From 2022, Social Insurance and Health Insurance policies will have many changes.

(Baonghean.vn) - Many Social Insurance and Health Insurance policies will change from January 1, 2022 to benefit workers.

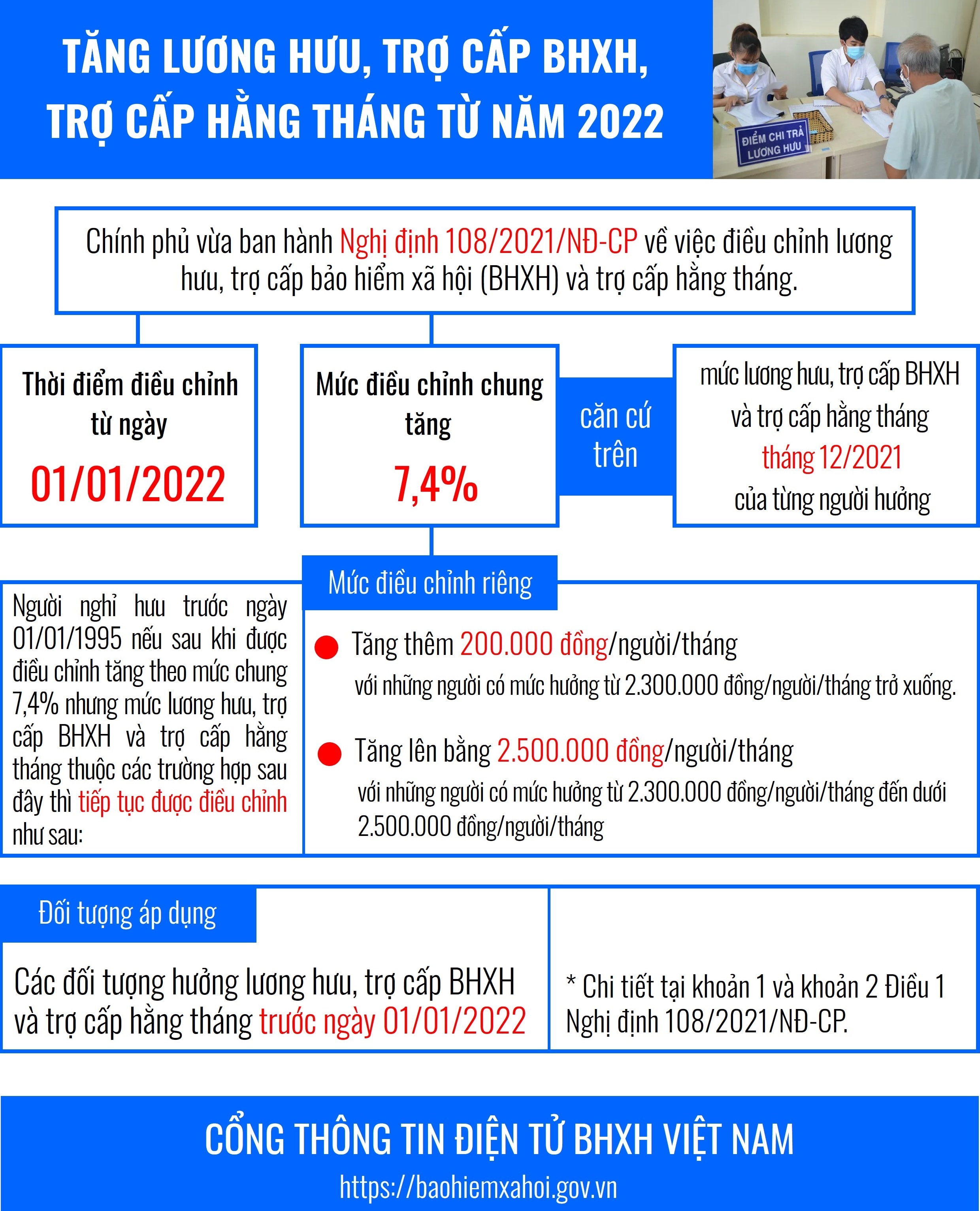

I.Increase pensions, social insurance benefits, monthly allowances for many subjects

From January 1, 2022, an additional 7.4% increase will be made to the pension, social insurance benefits and monthly allowances of December 2021 for pensioners, social insurance benefits and monthly allowances before January 1, 2022, including 7 groups of subjects:

1. Cadres, civil servants, workers, public employees and laborers (including those who have participated in voluntary social insurance, retirees from Nghe An Farmers' Social Insurance Fund transferred according to Decision 41/2009/QD-TTg on transferring Nghe An Farmers' Social Insurance to voluntary social insurance); Military personnel, people's police and people working in key positions who are receiving monthly pensions.

2. Commune, ward and town officials are specified in:

- Decree 92/2009/ND-CP on titles, numbers, some regimes and policies for cadres, civil servants in communes, wards, towns and non-professional workers at commune level;

- Decree 34/2019/ND-CP amending a number of regulations on commune-level cadres, civil servants and non-professional workers at commune level, in villages and residential groups;

- Decree 121/2003/ND-CP on regimes and policies for cadres and civil servants in communes, wards and towns;

- Decree 09/1998/ND-CP amends Decree 50/CP on living allowance regime for commune, ward and town officials receiving monthly pensions and allowances.

|

| Consulting for workers at Quynh Luu Social Insurance Agency. Photo: My Ha |

3. People receiving monthly disability benefits according to the provisions of law; people receiving monthly benefits according to:

- Decision 91/2000/QD-TTg on allowances for people who have reached retirement age at the time of stopping receiving monthly allowances for loss of working capacity;

- Decision 613/QD-TTg on monthly allowances for people with 15 to under 20 years of actual work experience whose period of receiving allowances for loss of working capacity has expired;

- Rubber workers are receiving monthly allowances according to Decision 206-CP on policies for newly liberated workers who do hard work that is harmful to their health but now have to quit their jobs due to old age.

4. Commune, ward and town officials who are receiving monthly allowances according to Decision 130-CP dated June 20, 1975 and Decision 111-HDBT on amending a number of policies and regimes for commune and ward officials.

|

| Consulting for workers at Hung Nguyen Social Insurance Agency. Photo: My Ha |

5. Military personnel receiving monthly allowances according to Decision 142/2008/QD-TTg on implementing the regime for military personnel participating in the resistance war against the US to save the country with less than 20 years of service in the army who have been demobilized and returned to their localities (amended by Decision 38/2010/QD-TTg).

6. People's Public Security officers who are receiving monthly allowances according to Decision 53/2010/QD-TTg on the regime for People's Public Security officers and soldiers who participated in the resistance war against the US with less than 20 years of service in the People's Public Security who have quit their jobs and returned to their localities.

7. Military personnel, people's police, and people working in secretarial work receive salaries similar to those of military personnel and people's police who are receiving monthly allowances according to Decision 62/2011/QD-TTg on regimes and policies for those who participated in the war to protect the Fatherland, performed international missions in Cambodia, and helped Laos after April 30, 1975 and have been demobilized, discharged, or quit their jobs.

|

In addition, the subjects specified in Clause 1 of this Article who retired before January 1, 1995, after making adjustments according to the provisions of Clause 1, Article 2 of this Decree, and whose pension, social insurance allowance, and monthly allowance are less than VND 2,500,000/month, are also subject to adjustment.

Accordingly, increase by 200,000 VND/person/month for those with pension, social insurance allowance, monthly allowance from 2,300,000 VND/person/month or less; increase by 2,500,000 VND/person/month for those with pension, social insurance allowance, monthly allowance from 2,300,000 VND/person/month to less than 2,500,000 VND/person/month.

The level of pension, social insurance allowance, and monthly allowance after adjustment according to regulations is the basis for calculating pension and allowance adjustments in subsequent adjustments.

I.Continue to adjust retirement age, increase years of social insurance payment to receive pension for men

According to Article 169 of the 2019 Labor Code, the retirement age will be adjusted annually from 2021, adding three months for male workers until reaching 62 years old in 2028; adding four months for female workers until reaching 60 years old in 2035.

In 2022, the retirement age for male workers under normal working conditions will be 60 years and 6 months and for female workers it will be 55 years and 8 months.

By LawSocial insuranceIn 2014, from 2022, the number of years of social insurance contributions to receive pensions for male workers will be adjusted. The pension rate of 45% must have paid social insurance for 20 years or more instead of 19 years as currently. To receive the maximum rate of 75%, male workers must have paid social insurance for 35 years, an increase of one year compared to 2021.

|

| Workers complete procedures to receive support from the Social Insurance Fund. Illustrative photo |

III. MThe lowest voluntary social insurance contribution is 330,000 VND/month.

According to Clause 2, Article 87 of the Law on Social Insurance 2014, the voluntary social insurance contribution rate is equal to 22% of the monthly income chosen by the employee, the lowest being equal to the poverty line in rural areas in each period. Starting from January 1, 2022, the poverty line for rural areas in the period 2021-2025 prescribed in Decree No. 07/2021/ND-CP dated January 27, 2021 of the Government is 1,500,000 VND.

Accordingly, the lowest voluntary social insurance contribution is 330,000 VND/month and the amount of State support for participants will also increase. Specifically:

For poor participants: The support amount will increase from 46,200 VND to 99,000 VND/month.

For participants from near-poor households: The support amount will increase from 38,500 VND to 82,500 VND/month

For other participants: The support amount will increase from 15,400 VND to 33,000 VND/month.

|

For those who previously participated in voluntary social insurance and registered an income level of less than VND 1,500,000 by December 31, 2021, the social insurance collection agent will directly contact and guide people through the procedures to change the income level as the basis for payment.

For those who have participated in voluntary social insurance and registered an income level of less than VND 1,500,000 but have not yet reached the payment deadline by December 31, 2021, they will still follow the previously registered method until the payment deadline. Participants will not have to pay the difference when the Government adjusts the income level used as the basis for payment.

IV.Agricultural, forestry, fishery and salt-making households with average living standards are supported by the budget with 45% of the contribution when participating in health insurance.

From January 1, 2022, people in agricultural, forestry, fishery and salt-making households with an average living standard in Nghe An province will receive 45% of the contribution from the budget when participating in health insurance (an increase of 5% compared to 2021). Of which:

The state budget supports 30% of the contribution, equivalent to: 241,380 VND.

Local budget supports 15% of the contribution, equivalent to: 120,690 VND.

The contribution level when participating in health insurance for people in households working in agriculture, forestry, fishery, and salt production with an average living standard in Nghe An province in 2022 is: 442,530 VND/person/12 months./.

.jpg)