Warning of fraud using biometrics

The implementation of biometrics is a policy of the State Bank of Vietnam (SBV) to enhance customer security and help reduce fraud. However, the forms of fraud are also rapidly changing.

16.6 million accounts have been "matched"

According to information from the State Bank of Vietnam, currently more than 87% of adults have a payment account at a bank and many banks have processed more than 95% of transactions on digital channels. Non-cash payments have grown strongly, especially in the number of payment transactions via mobile phones and QR codes, reaching an average of more than 100% per year from 2017 to 2023.

However, in addition to the benefits and conveniences that banking products and services on the internet bring, the banking industry also faces risks and challenges related to security, safety, and confidentiality against the risk of cyber attacks, the use of high technology to defraud and appropriate people's money and bank accounts, and increasingly sophisticated and complex tricks.

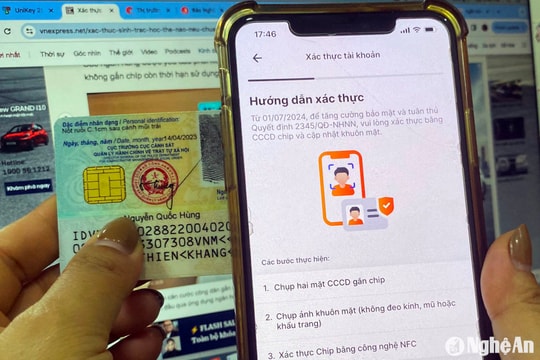

Therefore, to protect customers using banking services, from July 1, banks will require biometric authentication for money transfers of VND10 million or more. Deputy Governor of the State Bank of Vietnam Pham Tien Dung said that biometric authentication is necessary, adding a layer of protection so it will be safer. In case customers lose their documents or are brought to the bank by bad guys to fake and defraud money, it is difficult to do because there is facial biometrics to confirm whether the owner is real or not. Customers who do not have a chip-embedded citizen ID card have been instructed and supported by the bank when making transactions of over VND10 million.

As of 5:00 p.m. on July 3, 16.6 million bank accounts had been checked and compared with data from the Ministry of Public Security to eliminate fake accounts that were not owned by the owner, created with fake documents, etc. Statistics show that in the first 3 days of July, the entire system performed an average of about 23 million transactions per day, of which over 1.9 million transactions were over 10 million VND, accounting for 8.2% of the total transaction value, higher than the average of June 2024. "Only over 8% of transactions required biometric authentication, while nearly 92% were normal transactions, so there was no congestion. Some local congestion cases on the first day of application were handled, and by July 2-3, basically all transactions were smooth," Mr. Dung added.

Although the mandatory biometric authentication requirement only started on July 1, immediately, on the cyberspace, there has been a situation where subjects took advantage of the situation when customers had difficulty updating biometric information to appropriate information. Some banks such as Vietcombank, Agribank... have warned customers about subjects impersonating bank employees contacting to support information updating, from there asking customers to provide personal information, service information or sending fake links to defraud and appropriate property.

Biometrics to protect customers

Lieutenant Colonel Trieu Manh Tung - Deputy Director of the Department of Cyber Security and High-Tech Crime Prevention, Ministry of Public Security said that the risk of cyber security in the current context is very high, if the opening of accounts and the use of accounts for transactions are not managed, any criminal can take advantage. According to comrade Tung, fraud to appropriate money in banking accounts has now become a "money-making profession" for many subjects. Fraudsters are increasingly professional, the scale of each organization is up to hundreds of people, sitting in the office, with clear roles and tasks: There are groups specializing in researching scenarios; there are groups trained to carry out fraud scenarios, responding to situations after a few months of apprenticeship; there are groups handling cash flow... Scenarios are "created" very quickly by fraudsters. Specifically, the banking industry has only implemented biometric authentication since July 1, and immediately there has been a form of fraud impersonating bank officials to guide people in biometric authentication. The impersonators are also increasingly professional and proficient.

Previously, scammers impersonating police and inspectors were easily detected because they used many incorrect concepts and commands, but now, all commands and specialized terms are used almost completely correctly by the subjects. The processing of money flow is also handled very quickly by scammers. After the fraudulent money is transferred to the recipient's account (all of which are accounts not owned by the owner and purchased from others), it only takes a few seconds for the money to spread in all directions.

For example, in 2023, the Department of Cyber Security and High-Tech Crime Prevention (Ministry of Public Security) coordinated with Quang Binh Police to discover an online fraud ring with 300 subjects. Therefore, according to comrade Tung, it is extremely important for the banking industry to implement biometric authentication requirements for money transfers of over VND 10 million/transaction or total transaction value of over VND 20 million per day.

From the management agency side, the State Bank said that in the coming time, in order to promote and enhance the security, safety and confidentiality of banking services in cyberspace, the State Bank will continue to focus on the following key tasks: Investing in perfecting the information technology infrastructure of credit institutions and payment intermediary organizations; at the same time, upgrading and developing payment infrastructure to ensure continuous, smooth, safe operations, seamless and continuous connection with other sectors and fields (such as public services, healthcare, education, e-commerce, etc.) and cross-border payment connections to meet the needs of using diverse banking services...

Police warn of 4 common scams

Firstly, impersonating reputable organizations, individuals, relatives, banks, etc. accounts for 50% of fraud activities and methods.

The second is to invite investment in online business. Recently, scammers have called for investment in gold exchanges, international stock exchanges, etc. Accordingly, the subjects lure players by letting them win a few times, the account increases a few times but they cannot withdraw money. To withdraw money, players must deposit more money. Just like that, some investors have lost up to 20-30 billion VND.

The third is using sensitive information to blackmail, mainly to deceive the emotions, then lure the victim to send sensitive information, videos, and images, then use these sensitive clips to threaten and blackmail. Recently, many people, including those working in state agencies, have fallen into the trap. This scam is very professional, organized, and has a clear scenario.

Fourth is to trick people into installing applications containing malicious code to take over their accounts.