From June 1, 2025, which business households must use electronic invoices generated from cash registers?

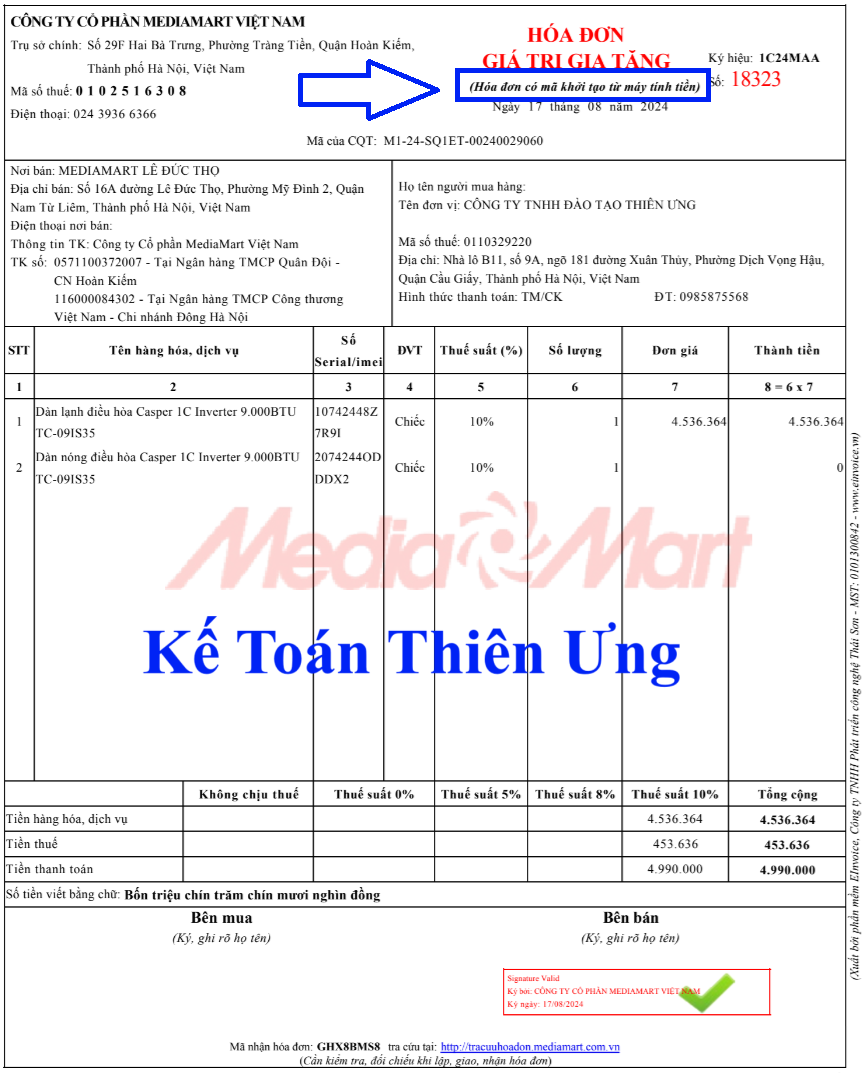

From June 1, 2025, it is mandatory to use electronic invoices generated from cash registers for a number of business sectors and business households.

Mandatory regulations

According to new regulations of the tax industry, from June 1, 2025, businesses and business households operating in the fields of: food and beverage, accommodation, entertainment, transportation, retail goods... and having revenue of 1 billion VND/year or more will be required to use electronic invoices with codes of tax authorities generated from cash registers. This is an important step to accelerate the digital transformation process, modernize tax management and build a transparent and sustainable digital economy.

A representative of the Tax Department of Region X said: The implementation of electronic invoices from cash registers is carried out in accordance with Decree No. 123/2020/ND-CP of the Government and Circular No. 78/2021/TT-BTC of the Ministry of Finance. To ensure timely application, mandatory subjects must complete registration and implementation before May 30, 2025. Cases of non-compliance may be subject to administrative sanctions with fines of up to VND 20 million, according to the provisions of the Law on Tax Administration.

Using electronic invoices from cash registers is not only a legal requirement but also brings many practical benefits to businesses and business households. Specifically, the electronic invoice system helpstSave time, printing and storage costs, and minimize the risk of errors in declaration and recording. On the other hand, connecting directly with the tax authorities through the cash register system will help increase transparency in business operations, limit tax fraud and create a healthy competitive environment.

Prepare infrastructure in advance

To support businesses and business households in timely implementation, the General Department of Taxation has announced a list of qualified e-invoice solution providers connecting to the tax system. This list is publicly posted at:

👉http://hoadondientuhoadondientu.gdt.gov.vn/danh-sach-tvan

In addition, taxpayers can also look up detailed information, implementation instructions, and related policies on the Nghe An Provincial Tax Department's Electronic Information Portal at:

👉https://nghean.gdt.gov.vn

The Tax Department of Region X encourages business units to proactively contact solution providers, test the system early and fully prepare necessary technical conditions to avoid being passive and affecting business operations.

In the context of the economy strongly transforming towards digitalization, compliance and application of technology in financial and accounting management is a key factor to help businesses improve operational efficiency, while actively contributing to tax administrative reform and socio-economic development.