Policy capital serves well the goal of poverty reduction and ensuring social security.

(Baonghean) - In 2017, the Social Policy Bank, Nghe An branch, achieved many outstanding achievements. Mr. Tran Khac Hung - Director of the Social Policy Bank, Nghe An branch, gave an interview to Nghe An Newspaper about preferential credit policies that brought important results in ensuring social security in the province.

PV:Could you please tell us about the role of the Board of Directors in the activities of the social policy bank in the past year?

Mr. Tran Khac Hung:In 2017, the Branch Executive Board advocated improving the quality of consulting for local Party committees and authorities, directly the Board of Directors' Representative Board. The effective and responsible direction of the Representative Board has truly created conditions for the Social Policy Bank to successfully complete important goals and tasks.

|

| Capital disbursement at Nghi Long commune transaction point (Nghi Loc). Photo: TH |

The Executive Board has advised on timely organization consolidation, carefully prepared content, selected important and truly meaningful issues to discuss, make recommendations and seek opinions at meetings to include in the resolution; promptly advised the Head of the Board and members in charge on the implementation of the resolution, reported difficulties, problems and solutions to seek timely direction and handling.

In 2017, 100% of the members of the Provincial Representative Board successfully completed their assigned tasks; the activities of the District Representative Board quickly changed in a practical and effective direction; the work of allocating capital sources, directing the implementation of credit plans, inspection and supervision... achieved high results.

|

| Graphics: Huu Quan |

PV:Could you elaborate on the outstanding results of policy credit in 2017 in implementing the task of ensuring social security in the area?

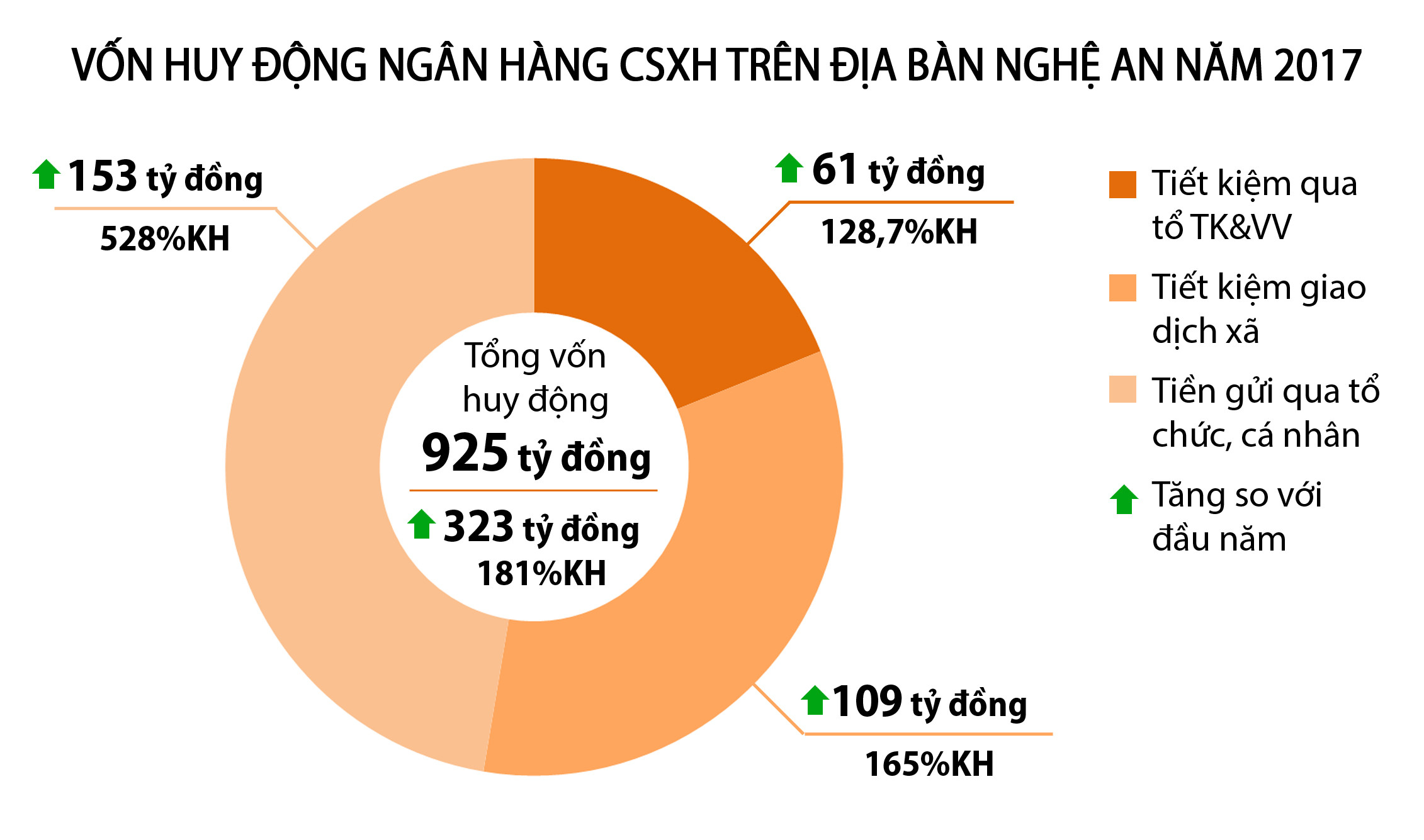

Mr. Tran Khac Hung:In 2017, the Branch promptly took advantage of the attention of the Central Bank, actively advised to increase local support resources, and at the same time promoted capital mobilization from organizations and individuals in the area. Capital reached 7,212 billion VND, an increase of 7% compared to 2017, basically meeting the actual needs of the locality. Capital mobilized in the area reached 925 billion VND, an increase of 323 billion VND compared to the beginning of the year.

The Board of Directors has focused on directing the acceleration of outstanding loan growth, for areas with low outstanding loans, it is difficult to increase outstanding loans due to the lack of priority capital sources to ensure a reasonable level of outstanding loans. By December 31, 2017, the total outstanding loan reached VND 7,200 billion, an increase of 7% compared to the previous year. Outstanding loans of 3 programs for poor households, near-poor households and households escaping poverty continued to lead the total of 17 programs, reaching VND 4,373 billion (accounting for 60.7%).

PV:Trust activities and the network of savings and credit organizations play a very important role in the credit quality of policy banks. How has this content changed over the past year, sir?

Mr. Tran Khac Hung:Based on its target orientation, the branch and the entrusted organizations agree on the goals and tasks of the year, develop appropriate plans and implementation roadmaps, and quarterly evaluate the results of implementing the common goals, specifically analyze the results, shortcomings and causes of each agency. The positive changes in coordination and direction are a solid foundation to help the province-wide entrusted activities achieve outstanding results, complete and exceed the credit plan targets, and continue to improve the quality of entrusted activities.

Outstanding debt increased by 480 billion VND, reaching 7,169 billion VND; capital mobilization through groups reached 260 billion VND, reaching 128.7% of the assigned plan, commune transaction savings reached 123 billion VND, reaching 165% of the assigned plan. Overdue debt was 11,339 million VND, accounting for 0.16% (equal to 2016); 195 communes had no overdue debt, accounting for 40.6%; the number of commune-level associations with commission fees deducted due to high overdue debt ratio continued to decrease by 7 units, leaving 25 units; communes with overdue debt of over 2% remained 9 communes, accounting for 1.88%.

|

| Ms. Nguyen Thi Hanh in Hamlet 1, Hung My (Hung Nguyen) invested in a clean water system using a loan from a policy bank. Photo: TH |

The quality of the savings and credit network has changed significantly thanks to the attention and close supervision from the transaction offices and the responsible coordination and direction of the entrusted organization, exceeding the set target. The whole province currently has 7,633 teams (down 125 teams compared to the beginning of the year), the number of good teams has increased, the number of weak teams has decreased sharply. Quy Hop alone has achieved 100% good teams, the whole province has only 2 units with weak teams. This is a very meaningful result, clearly demonstrating the ability to control as well as great efforts, especially the staff at the transaction offices.

PV:To advise on the effective implementation of Directive No. 29-CT/TU of the Provincial Party Committee, striving to complete the growth target of 20 billion VND of entrusted capital from the local budget in 2018, could you please tell us the key tasks and solutions?Mr. Tran Khac Hung:In 2018, the Provincial Social Policy Bank set a target of increasing capital and outstanding loans by 7-10% compared to 2017, corresponding to an increase of 500 to 700 billion VND, outstanding loans estimated at 7,700 to 7,900 billion VND. Strive to complete 100% of the capital mobilization plan assigned by superiors (including: savings deposits through groups, mobilization at commune transaction points and mobilization of organizations and individuals), completing the minimum outstanding loan plan target of 99.5% or more.

Regularly consolidate and improve credit quality comprehensively, overdue debt does not exceed 0.17%; strive for the debt collection rate to reach about 70%; terminate loans extended beyond the prescribed time. Improve the quality of the savings and credit network: the rate of good savings and credit groups is regularly 95% or more, poor groups are regularly below 0.2%; strive for 2 transaction offices to have no overdue debt, 290 communes to have no overdue debt, reaching about 60%, increasing by 95 communes (these are communes with overdue debt of no more than 10 million VND). Collect 98% or more of receivable interest, complete the financial plan, and salaries reach the maximum level according to the prescribed regime. At the same time, complete the inspection plan of channels and levels with high quality and efficiency.

Currently, key solutions have been built and we have determined that this is not a simple goal, so Nghe An Social Policy Bank has prepared to implement it right from the first days and months of 2018.

PV:Thank you!