Compulsory insurance for motorbikes: To abandon or to continue?

(Baonghean.vn) - In the face of mixed public opinions on whether to abolish or continue compulsory insurance for motorbikes, many opinions say that it is necessary to make a thorough assessment, at the same time have a strict management mechanism as well as propaganda so that people clearly understand their rights when participating in compulsory insurance for motorbikes.

Many conflicting opinions

On June 16, 2022, the 15th National Assembly passed the Law on Insurance Business No. 08/2022/QH15, which stipulates compulsory civil liability insurance for motor vehicle owners, including motorbikes and scooters. This law will officially take effect from January 1, 2023 (except for some provisions that take effect from January 1, 2028).

However, recently, voters in some localities such as Dak Lak, Ba Ria - Vung Tau... have suggested that motorbikes should be removed from the list of compulsory civil liability insurance.motor vehicle owners. Most recently, in response to Official Dispatch No. 9095/BTC-QLBH dated September 12, 2022 of the Ministry of Finance regarding the request for comments on the Draft Decree regulating compulsory civil liability insurance of motor vehicle owners and some other types, the Vietnam Chamber of Commerce and Industry (VCCI), based on the opinions of businesses and experts, stated that compulsory insurance is an intervention by the State's administrative power in the freedom of agreement of people and businesses. Therefore, state agencies must prove that the public benefits gained from restricting rights far exceed the costs incurred.

In recent times, the implementation of compulsory insurance has been proven to bring many social benefits, except for civil liability insurance for motorbike owners. According to the report, after more than 10 years of implementing Decree 103/2008/ND-CP, the payment rate of compulsory civil liability insurance for motorbikes is still very low, nearly 6% in 2019 (VND 45 billion paid over VND 765 billion in insurance premiums). This rate is much lower than other types of compulsory insurance, specifically the payment rate of civil liability insurance for cars is about 33%, fire and explosion insurance is 31%.

|

A motorbike accident in Nghe An. Photo courtesy of BNA |

VCCI also acknowledged that insurance has the advantage of paying faster to accident victims and reducing financial pressure on those who have to pay compensation. However, with a small payment of 45 billion VND, it is difficult to convince that the benefits from this compensation are greater than the social cost of 765 billion VND. Thus, looking at the total benefits for society, current compulsory insurance for motorbikes does not guarantee the principle of benefits being greater than costs.

Currently, in Nghe An, there are about 19 units and enterprises operating in the insurance sector. With a total of about 2 million motorbikes/province today, the number of people participating in compulsory civil liability insurance is very low. At the same time, the rate of vehicle owners who are paid and paid insurance after an accident also accounts for a very small percentage. For example, at Bao Viet Nghe An, in 2021, more than 18,000 motorbike owners participated in compulsory civil liability insurance; in the first 10 months of 2022, the number of vehicle owners participating was 16,550 people. However, in both 2021 and the first 10 months of 2022, no payment was made to any case.

In its comments, VCCI also said that the low payment rate of civil liability insurance for motorbike owners is due to specific regulations and weak implementation, not because this type of insurance does not bring social benefits. However, this policy has existed for more than 30 years, since 1988 and has undergone many amendments. If it is believed that the detailed regulations or the implementation process have problems, then why has this situation not been resolved?

Therefore, VCCI has proposed that the drafting agency consider abolishing the regulation requiring the purchase of civil liability insurance for motorbike owners, and instead rely on the voluntary agreement of the parties. At the same time, amend many regulations to help increase the payment rate for civil liability insurance products for motorbike owners, such as reducing insurance premiums; increasing insurance compensation levels; reducing cases of insurance liability exclusions; simplifying insurance compensation records. In addition, it is necessary to publicize information on compulsory insurance, such as data on insurance revenue and data on the quality of compensation settlement, including aggregate data and the number of types classified by vehicle type and by business. If made public, this information will contribute to promoting insurance businesses to compete in the direction of improving service quality, better customer care, thereby bringing higher added value to the whole society.

However, there are also many opinions that we should continue to have compulsory civil liability insurance for motorbike and scooter owners. Because when people's sense of responsibility is still very limited, it is not feasible to expect people to voluntarily buy insurance.

Dr. - Lawyer Nguyen Trong Hai - Director of Trong Hai Law Firm and Associates believes that this type of insurance should continue to be mandatory, because it aims to protect the financial interests of motorbike owners. The principle of this form of insurance is "taking the majority to compensate for the unlucky few". Regulations on compulsory civil liability insurance for motor vehicle owners are becoming more specific and clear.

Insurance payment, whether compulsory or voluntary, regardless of the field, must ensure a certain procedure. While the procedure is a unified rule, including a series of closely related tasks, it is often inconvenient for the person handling and the person requesting the settlement.

|

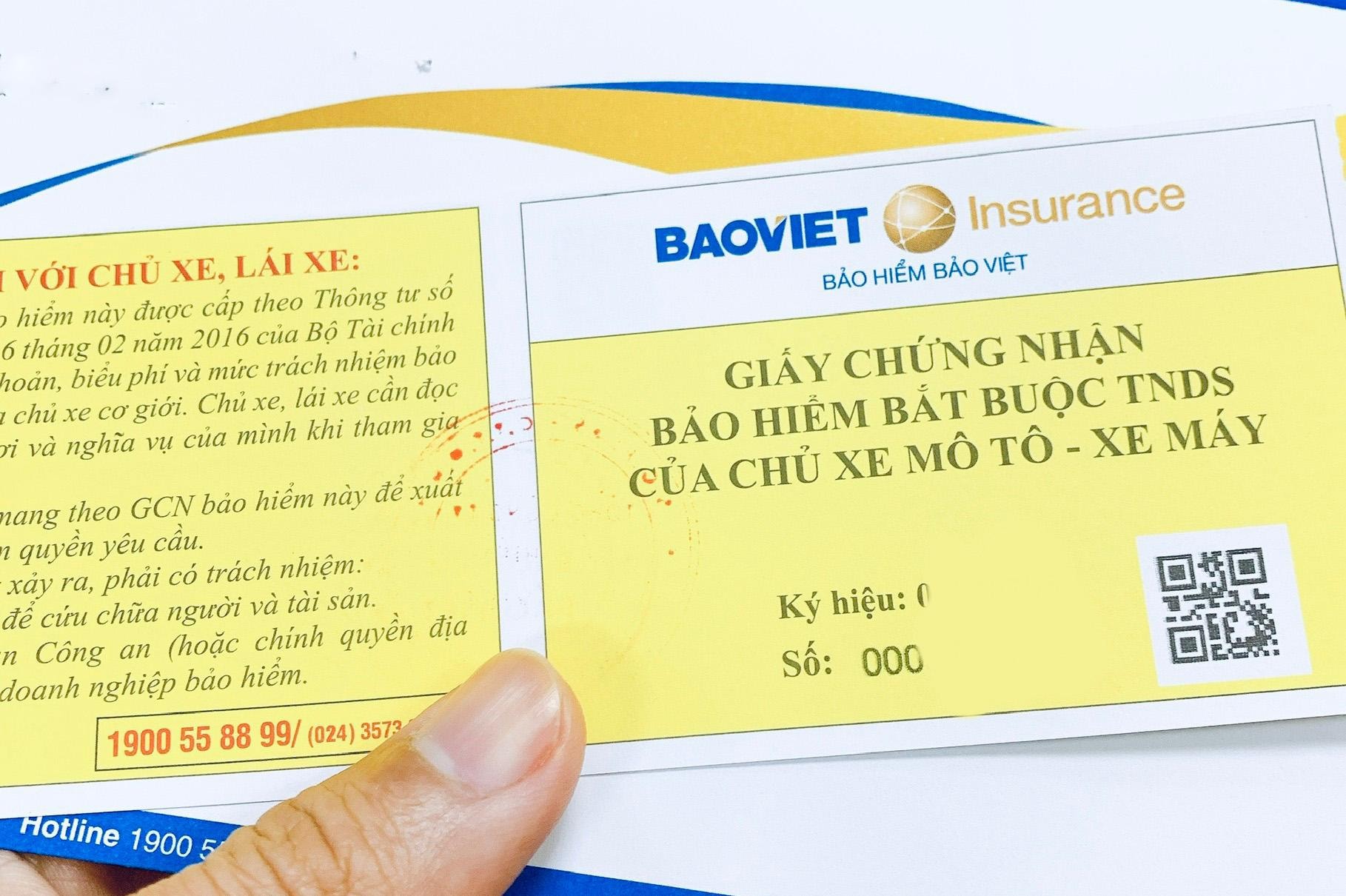

Currently, the insurance premium and compensation amount for an accident caused by a motorbike owner to a third party are clearly regulated by law. Photo: Tien Dong |

Correct understanding of compulsory insurance for motorbikes

According to regulations, the insurance premium for two-wheeled motorbikes with a cylinder capacity of 50cc or less and electric motorbikes is 55,000 VND, for motorbikes over 50cc the insurance premium is 60,000 VND; for similar types of motor vehicles, the insurance premium is 290,000 VND, all excluding 10% VAT. The insurance liability for damage to health and life caused by motor vehicles is 150 million VND for one person in an accident. The insurance liability for property damage caused by two-wheeled motorbikes; three-wheeled motorbikes; motorbikes (including electric motorbikes) and vehicles with similar structures as prescribed by the Law on Road Traffic is 50 million VND in an accident.

In addition, the provisions on compensation payments have also been clearly stated in current legal documents. However, in reality, many people still do not clearly understand their rights, obligations and legal benefits after purchasing compulsory civil liability insurance.

Many people in Vinh City, when asked about buying compulsory civil liability insurance for motorbikes, shook their heads. Many people said they only went around the city so they did not buy it; some people said that even if they bought insurance, if an accident happened, they would not receive any benefits, so they often "avoided" buying insurance.

Ms. Nguyen Thi Huyen, residing in Ha Huy Tap ward (Vinh city) said that more than a month ago, while driving on the road, she was driving a motorbike and collided with a student riding an electric bicycle. After the accident, the other student suffered scratches on his arms and legs and had to go to the hospital for a health check. To resolve the matter quickly, Ms. Huyen agreed to pay more than 1 million VND in compensation to the person riding the electric bicycle, not knowing that when purchasing compulsory civil liability insurance, the insurance company would pay the injured party.

In fact, through statistics, the number of casesroad traffic accidentsTraffic accidents involving motorbikes often account for a very large proportion, about 70%. In Nghe An, in the first 10 months of 2022 alone, there were 74 traffic accidents involving motorbikes in the whole province, killing 59 people and injuring 60 people. Obviously, once a traffic accident occurs, it causes serious consequences, causing no small amount of damage to those involved.

|

Through inspection, many cases could not present compulsory civil liability insurance but only had voluntary insurance for people riding motorbikes. Photo: Dang Cuong |

According to a representative of a Traffic Police Team on National Highway 1A in Nghe An, through patrolling and checking, most people could not present compulsory civil liability insurance for motorbikes, but only voluntary insurance for people riding motorbikes. Many people still confuse these two types of insurance. For the type of accident insurance for people riding motorbikes, motorbikes, it only has compensation value for cases of people riding motorbikes, motorbikes of the vehicle owner who have an accident, but has no compensation value for third parties.

Some people even think that it will take time to get insurance to pay compensation, and have to go through many complicated procedures, so they negotiate with the injured party themselves instead of waiting for insurance.

Mr. Duong Minh Tu - Deputy Director of Bao Viet Nghe An said: If people participate in compulsory civil liability insurance, when an accident occurs, they will be compensated by the insurance agency (except in cases of intentional or using alcohol, beer causing the accident...), otherwise people will have to agree with each other on the amount of compensation. If the vehicle owner causing the accident does not buy insurance and falls into difficult circumstances, then the responsibility for compensation will be placed heavily on the family's shoulders, otherwise the insurance will pay.

Many opinions say that, in order for people to better understand the compulsory civil liability insurance for motorbikes and motorbikes and their personal benefits after an unfortunate accident, there needs to be widespread propaganda in society. There must be a mechanism to monitor and handle complaints quickly if people are slow to receive compensation from the insurance agency.

In addition, there should be a mechanism to manage the civil liability insurance fund for motorbikes. If the annual payment amount is much lower than the amount collected from this type of vehicle, it will be transferred to the fund for management and use. Or should there be a mechanism to gradually reduce the premium for those who participate in civil liability insurance for motorbikes for 5 consecutive years or more?

In a recent press conference on this issue, Minister of Finance Ho Duc Phoc said that the regulation of compulsory civil liability insurance for motorbikes and motorbikes is necessary and in accordance with the law, meeting practical needs to protect social interests and safety. Minister Ho Duc Phoc also said that many countries in the world also implement this type of insurance in a compulsory form. And this is a financial solution to support victims to promptly overcome damage to health, life and property when traffic accidents unfortunately occur./.