Gold price increases again, close to 38 million

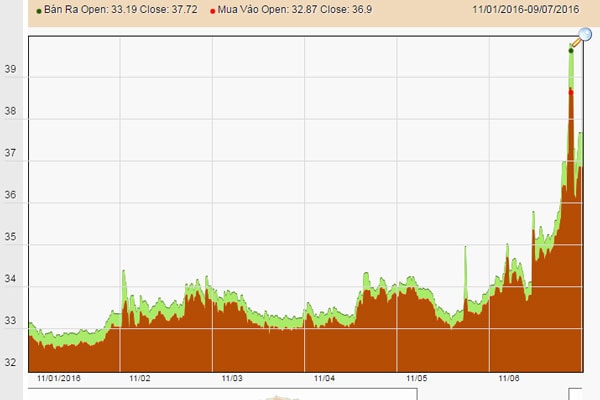

Domestic gold prices closed last week up a total of about 1.2 million VND/tael and continued to fluctuate unpredictably in the new week in the context of world gold prices in the Asian market that are on the rise again despite having just established a peak of more than 2 years.

On the Asian market, opening the new week, early morning of July 11 (Vietnam time), spot gold price skyrocketed by 5.6 USD to 1,371 USD/ounce.

|

| Gold price last 3 days. |

The $5.60 increase immediately after the Asian market reopened showed strong demand for this commodity. Good news about US jobs in the last trading session of the week could not erase investors' worries about the consequences of the British vote to leave the European Union - EU as well as the phenomenon of bond yields in many countries continuously hitting new lows last week.

The recovery of the Japanese stock market in the early morning then pulled down the gold price. As of 8:20 a.m. on July 11 (Vietnam time), the world spot gold price only increased by 1.4 USD to 1,366.8 USD/ounce.

The current world gold price is equivalent to about 37 million VND/tael, excluding taxes and fees.

Updated at 9:10 am, SJC gold price continues to increase, approaching the 38 million VND/tael mark. Specifically, in the Ho Chi Minh City market, SJC gold price is listed by Saigon Jewelry Company at 37.2 million VND/tael (buy) and 37.9 million VND/tael (sell). In the Hanoi market at the same time, the buying price is at 37.2 million VND/tael and 37.92 million VND/tael for selling.

Opening this morning (July 11) at 8:15 am, Saigon Jewelry Company listed SJC gold price unchanged compared to last weekend at: 36.9 million VND/tael (buy) and 37.62 million VND/tael (sell).

DOJI Gold and Gemstone Group increased the price of SJC gold and kept the same price in both buying and selling directions compared to last week at: 37.00 million VND/tael (buy) and 37.45 million VND/tael (sell). Meanwhile, Bao Tin Minh Chau Gold and Silver Company listed the price of SJC gold at a similar level, 37.12 million VND/tael (buy) and 37.4 million VND/tael (sell).

|

In the domestic gold market, the price of gold closed last weekend at about 37.5 million VND/tael after reaching a 3-year peak of 40 million VND/tael.

Specifically, as of the end of last week, DOJI Gold and Gemstone Group listed the price of SJC gold at: 37.00 million VND/tael (buy) and 37.45 million VND/tael (sell). Saigon Jewelry Company listed SJC gold at: 36.9 million VND/tael (buy) and 37.62 million VND/tael (sell). Bao Tin Minh Chau Gold and Gemstone Company listed the price of SJC gold at: 37.12 million VND/tael (buy) and 37.4 million VND/tael (sell).

Last week, the gold market witnessed a rare whirlwind in recent years: there were sessions when gold prices increased by up to 3 million VND/tael and vice versa, there were also sessions when gold prices decreased by 2 million VND/tael. Gold prices jumped from a low of about 36 million VND/tael at the beginning of the week to a record high of 40 million VND/tael in the middle of the week.

|

| Gold price movements last week. |

The sharp increase in domestic gold prices mainly follows the world gold price trend. However, there are times when domestic gold prices increase faster than the world gold price. At times, the converted domestic gold price is higher than the converted world price excluding taxes and fees. The sharp increase in gold prices has made the market lively again after a long period of stagnation. The number of buyers at many times has overwhelmed the number of sellers, contrary to the previous situation.

Investors and analysts believe that in the short term, gold prices will continue to be affected by global macroeconomic factors as well as interventions from the domestic market, which will cause gold prices to have unpredictable trends.

In the world, gold prices are forecast to continue to increase in both the short and long term.

According to Kitco's survey, 58% of experts surveyed believe that gold prices may continue to rise this week; 32% of respondents believe that gold prices will fall and 11% believe that gold prices will go sideways.

On Kitco, Bank of America Merrill Lynch (BofA) has just forecast that gold prices will increase by 10% from now until the end of 2017 to reach $1,500/ounce.

“We continue to believe in the positive outlook for gold and silver, which should outperform amid slowing global economic growth and risks related to demographics, immigration and the consequences of economic policymaking by countries,” the report said.

In a recently released report, HSBC also predicted that gold prices would increase by 10%, and actual gold prices could increase even higher if the market becomes increasingly concerned about the future of the EU after the recent referendum in the UK (Brexit).

“Gold is not tied to or subject to any monetary authority or economic policy. Therefore, it is almost completely immune to intervention risks. If investors truly believe that a rise in the CHF or JPY could trigger government intervention, they will move their investments into gold, a safer investment,” HSBC said in a report.

A previous report from PriceqwaterhouseCoopers also said that gold is still in a bull market.

Meanwhile, the World Gold Council predicts that there could be an unprecedented gold rush in China and India in the next few years due to rising incomes of workers in these two countries.

Recently, some asset management companies have made shocking predictions that gold could reach 2,300 USD/ounce by mid-2018 (equivalent to 62 million VND/tael), or even 7,500 USD/ounce (about 200 million VND/tael) in the next 10 years.

According to Vietnamnet

| RELATED NEWS |

|---|