Former National Assembly member Nguyen Thi Nguyet Huong quietly withdrew from the hot seat of VID Group.

Ms. Nguyen Thi Nguyet Huong - Chairwoman of VID Group, was a National Assembly delegate for the 12th and 13th terms... before withdrawing because she was found to be unqualified to be a National Assembly delegate for the 14th term.

According to the latest information from Vietnam Investment and Development Group (VID Group), Ms. Nguyen Thi Nguyet Huong is no longer the Chairwoman of the Board of Directors. Ms. Nguyet Huong has been the Chairwoman of VID Group since 2006 when she was only 37 years old.

In the business world, Ms. Nguyet Huong is a famous businesswoman, known as a midwife for industrial zones in the North as well as an expert in attracting foreign investment.

VID Group is the predecessor of TNG Holdings Vietnam. In which, TNG Holdings is said to have a large stake in TNR Holdings Vietnam Real Estate Investment and Development Joint Stock Company.

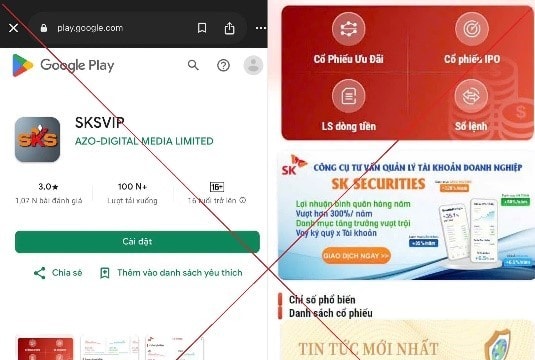

|

| Ms. Nguyet Huong is no longer the chairwoman of VID. |

Born in 1970, Ms. Huong is considered one of the most powerful women in the construction investment and real estate business. She took on the role of Chairwoman of the Board of Directors of VID Group since its inception, when she was 36 years old.

Ms. Nguyen Thi Nguyet Huong was a delegate of the Hanoi People's Council in the 12th and 13th terms and a delegate of the 12th and 13th National Assembly. She also held the following positions: Member of the Economic Committee of the National Assembly... However, in July 2016, the National Election Council held an extraordinary meeting and voted by secret ballot not to recognize Ms. Nguyen Thi Nguyet Huong as a delegate of the 14th National Assembly due to her ineligibility and her personal request to withdraw.

Meanwhile, Minh Phu Seafood (MPC) of Chairman Le Van Quang increased its charter capital for the first time after ten years of maintaining the same level of 700 billion VND and 'returned' to the HOSE floor after 3 years of voluntarily canceling transactions.

In 2017, total revenue reached over VND 16,800 billion, up 40.7% over the same period and exceeding the plan by 6.8%. Profit after tax reached VND 841 billion, up nearly 8 times over the previous year but did not complete the plan approved by the 2017 Annual General Meeting of Shareholders.

Previously, in March 2015, Minh Phu surprised investors when it made the bold decision to withdraw from listing on HOSE after announcing huge profits in the previous year. The reason given was that listing on the stock exchange made it difficult for the company to sell shares to foreign partners due to the foreign room regulation at 49%.

Also related to real estate, Samland is one of four subsidiaries of Sacom Holdings preparing to go public. The Chairman of the Board of Directors of Samland is Mr. Dao Ngoc Thanh. Mr. Thanh is also the Vice Chairman of the Board of Directors of Sam Holdings and the General Director of Vihajico, the Investor of Ecopark urban area. Mr. Tran Anh Vuong is a member of the Board of Directors and General Director of Sam Holdings.

In 2015 and 2016, the company achieved revenue of VND820 billion and VND851 billion, respectively, with net profit of VND17.3 and VND24.8 billion. In the first 6 months of 2017, profit after tax reached VND5.2 billion.

VN-Index closed down 27.73 points (-2.54%) to 1,093.48 points. HNX-Index also fell 2.74 points (-2.14%) to 125.51 points. Foreign investors continued to net sell on HOSE and net buy on HNX.

In total, foreign investors bought 20.36 million shares, worth VND1,591.6 billion, while selling 27.6 million shares, worth VND1,757.8 billion. The total net selling volume reached 7.2 million shares, equivalent to a net selling value of VND166 billion.