China regains title of largest US creditor from Japan

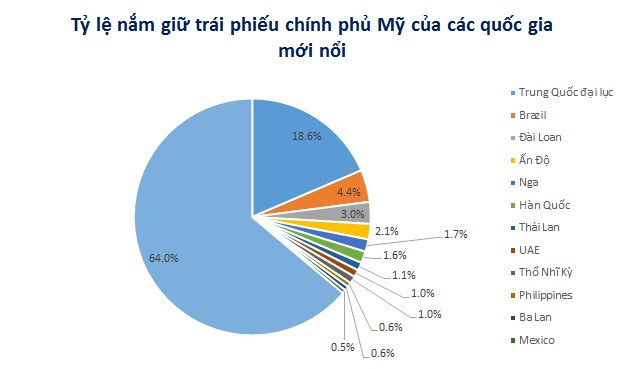

According to a recent report by the US Treasury Department, as of June 2017, emerging countries hold 36% of the total government bonds of the world's largest economy.

|

| US Treasury Department headquarters. Photo: Seeking Alpha |

Foreign countries are holding about 6,170 billion USD of US government bonds, of which emerging countries hold about 2,200 billion, accounting for 36% of total outstanding bonds.

Among the 12 emerging countries (according to MSCI criteria) mentioned in the report, China is the largest creditor of the US government, holding 1,147 billion USD, an increase of 44.3 billion compared to May 2017 and accounting for 18.6% of the total outstanding US government bonds.

As a result, China regained the title of the largest creditor of the US from Japan, which has become the largest holder of US government bonds since October last year. Japan now owns 1,091 billion USD of debt issued by the US government.

Brazil holds 4.4% of total outstanding US government bonds. The list of emerging countries that are the largest US creditors also includes Taiwan, India, Russia, South Korea, Thailand and the Philippines.

The top five emerging countries that hold US debt – China, Brazil, Taiwan, India and Russia – account for 82.6% of outstanding debt in the emerging market bloc. Each holds at least $100 billion in US government bonds.

In May 2016, Tri Thuc Tre website cited data from the US Treasury Department stating that Vietnam held at least $12 billion in US government bonds at that time. Accordingly, Vietnam was among the top 50 largest creditor countries of the US. The amount of US debt held by Vietnam increased 3.5 times between the beginning of 2012 and the end of 2014.

|

| Source: US Treasury Department. |

Why does China keep buying US debt?

China has been buying US government bonds for the past seven months, while Japan has reduced its holdings.

Last year, China dumped US government bonds to prop up its currency, the yuan, which was plunging, in a campaign to stem the flow of foreign currency out of the country. When the situation stabilized, China went back to buying US debt.

Despite its continued purchases, China's holdings of US bonds remain lower than they were in September 2016, a month before China lost its position as the top US creditor to Japan.

According to Frontera, China's return to buying US bonds shows the country's confidence in its currency and the health of its economy. Moreover, China is increasing its outstanding US government bonds.

In contrast, Japan is cautious about buying due to rising US interest rates. Japan does not want to buy at a time when yields are expected to continue rising.

According to bizlive.vn