Policy credit to support poor households in Quy Hop

After 10 years of implementing Directive No. 40, policy credit activities have supported poor households, contributing to the construction of new rural areas in Quy Hop.

The diligent do not let the land rest

Following the staff of the Social Policy Bank of Quy Hop district, we went to Manh village, Bac Son commune to meet Ms. Vi Thi May Xung (born in 1989) - Head of the village's savings and loan group, who is also an effective production loan group member.

Ban Manh is located 10km from the center of Bac Son commune, but the people's lives have changed a lot compared to a decade ago. The Thai ethnic people here gather along the Pu Sung mountain range. When we arrived, the whole village was bustling with rice harvest season. Temporarily putting aside the busy household chores and village affairs, Ms. Vi Thi May Xung and her husband - Mr. Lo Van Dan (born in 1986) welcomed us in a spacious, cool stilt house in the middle of the green of tangerines and hybrid acacias.

Ms. Xung said: "Being elected as the leader of the savings and loan group, I determined that first of all I must set an example for members and people to follow in order to produce and do business effectively. Therefore, amidst the hundreds of worries about family and children, I focused on developing the farm economy, comprehensive animal husbandry and crop cultivation."

In 2016, Xung's family borrowed 30 million VND from the poor household program to buy breeding cows. The livestock farming developed and the bank loan was paid off. In 2019, the couple escaped poverty and borrowed another 50 million VND from the near-poor household program to raise breeding cows.

Next, her family borrowed 20 million VND from a computer program for their two children to go to school. Hardworking people do not let their land rest, in 2023, they continued to borrow another 30 million VND from the near-poor household program to plant acacia.

Ms. Xung shared: If we want to have enough food and move up, we can only look to forest land and develop livestock farming. After a period of focusing on livestock farming, the herd of cows has grown, the family has sold some of the cows to pay off some of the bank debt, and currently has 14 cows left. In addition, the family currently has 18 hectares of raw acacia trees that are about to be harvested, and are also growing very well.

With loans from the Social Policy Bank, many households in Bac Son have escaped poverty and become well-off. A typical example is Ms. Lo Thi Dat's family in Manh village who borrowed 30 million VND from the poor household program to invest in cattle breeding and acacia planting; to escape poverty in 2023. Ms. Dat currently has 15 cows, 5 hectares of acacia, and 1 hectare of sugarcane. Or Sam Thi Tuat's family in Puc Nhao village has gone from near-poor to well-off, now having 16 cows.

Mr. Vi Van Thoai - Chairman of the People's Committee of Bac Son Commune, Quy Hop said: In the commune, there are currently 300 customer households borrowing capital, with outstanding debt from the Social Policy Bank of 22 billion VND. Particularly for Manh village, from a particularly difficult village with a very high rate of poor households, in recent years, it has "transformed" into one of the rich villages of Bac Son commune.

Through implementation, it shows that the Party Committee and the Government affirm that loans from the Social Policy Bank play an important role in economic development, job creation and poverty reduction. Currently, more than 80 households have escaped poverty sustainably, the current poverty rate is 21.6% (in 2014 the poverty rate was over 35%).

Ms. Ho Thi Kieu's family in Xuan Loi hamlet, Van Loi commune, Quy Hop district was also considered a poor household in the past. In 2018, Ms. Kieu was considered for a loan of 50 million VND to create jobs, to invest in raising breeding buffaloes and growing fruit trees such as oranges, tangerines...

Thanks to technical training and hard work, Ms. Kieu's family model has been very effective. Currently, Ms. Kieu's family has 2 hectares of citrus trees and more than 1 hectare of sugarcane. From livestock production, each year her family earns about 200 million VND. With that amount of money, her family can cover their living expenses and gradually become a well-off household and a typical example in effectively utilizing policy credit capital.

Or in Tho Hop commune, Mr. Tran Ngoc Huy (born in 1992) in Tho Son hamlet borrowed capital from the job creation program to open a wood painting manufacturing facility.

Mr. Huy shared: Tho Hop commune is mostly inhabited by Tho ethnic people, many families have perennial garden trees such as jackfruit wood, teak wood. I take advantage of local raw materials in the commune, district, and my own skills to create wooden paintings.

Thanks to the loan from the Policy Bank, Mr. Huy invested in advanced machinery to produce decorative details on wooden materials, reducing labor, increasing productivity and product quality. The facility's revenue is currently about 400 million VND/year, with products sold in the province and other provinces and cities.

Local authorities actively participate

Quy Hop is a mountainous district in the Northwest of Nghe An province. The whole district has 20 communes and 1 town, of which 14 communes are in extremely difficult areas; the proportion of ethnic minority households accounts for 52% of the total number of households in the area. The geographical location of the district is very favorable for the development of agriculture, forestry and the cultivation of short- and long-term industrial crops.

After 10 years of implementing Directive No. 40-CT/TW dated November 22, 2014 of the Central Party Secretariat, Conclusion No. 06-KL/TW dated June 10, 2021 of the Secretariat on strengthening the Party's leadership over social policy credit, social policy credit activities in the area have had many positive changes.

Party committees and authorities at all levels pay attention to and focus on leadership, direction, and creating favorable conditions in all aspects for the activities of the Social Policy Bank in the area.

Every year, the People's Committee of the district and communes and towns have paid attention to allocating budget sources to entrust the Social Policy Bank to provide loans to poor households and policy beneficiaries, support funding, facilities, arrange commune transaction points, remove difficulties, and create favorable conditions for the Social Policy Bank to operate effectively and complete assigned tasks well.

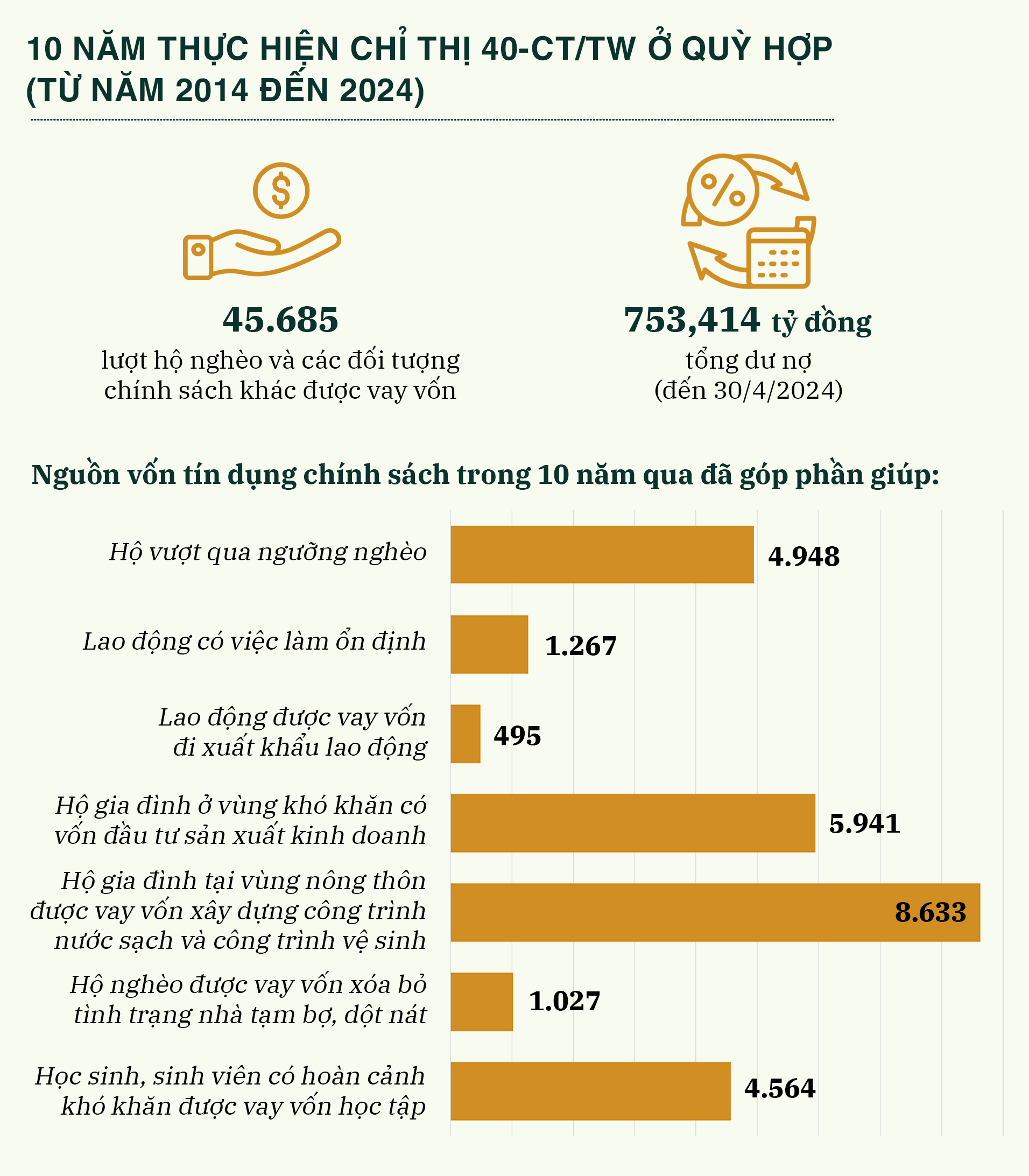

Mr. Nguyen Thanh Hai - Director of the Social Policy Bank of Quy Hop district said: From 2014 to now, 45,685 poor households and other policy beneficiaries in the district have received loans from banks, including 10,888 poor households, 11,097 near-poor households and 1,208 newly escaped poverty households receiving loans for production development. By April 30, 2024, the total outstanding debt reached 753,414 billion VND, an increase of 457,634 billion VND compared to before implementing Directive 40-CT/TW, with 12,555 households still having outstanding debt.

With that result, social policy credit has significantly contributed to reducing the annual poverty rate from 22.05% in 2014 to 11.68% by the end of 2023; contributing to the successful implementation of the poverty reduction and new rural construction goals, stabilizing security and politics in the locality.

Currently, the outstanding debt of the District Social Policy Bank is in the top 5 of Nghe An province, and credit quality is increasingly improved. In recent years, the leaders of Quy Hop district have paid attention to directing and allocating financial resources from the district budget to support the poor and policy beneficiaries through credit channels. As of April 30, 2024, the total budget reached 5,184 billion VND. This support capital, together with the central capital and the provincial budget, has helped tens of thousands of poor households and policy households have capital to invest in production, create jobs and stable income, contributing to improving their lives and gradually escaping poverty sustainably.

Mr. Hoang Van Thai - Vice Chairman of the District People's Committee, Head of the Board of Directors of the Social Policy Bank of Quy Hop District