What factors affect the first quarter 2023 budget revenue in Nghe An?

(Baonghean.vn) - The world economy is facing recession and inflation, which has directly affected the production and business situation of enterprises, leading to difficulties in Nghe An's first quarter 2023 budget collection.

|

An Son Joint Stock Company in Dong Hop commune, Quy Hop district, currently has over 100 containers (300m2paving stone/container). Photo: Van Truong |

Businessdifficult career

In Quy Hop district, budget collection is difficult because many mineral exploitation and processing enterprises cannot sell their products and are having a lot of inventory. For example, at An Son Joint Stock Company in Dong Hop commune, Quy Hop district, there are currently over 100 containers (300m2paving stone/container), in addition, there are many outdoor paving stone products that have become moldy.

A representative of this company said: The stone products for cladding have long been mainly exported to the markets of Middle Eastern countries, Taiwan, and China, but from October 2022 until now, other countries have been buying them in small quantities at low prices. To cope with the difficulties, we are currently still operating at stone cutting workshops, trying to find new markets. At the same time, we have to switch to quarrying boulders to have more funds to support workers, paying taxes to the State from 250-300 million VND/month.

|

Stone cladding inventory at stone processing facilities in Quy Hop district. Photo: Van Truong |

Also in the same situation, a stone processing unit in Tho Hop commune (Quy Hop) shared: After Tet until now, the unit is also in stock with over 20,000 tons of stone powder, over 2,000 m2The stone tiles have not been exported yet. Currently, we are looking for domestic consumption markets in the country, however, it is difficult to find an outlet. The unit still has to maintain operations to provide jobs for over 120 workers.

Mr. Bui Kieu Hung - General Director of Nghe Tinh Port Joint Stock Company said that budget revenue depends on production and business results, in the first 3 months of the year, many goods passing through the port decreased. The reason is due to low prices, businesses "holding goods" and not rushing to sell, besides, the economic crisis causes demand for goods to decrease, consumption is slower so production stagnates. For example, at Nghe Tinh Port, the main goods of the Port are animal feed, ore, potassium, wood chips, in which ore and potassium are goods in transit to Laos, also reducing output, due to limited sales sources.

The output of goods through the port has decreased quite a lot: Stone and wood chips have decreased by half due to the restriction of sales to China. In addition, animal feed, rice... have also decreased. Therefore, production and business efficiency will be more limited and budget revenue will certainly be affected. At Nghe An Sugarcane Company Limited, sugar inventory is large, and textile enterprises have also cut back a lot.

Sharing the same difficulties, at this time Hai Van Company Limited (investor of the project "Dien Ngoc Residential and Commercial Service Area" in Dien Ngoc commune, Dien Chau district) is also facing many difficulties.

Mr. Nguyen Hai Van - Director of Hai Van Company Limited added: The project "Dien Ngoc Residential and Commercial Service Area" has been approved by the People's Committee of Nghe An province in principle for investment according to Decision No. 3437/2014, the total land area for project implementation is 32 hectares.

|

The "Dien Ngoc Residential and Commercial Service Area" project is facing many difficulties due to the frozen real estate market. Photo: Van Truong |

To date, the project has completed land use fees for the State of over 106 billion VND. The project has invested in infrastructure construction of over 380 billion VND, built a traffic system, and welfare works of the project such as kindergartens, markets, and water parks. However, from the end of 2022 until now, the real estate market has frozen, no products have been sold, there are currently over 300 unsold plots of land, leading to no production and business efficiency this year.

Mr. Le Van Thanh - Deputy Head of Phu Quy 1 Tax Department said: The Department manages the districts of Quy Hop, Quy Chau, Que Phong, the budget revenue of Quy Hop district mainly comes from minerals. However, from October 2022 to now, the consumption of sawn stone and stone powder exported to Middle Eastern countries and China has been limited, so most units have had to operate at a low level, some places have stopped the production of sawn stone and tiles. The remaining "stock" of various types of stone and tiles is still quite large, so it also affects the budget revenue.

|

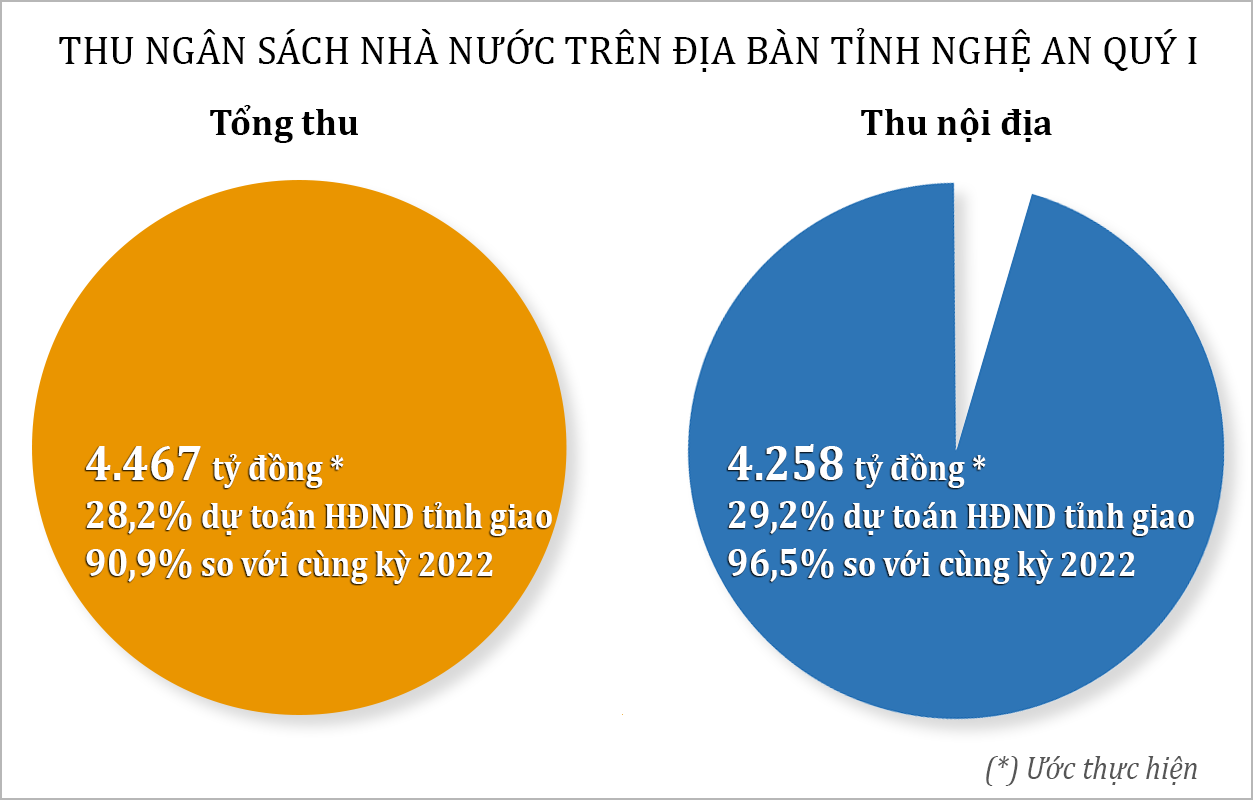

Graphics. Huu Quan |

In the first quarter of 2023, the State budget revenue in the districts is estimated to be over 65.8 billion VND, reaching 34.5% of the estimate assigned by the Provincial People's Council, of which, thanks to the collection of arrears from the previous year, 7 billion VND was collected from mineral exploitation and processing enterprises, a decrease of 1.2 billion VND compared to the same period. Currently, mineral exploitation enterprises in Quy Hop still have arrears of over 26 billion VND.

It is forecasted that the first quarter and the following quarters will be very difficult to collect budget revenue, due to the difficult demand in major export markets, thousands of transport vehicles are operating at a standstill, and 5 wood chip processing facilities that annually pay 8-9 billion VND in taxes have also stopped operating due to lack of sales.

In the Quynh Luu area, Hoang Mai town managed by the Bac Nghe I Tax Department, the budget revenue increased slightly. As of March 31, 2023, it reached 192.3 billion VND, reaching 27% of the Provincial People's Council's estimate, an increase of 10% over the same period in 2022. After deducting land use fees, the revenue was 94.6 billion VND, reaching 34% of the Provincial People's Council's estimate, equal to 98% over the same period.

However, there are some items lower than the same period, such as registration fees only reaching 21% of the estimate and equal to 74% compared to the same period. Land registration fees: Collected 2.8 billion VND, equal to 25% of the estimate, equal to 75% compared to the same period. The People's Committees of communes, wards and towns have not yet organized auctions, so it has also greatly affected the implementation of the estimated revenue, such as registration fees. Property registration fees: Due to the many fluctuations and instability in the economic situation, the slow recovery and decline in people's consumption demand have greatly affected purchasing power...

The representative of the Tax Department of Bac Nghe I region also said that in the coming time, budget collection will face more difficulties due to inflation and the impact of the global economic recession. In the Quynh Luu area, Hoang Mai town, there are many businesses operating at a low level, while land use fees are limited.

According to the report of Nghe An Tax Department, the State budget revenue in the first quarter is estimated at 4,467 billion VND, reaching 28.2% of the estimate assigned by the Provincial People's Council and equal to 90.9% compared to the same period in 2022. Of which: Domestic revenue is estimated at 4,258 billion VND, reaching 29.2% of the estimate and equal to 96.5% compared to the same period in 2022.

Excluding land use fees and lottery fees, domestic revenue in the first quarter is estimated at VND 3,078 billion, reaching 27.8% of the estimate and equal to 97.2% over the same period in 2022. Revenue from import-export activities in the first quarter is estimated at VND 209 billion, reaching 16.8% of the estimate and equal to 41.8% over the same period in 2022.

Thus, the estimated budget collection in the first quarter of 2023 exceeded the progress of the estimate assigned by the Provincial People's Council (according to the progress of 25%) but did not reach the target set in the first quarter (VND 4,467 billion/VND 4,900 billion) according to Decision No. 162/QD-UBND dated January 18, 2023 of the Provincial People's Committee on the main tasks and solutions to implement the Socio-Economic Development Plan and State Budget Estimate in 2023 and was lower than the same period in 2022.

Deploy synchronous solutions to achieve the budget

Faced with such difficulties, the Bac Nghe I Regional Tax Department has deployed key tasks and solutions in the coming time. That is to continue promoting tax administrative reform, creating maximum conditions for taxpayers to fulfill their obligations to the State budget, supporting taxpayers, promoting the application of electronic invoices generated from cash registers, implementing electronic tax payment by taxpayers on mobile devices (Etax Mobile)...

The leader of the Department of Finance said: To boost budget collection in the coming time, sectors and localities focus on removing difficulties for businesses, continue to synchronously and effectively implement the most appropriate mechanisms and policies, especially on finance, currency, and social security to support people and workers, and remove difficulties for production and business.

|

The Provincial Budget Department met to discuss solutions for budget collection. Photo: Tran Chau |

The Tax sector resolutely directs the work of budget collection, preventing revenue loss, ensuring correct, sufficient and timely collection of taxes, fees and charges, especially in some sensitive areas with high tax risks such as: mineral exploitation, land, business, real estate transfer, environment, non-state economic sectors, direct goods and services business to retail consumers with few invoices; effectively deploying solutions to support businesses to overcome difficulties and nurture revenue sources.

Continue to reform and modernize the tax system, simplify tax administrative procedures, strive to achieve and exceed the budget revenue target in 2023. Coordinate with relevant agencies, units and individuals to organize emulation movements to implement tax laws and policies and obligations to the State budget in 2023 according to Plan No. 142/KH-UBND dated March 8, 2023 of the People's Committee of Nghe An province.

The Customs sector directs the monitoring, grasping the situation, closely following the import and export plans of enterprises with large revenues to promptly remove difficulties and obstacles, facilitate import and export activities and accompany enterprises. Strengthening administrative procedure reform, focusing on customs procedures. Improving the convenience and ease of implementing customs procedures; effectively implementing the Online Public Service System, the project of electronic tax payment and 24/7 customs clearance; the program of electronic tax payment for enterprises collecting according to the roadmap of the General Department of Customs.

Closely review data on the Customs Software System to promptly detect items with low declared value, incorrect declared commodity codes, and signs of trade fraud to handle and collect the full amount of tax according to regulations.