Nghe An Tax Department: Pioneer in fighting against tax loss from petroleum business

(Baonghean) - For decades, the situation of selling gasoline without invoices and declaring lack of transparency in gasoline business activities has caused this sector to potentially lose large amounts of tax revenue. With dedication and responsibility, Nghe An Tax Department has worked hard to research and develop a project to combat the loss of gasoline business tax revenue and has collected an additional 350 billion VND.

According to statistics, Nghe An province has nearly 400 petroleum trading enterprises with over 540 petroleum stations in operation.

Among the large petroleum enterprises in Nghe An such as Nghe An Petroleum Company, PTS Nghe Tinh Transport Joint Stock Company, PV Oil, Military Petroleum Company... Nghe An Petroleum Company accounts for more than 50% of the market share in the province, with 69 stores and 200 agents; the remaining 40% of the market share belongs to other petroleum retailers and enterprises.

|

| The General Department of Taxation's Budget Report reports on the results of petroleum tax collection at the industry's year-end meeting. |

The reason for the tax loss from petroleum business activities is that most consumers (individuals) do not take invoices when buying petroleum, so some businesses have sold or given invoices to businesses and business organizations that need invoices for accounting purposes, reducing the obligation for value added tax (VAT) and corporate income tax (CIT). Authorities at all levels and competent state management agencies have not yet had effective measures to prevent...

Faced with that reality, the officers of Nghe An Tax Department have researched and determined to "break through" this battlefield, coordinating with the Department of Science and Technology to find a measurement solution, with the press to guide public opinion, advising the Provincial People's Committee to direct the implementation of the Project to prevent tax loss in petroleum business activities in Nghe An province by the solution of managing total meters at petroleum stations.

After a rather difficult time, including opposition from businesses and stores; dozens of gas stations were closed, not operating, not cooperating... Nghe An Tax Department has achieved many results. In response to the Tax Department's determination to combat revenue loss, in May 2015, Nghe An Provincial People's Committee approved the project and assigned departments and branches to coordinate implementation, with the core being the Tax Department.

|  |

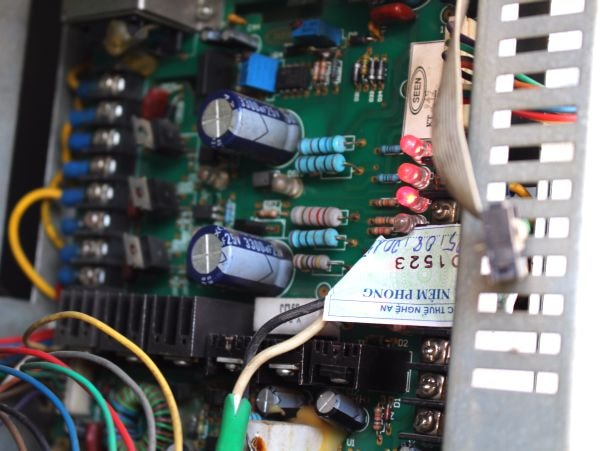

| Tax Department officers check gas station meters as a basis for tax calculation. Sealed lead clamps at gas stations. |

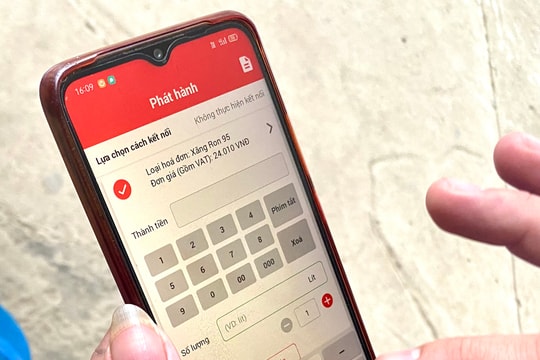

Every month, the tax authority records the number on the master meter to determine the amount of gasoline and oil sold and compares it with the taxpayer's declaration. During the recording of the amount of gasoline and oil, if the seal is found to be damaged or the master meter is not working, the Tax Department shall notify the Department of Standards and Quality Measurement to re-seal it. Based on the amount of gasoline and oil sold, the Tax Authority shall compare it with the input invoice of the supplier. If there is a difference, the Tax Authority shall impose a fine and collect additional taxes and environmental protection fees. The Tax Authority also established a standing team to handle related and unexpected tasks related to this project. After the project implementation period, the consumption output of gasoline and oil enterprises has increased significantly. After many months of following the locality and facilities, the Tax Department has sealed and locked the number on the master meter of gasoline and oil measuring devices of enterprises in 21 districts and towns with a quantity of nearly 1,200 pumps; Close the number on the total meter, compare it with the amount of gasoline sold and the tax declaration of the enterprise to manage and prevent tax loss.

Mr. Duong Minh Duc - Head of Yen Thanh Tax Department said: In 2014, the petroleum business sector in Yen Thanh paid 169,440,000 VND in taxes, but in 2015, after being sealed, the tax collected from this sector was 510,346,700 VND, and in the first 9 months of 2016, it was 363,750,000 VND.

In the whole province, after implementing the project, revenue from petroleum trading increased, creating a basis for calculating more taxes. In the first 10 months of 2016, Nghe An Tax Department increased tax revenue by 350 billion VND from petroleum trading, of which environmental protection tax was 309 billion VND.

Mr. Nguyen Dinh Hoa - Director of Nghe An Tax Department said: The initiative of Nghe An Tax Department on the project to prevent tax loss in petroleum business in the province after implementation has brought high efficiency. The Ministry of Finance issued Official Letter No. 12733/BTC-TCT dated September 13, 2016 to provinces and centrally-run cities requesting coordination in directing tax management for petroleum business activities such as Nghe An; The General Department of Taxation issued Official Letter No. 4156 on strengthening tax management for petroleum business activities applied in 63 provinces and cities nationwide. |

Chau Lan