Tax authorities have the right to inspect and collect money in personal accounts showing signs of fraudulent business activities.

If there are signs of tax fraud, the tax authority has the right to inspect and collect all accounts related to business activities. A business household is only allowed to register one main bank account with the tax authority to manage transactions.

According to Ms. Nguyen Thi Cuc, Chairwoman of the Vietnam Tax Consulting Association, at a discussion on July 8 organized by Tien Phong newspaper, each business household can own many bank accounts, but only one main account is registered with the tax authority.

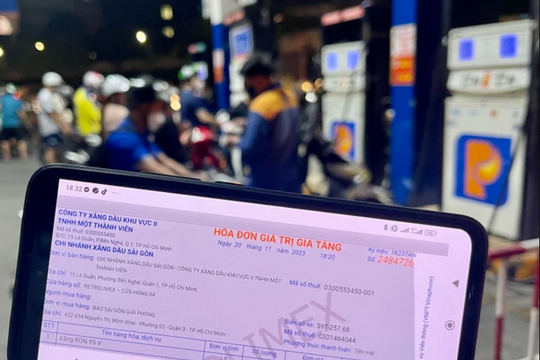

Transaction information of this account will be provided by the bank for tax management. In case of suspected violations, the tax authority can expand the inspection of all related accounts to ensure transparency.

To take advantage of tax incentives and easily expand, Ms. Cuc recommends that business households should convert into enterprises. This helps to make cash flow transparent, comply with tax responsibilities and access capital more easily. However, she also admits that the tax system is still complicated, especially for households that are new to technology or changing their business model.

Ms. Cuc proposed that the tax sector needs to simplify procedures, provide clear instructions and upgrade technology to support taxpayers, especially when implementing Decree 70 and digital transformation goals.

Mr. Nguyen Tien Minh, Deputy Director of the Hanoi Tax Department, emphasized that the tax sector prioritizes administrative reform, creating a synchronous legal framework to help business households easily comply with the law and develop sustainably.

Mr. Minh encourages business households to proactively learn about the law and ensure requirements such as origin of goods, invoices, documents and fire prevention regulations. Self-compliance not only helps avoid risks but also creates a foundation for long-term and stable business operations.