Proposal to increase gasoline tax to 4,000 VND per liter

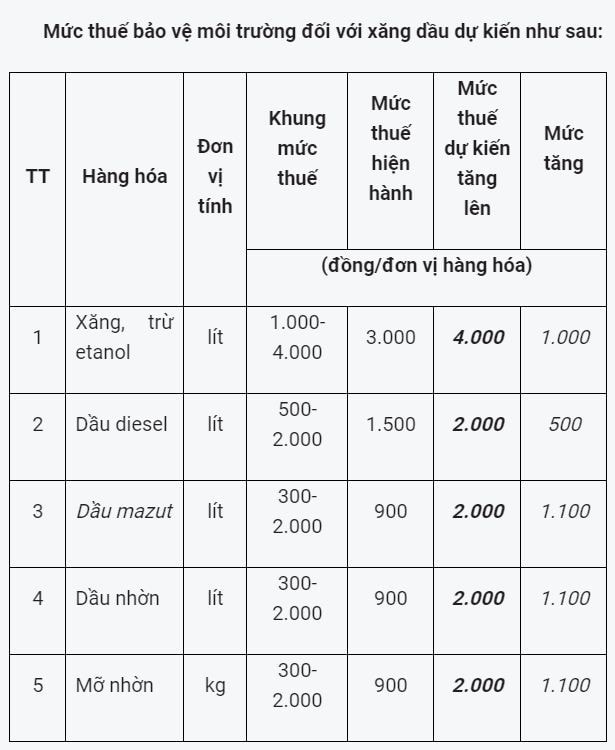

From July 1, 2018, environmental protection tax on gasoline is expected to increase by VND1,000/liter, to a ceiling of VND4,000/liter; other oil products will increase by VND500 - VND1,100/unit.

The Ministry of Finance is seeking comments on the draft resolution on environmental protection tax schedule.Accordingly, from July 1, 2018, the environmental protection tax on petroleum products is proposed to increase to the maximum level prescribed by law.

Specifically, gasoline: Tax range from 1,000 - 4,000 VND/liter. The current tax rate is 3,000 VND/liter. It is proposed to increase from 3,000 VND/liter to the ceiling of 4,000 VND/liter.

Diesel: Tax range from 500-2,000 VND/liter. Current tax rate is 1,500 VND/liter. Proposed increase from 1,500 VND/liter to a ceiling of 2,000 VND/liter.

Fuel oil, lubricants: Tax range from 300-2,000 VND/liter. Current tax rate is 900 VND/liter. Proposed increase from 900 VND/liter to the ceiling of 2,000 VND/liter.

Grease: Tax range from 300-2,000 VND/kg. Current tax rate is 900 VND/kg. Proposed increase from 900 VND/kg to the ceiling of 2,000 VND/kg.

|

| From July 1, 2018, the environmental protection tax rate on petroleum products is proposed to increase dramatically. |

In the report submitted to the Government on the draft resolution on environmental protection tax schedule, the Ministry of Finance explained that the proposal to increase gasoline tax as above is due to the sharp decrease in import tax.

Currently, Vietnam applies a tax rate of 20% for gasoline and 7% for all types of oil. However, implementing import tax reduction commitments, the preferential import tax rate for gasoline is only 10% and for all types of oil is 0%.

With the application of the above preferential import tax rates, revenue from petroleum import activities has continuously decreased over the years as importers switched to importing from markets with special preferential tax rates.

On the other hand, retail prices of gasoline in Vietnam are basically lower than those of neighboring countries in particular and many other countries in the ASEAN region.

With the above proposed adjustment plan, the Ministry of Finance calculates the total expected environmental protection tax revenue to be about 57,312 billion VND/year, an increase of about 15,684.2 billion VND/year.

Along with the increase in environmental protection tax revenue, the value added tax revenue for these goods will also increase to about 1,568.4 billion VND. At that time, the total state budget revenue is expected to increase to about 17,252.6 billion VND/year.

The Ministry of Finance also proposed to increase the maximum environmental protection tax on nylon to 50,000 VND/kg instead of the current tax rate of 40,000 VND/kg.

Increase environmental protection tax on coal because coal is a product that causes serious environmental pollution when used.

The tax rate on anthracite coal is expected to increase from VND20,000/ton to VND30,000/ton; that on brown coal, fat coal, and other coals will increase from VND10,000/ton to VND15,000/ton.