USD exchange rate today August 3: USD drops sharply

USD exchange rate today August 3: The State Bank announced the central exchange rate of the Vietnamese Dong to the USD decreased by 3 VND, currently at 24,242 VND.

USD exchange rate in the country today

At the beginning of the trading session on August 3, the central exchange rate between the Vietnamese Dong and the USD was slightly adjusted down by the State Bank, down to 24,242 VND/USD.

The buying and selling rates at the State Bank's Exchange remain stable, at 23,400 VND for buying and 25,450 VND for selling.

In the free market, the USD exchange rate continued to decrease, with the trading rate in Hanoi at 6:48 am being 25,597 - 25,677 VND/USD, down 7 VND for buying and 2 VND for selling compared to the previous session.

Vietcombank has reduced the USD buying and selling prices to 25,010 - 25,380 VND/USD, down 20 VND for both directions compared to the previous trading session.

BIDV increased the buying and selling prices of USD to 25,060 - 25,400 VND/USD, an increase of 30 VND for both directions.

Vietinbank announced a sharp reduction in the USD buying price of 305 VND, bringing the exchange rate down to 24,940 - 25,390 VND/USD, while the selling price only decreased by 5 VND.

Eximbank kept the USD buying and selling rates unchanged at 25,020 - 25,390 VND/USD, unchanged from the previous session.

USD exchange rates at commercial banks for buying and selling are as follows:

| USD exchange rate | Buy | Sell out |

| Vietcombank | 25,010 VND | 25,380 VND |

| Vietinbank | 24,940 VND | 25,390 VND |

| BIDV | 25,060 VND | 25,400 VND |

USD exchange rate today in the world

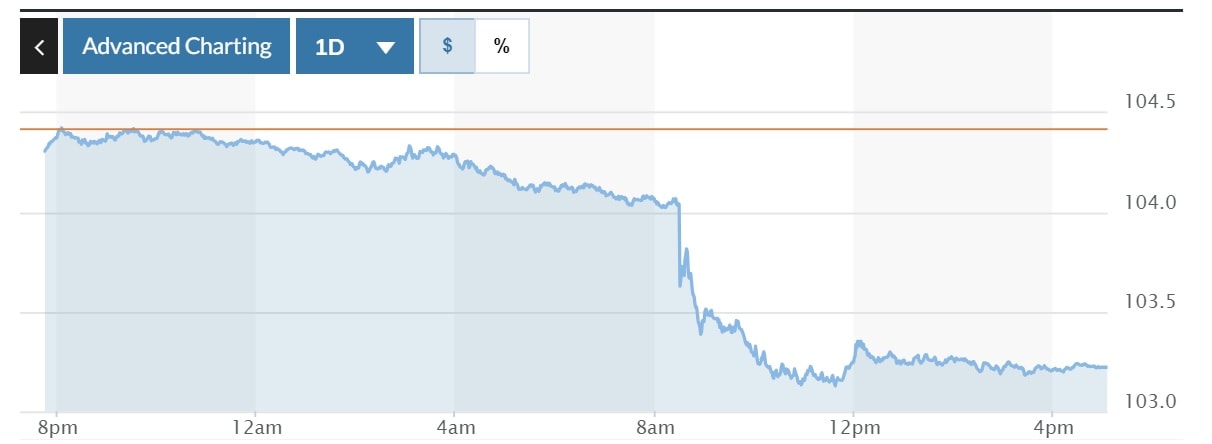

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) decreased by 1.20% to 103.22.

The US dollar exchange rate today saw a significant decline, reaching a four-month low, reflecting uncertainty in the July jobs report and the potential impact on the Fed's interest rate policy.

The latest jobs report showed an increase of 114,000 jobs, fewer than the forecast of 175,000, pushing the unemployment rate up to 4.3%, higher than previously expected.

Financial markets are strongly pricing in a 50 basis point rate cut by the Fed in September, with the forecast rate rising from 31% to 71% after the jobs data was released.

Forecasts suggest there will be at least a 25 basis point cut in September and a total easing of 116 basis points by the end of the year.

Wasif Latif of Sarmaya Partners expressed concerns about economic growth, noting that the market is aware of the economic slowdown.

The DXY index fell to 103.12, its lowest since March 14, marking its biggest one-day drop since November.

US Treasury yields also fell sharply, with the two-year yield falling to 3.845%, its lowest since May 2023, and the 10-year yield also falling to a low of 3.79%.

Fed Chairman Jerome Powell has hinted at a possible interest rate cut in September, depending on the US economic situation, after deciding to keep interest rates unchanged at a recent meeting.

Concerns that the economic situation is getting worse have been reinforced by recent weak jobs data and dismal manufacturing reports.

Analysts are closely watching new economic data to assess whether the growth outlook is really as weak as markets fear.

The US dollar recorded a 1.84% drop, currently at 146.62 Yen and has dropped to its lowest level since February 2 at 146.42.

Since hitting a 38-year low of 161.96 yen against the dollar on July 3, the Japanese yen has appreciated, thanks to Japanese government intervention and trading operations aimed at balancing interest rates between the two currencies.

The yen was further strengthened when the Bank of Japan raised interest rates to 0.25% on July 31, the highest level since 2008.

The Japanese Yen and the Swiss Franc have received attention as safe-haven assets amid volatile stock markets and geopolitical concerns.

Investors expressed concerns about the possibility of wider conflict in the Middle East following the funeral of Hamas leader Ismail Haniyeh, which took place in Qatar on August 2, following his assassination in Tehran, Iran.

Meanwhile, the euro rose 1.12% to $1.0912 and even touched $1.0927, its highest since July 18.

The British pound also recorded a 0.53% gain to $1.2807, recovering from a one-month low after the Bank of England decided to cut interest rates from a 16-year high on August 1.