Unstable rice sale to China

Experts warn that dependence on this market is a danger that many other agricultural sectors in Vietnam have had to bear, such as rubber, watermelon, dragon fruit...

Nearly a month ago, Mr. T. - director of a rice exporting company in An Giang - was quite worried about the news that China had banned the import of rice through unofficial channels. However, after verification, this country only tightened imports and did not stop them, so the export work still took place, although it was more difficult than before.

Despite the risks

American and European companies buy hundreds of thousands of tons of Vietnamese rice to package and sell around the world at high prices, but consumers do not know they are eating Vietnamese rice.

According to this businessman, Chinese businesses that want to import officially must pay a quota fee of 80 USD/ton plus value added tax and import tax. For example, 5% broken rice from Vietnam is currently sold for 460 USD/ton. If sugar is imported officially, the tax plus the quota fee will increase the price to China by 160 USD/ton, not including transportation and warehousing costs. Therefore, Chinese traders still choose to buy unofficially because of the price difference.

According to business circles, the price of domestic rice in China has been increasing continuously in recent years, prompting Chinese businessmen to seek out Vietnam through both official and unofficial trade.

On the contrary, Vietnam's rice exports in the past 3-4 years have faced many difficulties because traditional markets such as the Philippines, Indonesia, Malaysia, Bangladesh... have reduced their purchases or changed their purchasing methods. The number of government contracts has decreased from over 60% of total rice exports to only 20% while businesses have not invested properly in market diversification.

Entering 2012, Vietnam's rice industry faced the risk of surplus, rice prices fell sharply so domestic enterprises rushed to export to China.

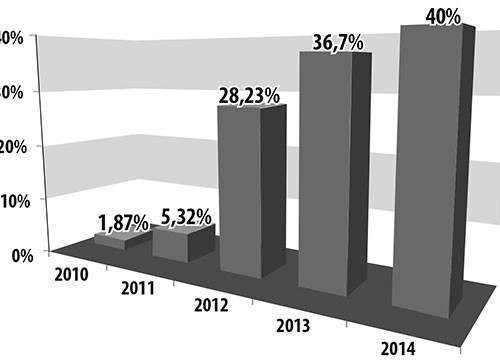

According to the Vietnam Food Association (VFA), Vietnam's rice exports to China increased dramatically from 250,000 tons in 2011 to over 3 million tons in 2012-2013. In the first seven months of this year alone, China remained Vietnam's largest rice import market, accounting for 40% of total rice exports.

Although it is an easy market because it mainly buys low-grade rice, according to export enterprises, this market is particularly risky in the payment stage. Chinese traders mostly pay in the form of post-payment (pay in advance about 20% of the contract value and pay the rest when receiving the goods), so if they encounter the risk of losing the ability to pay their Vietnamese partners. "Small-scale trading is smuggling in China, so there is a risk of having the whole shipment seized by customs and market management. At that time, the Chinese partner has no money to pay the Vietnamese businessmen" - Mr. T. said.

According to Dr. Ho Cao Viet - Southern Institute of Agricultural Science and Technology, China mainly buys low-quality rice through unofficial channels, which is full of risks. This way of buying and selling also does not put pressure on domestic enterprises to invest in building brands and creating added value for rice grains. "At that time, if China stops buying, Vietnamese rice will not be able to be shipped anywhere like other agricultural products," Mr. Viet warned.

|

| People harvest summer-autumn rice in Chau Thanh district, An Giang |

Should diversify the market

Mr. Ho Cao Viet said that the informal trade with China has caused a lot of disruption to the rice market in particular and the Vietnamese agricultural market in general. When they need goods, they are willing to order rice from domestic enterprises at a price 100-200 VND/kg higher, causing the price level to increase, but only a few weeks later they stop buying and the price drops sharply. "Vietnam should ban informal exports to China to focus on improving the quality and building rice brands to diversify the market and increase the value of rice grains," Mr. Viet suggested.

|

| The proportion of Vietnamese rice exports to China has increased sharply over the years. |

A study conducted by the Vietnam Centre for Policy Research (VEPR) in July showed that after Decree 109 on rice trading and export was implemented in early 2011, the number of rice exporting companies has decreased, with the remaining being mainly large-capital companies. Enterprises that are not qualified to export have become suppliers or seek to export to China in small quantities.

Mr. Nguyen Duc Thanh, director of VEPR, said that in the context of government contracts increasingly accounting for a small proportion of total exports, traditional markets such as the Philippines, Indonesia, Malaysia are unstable... Vietnam should change its rice industry development policy from ensuring food security to improving efficiency.

Accordingly, Vietnam should reduce the supply of rice by reducing the number of cultivation crops and focusing on high-quality, purebred varieties. “It is necessary to promote the private export market with stable export contracts, requiring high quality products. Vietnam has not yet formed large private rice exporting enterprises because state-owned enterprises still hold an important position in receiving rice export contracts and investment conditions in warehouses,” said Mr. Thanh.

According to Tuoitre online