One-time allowance for foreign workers working in Vietnam

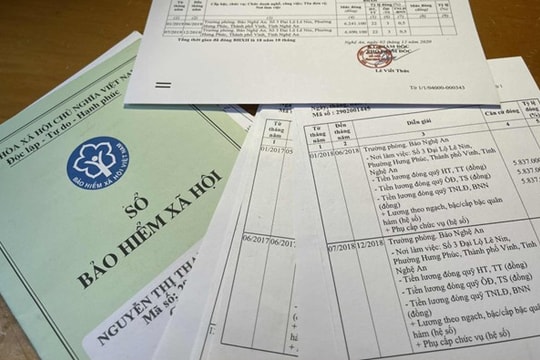

Vietnam Social Security has just answered questions related to insurance policies for foreign workers working in Vietnam.

The Government has just issued Decree No. 143/2018/ND-CPdetailing the Law on Social Insurance and the Law on Occupational Safety and Hygiene on compulsory social insurance for foreign employees working in Vietnam.

Accordingly, Article 15 specifically stipulates the order and procedures for participating in and resolving social insurance regimes as follows:

- The procedures for participating in social insurance and the procedures for settling social insurance benefits for employees prescribed in Clause 1, Article 2 of this Decree shall be implemented according to the procedures for Vietnamese employees and shall be implemented according to the provisions in Chapter VII of the Law on Social Insurance; Articles 57, 58, 59, 60, 61, 62 of the Law on Labor Safety and Hygiene; Article 5 of Decree No. 115/2015/ND-CP; Articles 9, 10, 13, 14, 17, 18, 21, 22, 25 and Article 26 of Decree No. 37/2016/ND-CP, except for the provisions in Clause 3 of this Article and Article 16 of this Decree.

- The application documents for participation and settlement of social insurance regime of employees in Clause 1 of this Article issued by foreign agencies must be translated into Vietnamese and certified according to the provisions of Vietnamese law.

- Settlement of one-time social insurance benefits: Within 10 days from the date of termination of the labor contract or the date the work permit, practice certificate, or practice license expires (whichever comes first), if the employee does not continue to work under the labor contract or the license is not renewed, the employee requests one-time social insurance benefits and submits the application as prescribed to the social insurance agency.

Within 5 working days from the date of receiving complete documents as prescribed, the Social Insurance agency is responsible for resolving and organizing payment to the employee. In case of failure to resolve, a written response must be given stating the reason.

.jpg)