Directive 40-CT/TW promotes social policy credit activities

(Baonghean.vn) - After more than 8 years of implementation, Nghe An province has thoroughly grasped and promptly deployed Directive No. 40-CT/TW on strengthening the Party's leadership over social policy credit to all levels, sectors, relevant agencies and units in the area.

Movement from Directive 40

Dien Chau district is one of the localities that has effectively implemented Directive 40-CT/TW on strengthening the Party's leadership over social policy credit, deploying many solutions to promote loan capital for beneficiaries. As of March 31, 2023, the capital source from the local budget reached 5,573 billion VND, and in January 2023, the People's Committee of Dien Chau district promptly transferred 850 million VND to the Social Policy Bank. Thereby, it has helped the poor and social policy beneficiaries to access the most convenient loan capital, creating motivation for them in labor, production, to escape poverty and become rich legitimately.

Mr. Pham Xuan Sanh - Vice Chairman of the District People's Committee and Head of the Board of Directors of the Social Policy Bank of Dien Chau District said: Implementing Directive No. 40, Party committees and authorities at all levels have clearly recognized the role and position of social policy credit in implementing the goals of poverty reduction, job creation, new rural construction and ensuring social security; many localities have actively participated in a strong manner.

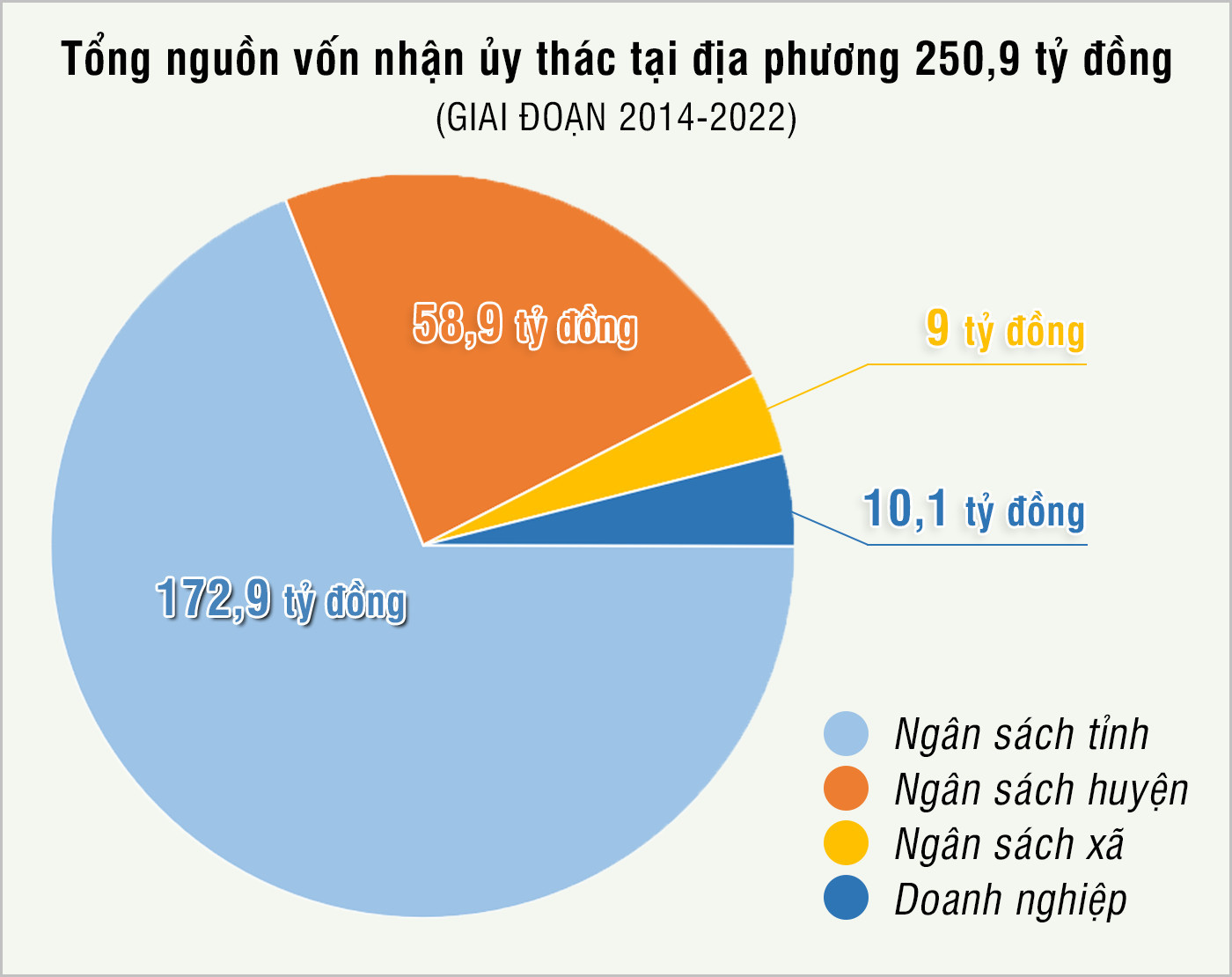

According to the assessment, Directive 40 has made positive changes in the leadership and direction of Party committees, Party organizations, and authorities as well as raised the awareness of cadres, Party members, civil servants, public employees, and people of all walks of life regarding policy credit. By the beginning of 2023, according to the report of the Vietnam Bank for Social Policies, Nghe An branch, the total capital reached nearly 10,878 billion VND, the average annual growth rate reached 9.28%/year, of which: The capital provided by the Vietnam Bank for Social Policies was 10,627 billion VND, accounting for 97.69% of the total capital; The capital entrusted locally reached 250.9 billion VND, accounting for 2.31%. The capital balance as of December 31, 2022 has increased 3.3 times compared to 2014. During the period 2014-2022, the capital entrusted to the locality increased by 179.6 billion VND.

In particular, after Directive No. 40 was issued, 305 communes have transferred budget capital with a balance of 9 billion VND. Other enterprises and organizations have entrusted 10.1 billion VND.

Thanks to that, many economic models have been implemented and brought high economic efficiency, creating stable income for poor households and policy beneficiaries, attracting workers, contributing to the restructuring of agricultural production in the area.

Typical models include: Projects for growing crops in Dien Chau, Nghi Loc districts and Vinh city; raising large livestock for breeding, meat, and black chickens in Ky Son, Tuong Duong, Que Phong, and Quy Chau districts; large-scale production forestation projects in Tan Ky, Nghia Dan, and Thanh Chuong districts; or models of farm economics, land reclamation, restoration, and renovation of mixed gardens to grow fruit trees for great economic value in Quy Hop, Con Cuong, Nghia Dan, Tan Ky, and Yen Thanh districts; models of growing industrial crops and high-value raw material crops (coffee, rubber, tea, sugarcane, etc.) in Anh Son, Nghia Dan, Quy Hop, Tan Ky, Anh Son, and Thanh Chuong districts;

Or investment loan projects to develop traditional craft villages contribute to preserving the national cultural identity and local culture, such as: soy sauce making in Nam Dan district; rattan and bamboo weaving in Yen Thanh district; brocade weaving in Con Cuong district; seafood processing in coastal districts and towns: Cua Lo town, Quynh Luu town, Hoang Mai town, Dien Chau; mulberry growing and silkworm raising in communes along Lam river in Do Luong district,...

Thanks to preferential capital through social policy credit programs, in recent years, thousands of poor and near-poor households have been helped to escape poverty sustainably and become rich.

Continue to increase resources for policy credit

Mr. Tran Khac Hung - Director of the Provincial Social Policy Bank said: In recent times, policy credit activities have always received close attention and direction from the entire political and social system. The companionship and understanding of the needs of the poor and policy beneficiaries is the basis for all levels and sectors to direct and lead political and social organizations to improve the quality of loan entrustment implementation, and expect a stronger movement in the coming time.

Currently, many localities have strengthened leadership and direction of social policy credit to all levels, sectors, agencies and units, creating clear changes.

“To continue to effectively implement Directive 40, the People's Committee of Dien Chau district will have policies to create maximum conditions for the operation of the Social Policy Bank in the area, in order to transfer preferential credit capital to the right beneficiaries. Continue to mobilize maximum resources to supplement policy credit capital associated with the transformation of production structure, economic development, education, vocational training, job creation, ensuring social security; organize technical training activities, training and technology transfer associated with loan activities, helping borrowers use capital effectively", said Mr. Pham Xuan Sanh - Vice Chairman of the People's Committee of Dien Chau district.

However, Nghe An is a province with harsh natural conditions, frequent natural disasters, epidemics, etc., which significantly affect production and people's lives, especially vulnerable groups such as the poor and policy beneficiaries, ethnic minority households in remote, isolated and border areas.

As a province with many difficulties and a large population, the demand for loans from poor households and other policy beneficiaries is still very large, but the source of policy credit has not met the actual demand, especially the source of loans to create jobs, maintain and expand employment for workers. Although the capital entrusted through the Social Policy Bank has many positive changes, compared to the total capital source, it is still very modest, only reaching 2.3%. Some policy credit programs have loan terms and loan levels that are not suitable to the actual growth cycle of some long-term crops and livestock, etc.

Typically, in Nghi Loc district, Mr. Nguyen Duc Tho - Vice Chairman of Nghi Loc District People's Committee said: Nghi Loc is a locality with many key industrial zones, with a large area of converted agricultural land recovered, high demand for capital for production, business, and career conversion, but the annual credit capital is low, not meeting the needs of local people. Therefore, it is recommended to pay attention to supplementing capital for job creation loan programs, capital for average households, and reducing the situation of rural youth without jobs, leading to social evils and black credit.

Recently, at a meeting with the Central Economic Committee on the situation of mobilizing, managing and using social policy credit capital, Nghe An proposed that the Central Government study and amend a number of points in the lending regulations of current policy credit programs. Specifically, increase the maximum loan term of the loan program for newly escaped poverty households from 5 years to 10 years (equivalent to the maximum loan term of the program for poor and near-poor households); increase the maximum loan amount of the rural clean water and environmental sanitation program from 10 million VND to 20 million VND/project. Pay attention to supplementing capital sources for the Social Policy Bank to implement loans to support job creation, maintain and expand employment for workers, especially in localities frequently affected by natural disasters...

Since the implementation of Directive 40-CT/TW, the total lending turnover has reached VND 23,117 billion; debt collection turnover has reached VND 18,307 billion (accounting for 79.2% of lending turnover). By December 31, 2022, the total outstanding policy credit balance has reached VND 10,866 billion, with 229,078 poor households and other policy beneficiaries still having outstanding debt.