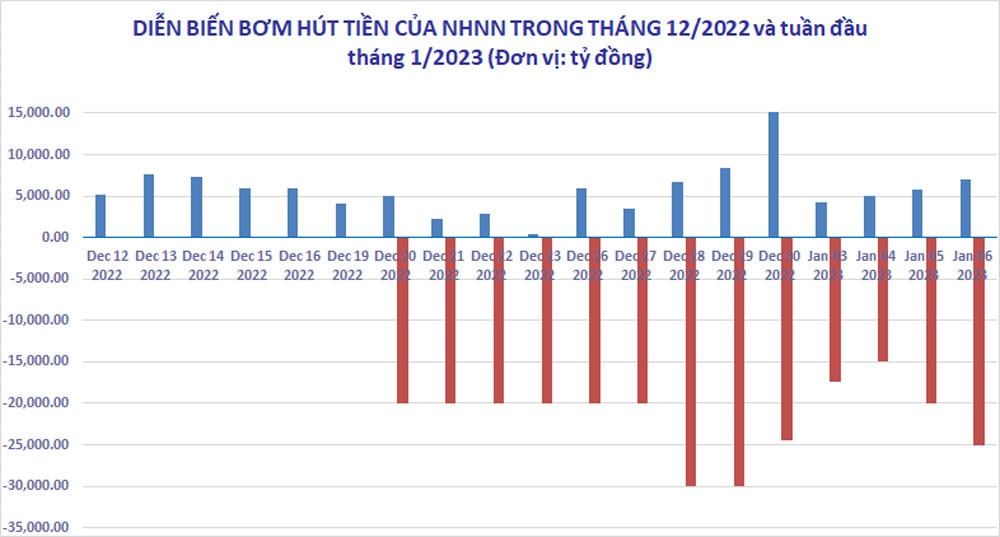

In the first week of the new year 2023, the State Bank withdrew a net of more than 97,267 billion VND

The State Bank continued to strongly withdraw money from the banking system in the first week of the new year 2023 amid concerns about the USD/VND exchange rate increasing due to signals from the US and despite overnight interest rates rising rapidly again.

Rush to suck money

In the trading session on January 6, the State Bank of Vietnam (SBV) continued to use the treasury bill tool to strongly attract a total of nearly VND 25,000 billion in the open market with a term of 7 days and an interest rate of 5.5%/year.

|

The State Bank continued to withdraw net capital strongly for the third consecutive week. (Chart: Manh Ha) |

The State Bank of Vietnam continued to withdraw money at quite high interest rates for the second consecutive week, from 5.3%-6%/year for a 7-day term, compared to 3.98%-4.39% for a 7-day term during the week of December 19-23.

In total, during the week of January 3-6, the State Bank withdrew nearly VND 77,350 billion from the banking system, thereby reducing liquidity in this market.

On the other hand, during the week of January 3-6, the State Bank continued to pump money through short-term repo contracts (7 days) but with a total value lower than the money injection. In all 4 trading sessions (1 session off on Monday), the State Bank pumped a total of more than VND 21,988 billion into the market.

However, also in the week from January 3-6, the State Bank recorded 5 repo contracts maturing, with a total value of more than VND 41,905 billion.

Thus, during the week from January 3-6, the State Bank of Vietnam withdrew nearly VND 97,267 billion from the market.

This is the third consecutive week that the State Bank has strongly withdrawn money from the system. In the last week of 2022 - from December 26 to 30, the State Bank has withdrawn more than VND 102,633 billion from the market. In the previous week, from December 19 to 23, the State Bank has withdrawn nearly VND 94,034 billion from the market.

In the last two weeks of 2022, the State Bank of Vietnam (SBV) strongly withdrew money in the context of the banking system showing signs of excess liquidity. Overnight lending interest rates dropped sharply, from the previous level of 5-6% to around 2.8-4%/year.

In the first week of 2023, overnight interest rates rose back above 5%/year, and were higher than overnight interest rates in the US. However, exchange rate pressure showed signs of increasing again. And this could be the factor that caused the SBV to continue to maintain net money withdrawal.

Exchange rate pressure is still high

In the middle of the week of January 2-6, the USD suddenly soared to a 4-month peak. The DXY index - measuring the USD's fluctuations against a basket of 6 major currencies in the world - soared before and after the US Federal Reserve (Fed) announced the minutes of its December 2022 meeting, at times reaching over 105.6 points.

The US dollar jumped on January 3 before the Fed released its minutes as the Fed earlier stressed the need to maintain a trend of raising interest rates to reduce inflation.

The US dollar continued to rise on November 5 as the minutes noted that inflation risks remained key to policy decisions and no official expected the Fed to cut interest rates in 2023.

This is also a week when the State Bank of Vietnam is quite cautious. On January 6, for the first time in 3 weeks, the State Bank of Vietnam adjusted the central exchange rate up by 1 VND to 23,605 VND/USD (equivalent to the floor and ceiling prices of 22,425 VND and 24,785 VND/USD, respectively).

Previously, the State Bank controlled the exchange rate and continuously reduced the central rate 16 times from 23,693 VND/USD on November 4, 2022 to 23,658 VND/USD on December 6, 2022. The State Bank then increased it for 1 session on December 7 and then continued to reduce it for 18 sessions after that to 23,603 VND/USD on January 5, 2023.

Currently, central banks around the world are still closely monitoring policy signals from the Fed and fluctuations of the USD.

One good thing is that the USD in the world in the last session of the week (morning of January 7, Vietnam time) has turned to decrease sharply. A survey shows that US inflation may be cooling down. In addition, the slow increase in wages and the narrowing of the ISM non-manufacturing PMI index in December have made many people believe that it will be difficult for the Fed to continue to "hawk" in monetary policy.

Many forecasts say that the Fed will lower interest rates this year (instead of 2024) and interest rates will peak at 4.98% in June, instead of 5.5% as previously forecast.

The DXY index on the morning of January 7 (Vietnam time) rapidly decreased from 105.6 points in the previous session to 103.9 points.

Domestically, in the first week of the new year, Governor Nguyen Thi Hong warned that Vietnam's credit has been at the warning threshold. This is a signal that 2023 will continue to be a year of cautious and tight monetary policy.

Some securities companies forecast that the State Bank of Vietnam is likely to increase operating interest rates by 100-150 basis points until mid-2023 to support the strength of the VND.

The domestic USD/VND exchange rate at Vietcombank continues to move positively, following the downward trend of the USD price. Since October 25, the USD/VND exchange rate has decreased by 5.1% from 24,888 VND/USD to 23,630 VND/USD.

As of January 6, compared to the beginning of 2022, the DXY index increased by 8.07%. However, the USD only increased by more than 3.1% compared to the VND.

In the free market, the USD fell sharply from its peak of 25,500 VND/USD (selling price) on November 1 to nearly 23,680 VND/USD on January 5, equivalent to a decrease of 7.1%.

In the interbank market, liquidity in the system was less abundant last week, overnight interest rates increased again, from 2.81% on December 29 to 5.09% on January 6, but still lower than the peak of 8.44% recorded on October 5, 2022.

Interbank interest rates for 6-9 month terms are at 9.61%-11.12%/year.