The first company to reach the 4 trillion USD mark, 8 times Vietnam's GDP in 2024

Nvidia has made history by becoming the first company in the world to reach a market valuation of $4 trillion, cementing its position as a giant in the global financial market.

Nvidia sets record with first $4 trillion valuation in history

Nvidia has made history by becoming the first company in the world to reach a market valuation of $4 trillion, cementing its position as a giant in the global financial market.

Nvidia shares rose 2.8% to $164.42 on July 9, marking a remarkable recovery from a difficult start to the year, when the company faced concerns about AI spending due to China’s DeepSeek and President Donald Trump’s trade war.

Nvidia's growth track record has been impressive, with the stock up more than 20% in 2025 and up more than 1,000% since the start of 2023. Nvidia now accounts for 7.5% of the S&P 500 Index, near its highest influence in history.

The main driver of Nvidia’s stock is the commitment of its biggest customers to spend on AI. Tech giants like Microsoft, Meta Platforms, Amazon and Alphabet are expected to spend about $350 billion on capital expenditures in the coming fiscal years, up from $310 billion currently. These companies account for more than 40% of Nvidia’s revenue.

There is strong demand for Nvidia chips, said Brian Mulberry of Zacks Investment Management. He said Nvidia products are needed to move AI to the next stage, which the market has focused on again during the rapid rally since April.

Investors have returned to AI after a tumultuous first half of 2025. In January, the emergence of DeepSeek sparked concerns that massive AI spending would soon slow down. President Trump's tariff threats in April added to those concerns, leading to a sell-off in stocks.

Nvidia shares, however, rebounded in May as progress in trade talks prompted investors to return to riskier assets. Earnings results showed spending from top customers accelerating, along with positive comments from CEO Jensen Huang about industry trends.

Positive outlook for the future

Ken Mahoney of Mahoney Asset Management believes the upcoming earnings season could be the next catalyst to push Nvidia shares higher. He says Nvidia's valuation is below its ten-year average, signaling there's still room for growth.

The stock is currently trading at about 33 times expected earnings, which is not too expensive given the current revenue growth. Wall Street is also bullish, with nearly 90% of analysts rating the stock at the equivalent of a buy recommendation.

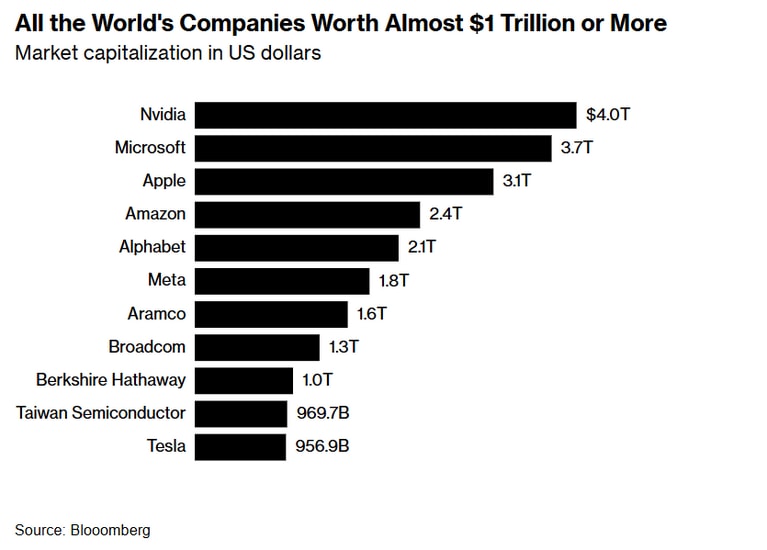

Only a handful of companies come close to Nvidia's $4 trillion valuation. Microsoft is valued at about $3.7 trillion, while Apple is valued at $3.1 trillion. Apple was the first company to hit $3 trillion in early 2022.

Nvidia's growth is astonishing given that the chipmaker was valued at around $750 billion when Apple hit $3 trillion and around $1 trillion by 2023.

Brian Buetel of UBS Wealth Management warns that Apple's largely limited run since the $3 trillion milestone shows that even popular stocks can change. Investors should be aware that this could go the other way, especially when stocks are big in indexes.

While Alphabet and Amazon both topped $2 trillion and Meta is a member of the trillion-dollar club, Tesla was once a trillion-dollar club member but is now trading below that threshold, showing the volatility of the market.