/2016/QH13 and are exempt from personal income tax according to the provisions of Article 4 of Personal Income Tax Law No. 04/2007/QH12.

The General Department of Taxation requests the Tax Departments of provinces and centrally run cities to base on the provisions of the Tax Law and related laws to carry out tax management for the purchase and sale of "mutated orchids" in the locality and related organizations and individuals according to the provisions of the law. During the implementation process, if any signs of law violations are detected, they will be transferred to the relevant authorities for handling according to the provisions of the law./.