The Provincial People's Committee needs to establish an interdisciplinary inspection team to combat tax losses.

(Baonghean.vn) - That was the proposal of Chairman of the Provincial People's Council Nguyen Xuan Son at the meeting between the Standing Committee of the People's Council and the Provincial People's Committee according to the program of supervising budget collection in the province, period 2016 - 2018 on the afternoon of May 31.

|

| Comrades: Nguyen Xuan Son - Standing Deputy Secretary of the Provincial Party Committee, Chairman of the Provincial People's Council; Thai Thanh Quy - Alternate Member of the Party Central Committee, Deputy Secretary of the Provincial Party Committee, Chairman of the Provincial People's Committee chaired the meeting. Photo: Mai Hoa |

Many shortcomings in budget collection

Based on the supervision of budget management and collection in a number of localities, at the meeting, the Provincial People's Council acknowledged that the Provincial People's Committee has annually closely followed the central budget targets assigned and forecasted the province's economic development situation to prepare and assign quality budget collection estimates in the locality.

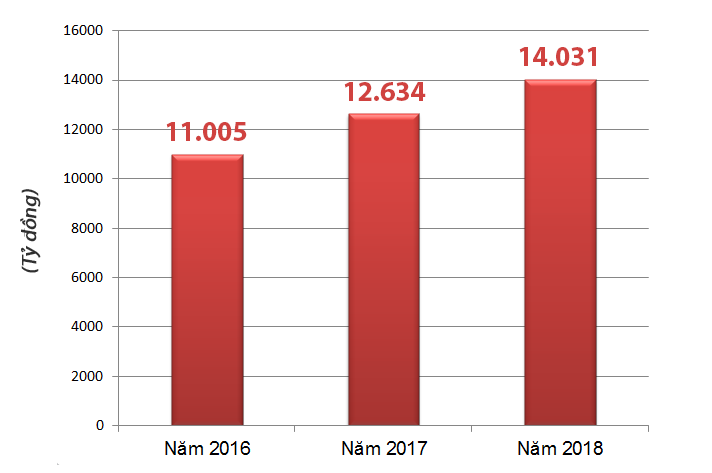

The Provincial People's Committee also regularly pays attention to directing and urging the progress of budget collection and preventing revenue loss, and recovering tax arrears. The annual budget collection results always fulfill the targets assigned by the Central Government and the Provincial People's Council, and the total revenue has increased gradually over the years.

|

| Budget revenue in the province increases annually, each year higher than the previous year. Graphics: Huu Quan |

In addition, the Provincial People's Council also pointed out a number of shortcomings and limitations related to budget revenue in the province. That is, although the total annual budget revenue increases, the main revenue is land use fees, while the revenue from non-state industrial, commercial and service taxes, revenue from enterprises, non-agricultural land taxes, etc., is low and does not meet the assigned estimate. Tax debt collection is not effective, the amount of tax arrears is still high, especially difficult-to-collect debts account for more than 50% of the tax arrears.

Along with the above issues, Vice Chairwoman of the Provincial People's Council Cao Thi Hien also pointed out a number of issues that the Provincial People's Committee needs to pay attention to. That is, the number of individual business households with tax records is lower than the number of existing business households, accounting for only about 18%; on the other hand, many transport business households have not yet had tax records established for management and tax collection.

|

| The number of individual business households with established management boards is much lower than the number of existing business households. Illustration photo: Mai Hoa |

The situation of some enterprises owing taxes but still expanding production scale or switching to establish other enterprises. Every year, the Tax Department organizes inspections of about 20% of enterprises and through inspections, more than 90% of enterprises are found to have violations, forced to pay additional payments and fines; this raises the issue that enterprises that have not been inspected or audited will also have signs of tax losses. It is recommended that the Provincial People's Committee pay attention to directing the Tax Department to strengthen this work.

Need to establish an interdisciplinary inspection team

Based on the limitations, shortcomings and inadequacies through the supervision practice pointed out by the Provincial People's Council, Chairman of the Provincial People's Committee Thai Thanh Quy also said that the work of collecting tax arrears is facing difficulties because the law does not have strict sanctions and the province has only applied a number of coercive measures for a long time but they are not effective.

|

| Chairman of the Provincial People's Committee Thai Thanh Quy affirmed that the Provincial People's Committee has directed and will continue to direct the review to prevent tax-indebted enterprises from continuing to implement new investment projects. Photo: Mai Hoa |

Regarding some manifestations of tax evasion in enterprises through the mechanism of self-declaration and self-payment of taxes, the Chairman of the Provincial People's Committee affirmed that the Provincial People's Committee will continue to direct and enhance the responsibility of the Tax sector in strictly controlling the business activities of enterprises, thereby promptly detecting inadequacies and manifestations of tax evasion for handling.

Along with that is the direction to review the tax collection for individual business households to be accurate, avoid missing taxpayers and ensure fairness among taxpayers.

The Provincial People's Committee also continues to resolutely direct the implementation of solutions to prevent tax losses in areas such as mineral business, real estate, restaurants, hotels, transportation business...; at the same time, directs review and does not allow enterprises with tax arrears to implement new projects.

|

| Chairman of the Provincial People's Council Nguyen Xuan Son proposed that the Provincial People's Committee establish an interdisciplinary inspection team to support the Tax sector in preventing tax losses and arrears. Photo: Mai Hoa |

Concluding the meeting, Chairman of the Provincial People's Council Nguyen Xuan Son requested the Provincial People's Committee to continue to pay attention to improving the investment environment, administrative reform, removing difficulties for businesses, promoting economic development, and increasing revenue in the area.

At the same time, the Tax and Customs sectors are directed to propagate and support taxpayers; at the same time, districts, cities and towns are directed to improve the quality of operations of commune-level tax advisory councils to focus on exploiting revenue sources at the commune level such as transportation business, private housing construction and other revenues.

The Provincial People's Committee also needs to study and innovate the work of assigning budget revenue estimates to be closer to the actual situation; innovate the work of managing and collecting budget, preventing tax losses and tax arrears. The Chairman of the Provincial People's Council also requested the Provincial People's Committee to direct departments and branches to re-study regulations related to the issuance of investment licenses and business registration licenses, to avoid the situation where enterprises with tax arrears still expand their production and business scale and organizations and individuals still establish new enterprises to operate.

“Tax evasion and tax arrears are posing difficult and complicated problems, so the Provincial People's Committee also needs to establish an interdisciplinary inspection team to support the Tax sector in fighting against revenue loss and tax arrears more effectively,” the Chairman of the Provincial People's Council emphasized.