New way of calculating personal income tax: Tens of thousands of people affected

If the personal income tax table is improved as proposed in August last year, the budget will have a revenue shortfall of 3,100 billion. Therefore, the Ministry of Finance is leaning towards another option that could increase the budget revenue by 500 billion.

Fear of 6,000 billion revenue shortfall

In 2009, the Personal Income Tax Law came into effect. At that time, people with incomes higher than the family deduction level had to start paying taxes according to a progressive tax schedule consisting of 7 levels (5%; 10%; 15%; 20%; 25%; 30%; 35%). People with the same income but different circumstances had different tax rates.

In this amendment to the tax laws, the Ministry of Finance proposed to reduce the personal income tax rate from 7 to 5. Because there are too many rates, the gap between the lower rates is too narrow, which can easily lead to a jump in tax rates when summing income at the end of the year, increasing the amount of tax payable, and the number of tax settlements increases unnecessarily while the amount of additional tax payable is not much.

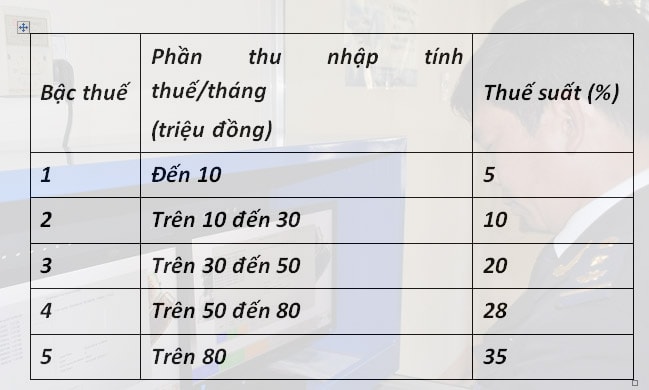

Therefore, in the plan proposed in August 2017, the Ministry of Finance wants to reduce the number of tax brackets to only 5, and at the same time stipulate a wide gap at the lower brackets. In addition, taxable income at each bracket will be adjusted to an even number.

|

| The plan was proposed in August 2017. |

According to the General Department of Taxation's calculations, with this draft Law, if the impact on 2015 revenue is calculated, the total budget revenue will decrease by about 3,100 billion VND. If economic growth factors are also taken into account, it is estimated that revenue by 2020 will decrease by about 5,968 billion VND.

The World Bank believes that: Although budget revenue is reduced, the poor will not benefit, while those with average and high incomes will benefit more.

Choose to increase revenue by 500 billion

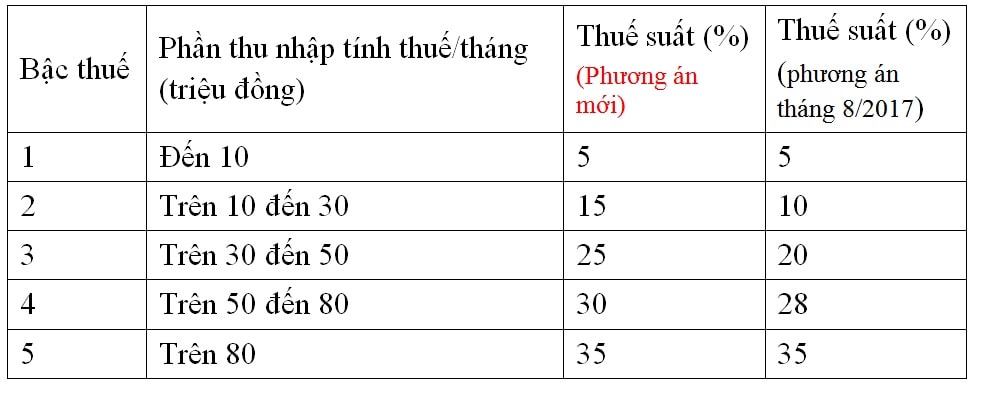

This significant revenue shortfall has the Ministry of Finance concerned. Therefore, in the latest draft of the personal income tax schedule, the Ministry of Finance still maintains the 5 levels but makes some adjustments.

|

| The new plan has been slightly adjusted compared to that of August 2017. |

By implementing this plan, the Ministry of Finance believes that it will meet the goal of reducing tax rates and adjusting taxable income at each rate to even numbers. However, budget revenue will decrease by about VND 1,300 billion (calculated based on the impact on 2015 revenue).

At the same time, there are opinions that this tax schedule amendment will benefit the rich, not low-income individuals. Specifically, individuals with taxable income currently at level 1 will not be affected, individuals currently paying tax from level 2 or higher will have their tax reduced compared to the present.

For example, an individual with a taxable income of 10 million/month will receive a reduction of 250,000 VND/month, an individual with a taxable income of 30 million/month will receive a reduction of 850,000 VND/month, an individual with a taxable income of 40 million/month will receive a reduction of 750,000 VND/month, an individual with a taxable income of 80 million VND will receive a reduction of 650,000 VND/month...

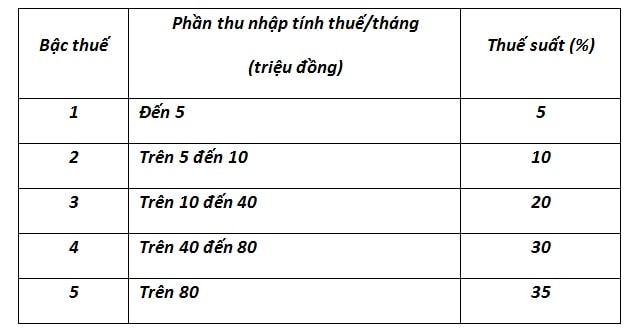

Therefore, the Ministry of Finance has proposed another option and this is the option that the Ministry of Finance is leaning towards.

|

| Another new option has been put forward and the Ministry of Finance is leaning towards it. |

With this plan, the Ministry of Finance believes that: Individuals with income at level 1 and level 2 will not be affected, individuals with income from level 3 and above will have their taxes increased compared to the current level. However, according to the Ministry's assessment, the increase compared to the income of high-income earners is not large.

For example, an individual with a taxable income of 15 million VND/month will pay an additional 250,000 VND/month, an individual with a taxable income of 30 million VND/month will pay an additional 400,000 VND/month, an individual with a taxable income of 50 million VND/month will pay an additional 500,000 VND/month, and an individual with a taxable income of 80 million VND/month will pay an additional 650,000 VND/month.

This option is different from other options in that the budget does not decrease but increases by about 500 billion VND.

Commenting on the personal income tax table, economic expert Ngo Tri Long said: To encourage talented workers with high incomes and prevent tax losses from income falsification and tax fraud, tax rates should be changed according to the progressive tax table so that the gap between the levels is not too different.

According to the authorities, personal income tax paid to the budget has now exceeded the revenue from crude oil and has continuously increased sharply over the years. In 2014, the budget collected more than 47,000 billion VND from this tax, by 2016 it had increased to 64,000 VND and according to the 2017 estimate, it could exceed 80,000 billion VND. Thus, the budget revenue through personal income tax tends to increase.

Economist Ngo Tri Long suggested that the progressive tax rate should be changed from 7 levels to 6 levels.

Specifically, the tax rate is 5% for taxable entities with taxable income of 10 million VND/month.

Tax rate of 9% for taxable entities with income from 10-15 million VND/month.

Tax rate of 13% for taxable entities with income from 15-30 million VND/month.

Tax rate of 18% for taxable entities with taxable income from 30-45 million VND/month.

Tax rate of 24% for taxable entities with taxable income from 45-70 million VND/month.

Tax rate of 30% for taxable entities with taxable income of over 70 million VND/month.