Why is online lending with 720% interest rate still viable?

A peer-to-peer (P2P) lending company was founded late last year, but now receives 2,000 loan applications every day.

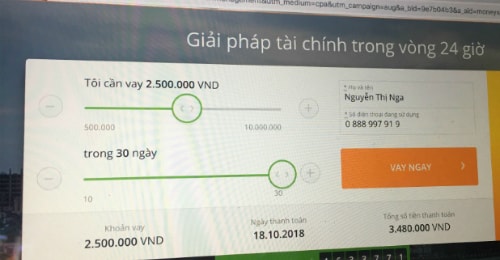

Peer-to-peer lending (online lending) websites are currently flourishing. Just type in the word "online lending", and dozens of "fast lending" pages will immediately appear. Along with that are invitations to borrowers such as "fast loans in 10 minutes, hot online loans, cash loans without documents",...

Commenting on this development, at a recent training session on the consumer finance market organized by the Vietnam Banking Association, financial experts said that the peer-to-peer lending model - P2P is really developing very "hotly" in Vietnam but there is no clear legal framework for management.

Dr. Can Van Luc, Chief Economist of the Bank for Investment and Development of Vietnam (BIDV) and Director of BIDV Training School, said that there is a P2P lending company in Vietnam that was only established at the end of 2017 but has up to 2,000 loan applications every day, showing that the demand is very large.

|

One of the online lending websites.Screenshot. |

This model is also growing in many countries. In China alone, the outstanding online loan balance as of the end of last year was about 30-40 billion USD, with more than 6,000 companies. However, due to the distortion of this model, the Chinese regulatory agency has narrowed it down from 6,000 to about 2,000 businesses.

Dr. Luc said that this is a lending method that does not go through an intermediary such as a commercial bank, but only has a unit providing a technology platform connecting the lender and the borrower, similar to Uber and Grab in the taxi industry that have appeared in Vietnam.

The reason why this type of loan has flourished recently, according to Mr. Luc, is because in real life there are always people who need to borrow and people who want to lend. In addition, because technology is developing very quickly, supporting existing needs, meaning that credit activities now will not need to go through intermediary financial institutions, so borrowers and lenders can connect with each other quickly. Especially itsuitable for social needs, psychology of liking simple procedures as well as development situation in the era of widespread technology like today.

"This model has many advantages, such as low cost and quick disbursement, but it is worrying that this form is being distorted, because many people raise capital but do not lend it but use the money to invest in other fields. The relationship between the technology platform provider, the borrower and the lender (investor) is unclear... At the same time, there is currently no legal basis to manage this lending model," said Dr. Luc.

Also because there is no legal framework, companies and investors who have finished lending will use many measures to collect and recover debts, including hiring gangsters... Some online lending companies take advantage of this form of lending and add many types of service fees, thereby pushing loan costs up to 100% per year, even 720% per year.

According to this expert, in the context of a huge demand for online loans but the management agency has no legal basis, so risks will occur for both borrowers and lenders. Investors investing in this model are even more risky.

Therefore, in the coming time, the management agency needs to orient and have a legal framework for this model to operate and develop to meet the needs of the market. The legal framework needs to be built as soon as possible, not necessarily banning it because it is difficult to manage.

Faced with the rapid and complex development trend of P2P, sharing with reporters, Dr. Nguyen Tri Hieu also recommended that the authorities should soon intervene to issue specific legal regulations (related to contracts, interest, fees, debt collection and repayment methods, etc.). In addition, the authorities need to have enough force to inspect and control this type to avoid unpredictable changes that cause social disorder.

At the regular Government press conference in early October, the State Bank leader also acknowledged the transformation of black credit through online loans.

According to current regulations, the State Bank manages credit activities of credit institutions, while black credit is not under the management of this agency. However, the State Bank will review and grasp the situation of black credit to propose to the Government to direct ministries and branches to have solutions to manage credit activities in general to avoid spreading black credit.