Vinamilk is about to spend 5,120 billion to pay dividends in cash, foreign investors are stepping up to buy goods

(Baonghean.vn) - Vietnam Dairy Products Joint Stock Company (Vinamilk) has just issued a document announcing the schedule for closing the list of shareholders to pay cash dividends at a rate of 24.5%, accordingly VNM will spend 5,120 billion VND to pay dividends for 2.1 billion outstanding shares.

With weak demand and strong selling pressure, VnIndex officially broke the 1,200 mark on June 20 with more than 900 stocks falling. The stock market then continued to witness declining sessions, with many stocks burning brightly for many sessions. Investors' opportunities to make profits from trading activities are becoming increasingly difficult and uncertain.

|

Therefore, the cash flow in the market has shifted to more stable channels such as investing in sustainable stocks, with low price fluctuations or high dividend payments. That trend has pushed some stocks to increase strongly.

Despite the difficulties of the past 2 years of Covid-19, many businesses still decided to pay dividends, even paying high dividends to shareholders. Looking back over the past few days, many businesses have set dividend payment dates such as Ca Mau Fertilizer (DCM), PVGas (GAS)... These businesses all announced the closing date for the shareholder list in the first days of July.

In which Vinamilk (VNM) - a familiar face in the top high dividend paying enterprises on the stock market - also announced the closing of cash dividend rights, total rate 24.5%, equivalent to 1 share receiving 2,450 VND.

Accordingly, July 7 is the last registration date to make a list of shareholders to pay the remaining dividend of 2021 (rate 9.5%) and the first interim dividend of 2022 (rate 15%).

With 2.1 billion shares in circulation, Vinamilk is expected to pay a total of VND5,120.4 billion in dividends to shareholders. This amount will be paid on August 19.

|

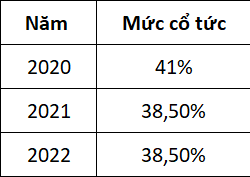

VNM's dividend payment level in recent years |

Vinamilk has always been among the top companies paying the highest cash dividends. In recent years, the company has focused its cash resources on investment projects to expand production and business, so the dividend payout ratio has decreased slightly but is still among the top in the market.

Currently, until the record date, Vinamilk shareholders still have about 2 weeks to "buy" VNM shares to receive dividends. This is also the move that makes VNM shares reverse the trend, increasing sharply in recent sessions from 66,700 VND/share (closing price of the trading session on June 17) to 73,700 VND/share (closing price of the trading session on June 21), equivalent to an increase of 10.5% in just 2 sessions. Market liquidity on June 21 also nearly doubled that of June 20, reaching approximately 5 million shares matched in the session. With this market price, Vinamilk's market capitalization reached more than 154,000 billion VND.

|

VNM stock price fluctuations in correlation with VNIndex in 1 month. (VNM: Blue line, VNIndex: Purple line). Source: TradingView |

The attraction of paying dividends in shares for VNM shares is not only for domestic investors, but foreign investors are also "collecting" goods. On June 21, the net buying volume of foreign investors reached 2.07 million units, equivalent to a net trading value of more than VND 152.6 billion. The net buying volume of foreign investors on June 21 was nearly 2.4 times higher than the previous session on June 20.

Signs of foreign investors "collecting" VNM shares continued to occur continuously in the last 4 sessions, from June 16 to June 21.

Previously, at this year's annual general meeting of shareholders, shareholders approved the 2021 dividend plan, at a rate of 38.5% in cash (VND 3,850/share), equivalent to a total value of VND 8,046 billion. Vinamilk has provisionally paid 29% dividends to shareholders on September 30, 2021 and February 25. In addition, the dividend for 2022 is also 38.5% in cash.