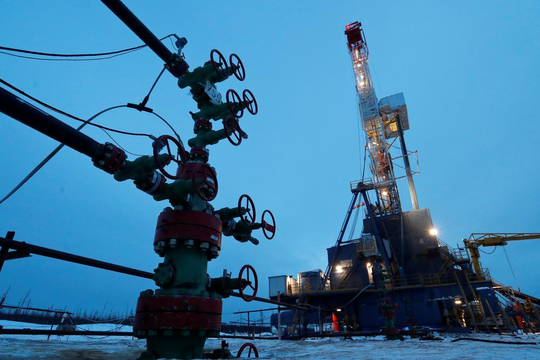

World oil price on October 4, 2025: Sharp drop all week

World oil prices today October 4, 2025: World oil prices stabilized at the end of the week but still recorded a decrease of 7-8% due to concerns about increased OPEC+ supply in November.

Oil prices recovered slightly in the trading session on October 4. Brent futures rose 0.5% to $64.40 a barrel, while US WTI crude rose 0.5% to $60.75 a barrel.

However, for the week as a whole, Brent crude fell 8.2% and WTI fell 7.6%, the steepest weekly declines in months, reflecting investor caution ahead of the new OPEC+ decisions.

According to Reuters, eight members of OPEC+ may agree to increase production from November by 274,000 - 411,000 barrels/day, double or triple the increase in October. This move is believed to help Saudi Arabia regain market share in the global energy market.

Experts said that the possibility of increased supply, along with global refineries entering a period of regular maintenance and reduced consumption demand after the summer, will continue to put pressure on oil prices, making it difficult for them to recover strongly in the short term.

Some market research organizations believe that the outlook for oil consumption in the Atlantic region is weakening. From October, the market is at risk of falling into a state of oversupply as the balance of supply and demand becomes increasingly unbalanced.

JPMorgan’s report said September could be a turning point, opening a period of surplus supply in the fourth quarter of this year and lasting into next year. This is an important factor that makes it difficult for oil prices to maintain their previous high levels.

In addition to supply and demand factors, the market also recorded a fire at Chevron's El Segundo refinery on the US West Coast, with a capacity of 290,000 barrels/day. The fire was quickly controlled, with no major impact on production recorded.

Experts said the incident only had a local impact on gasoline prices in California, while the global oil market was less affected because the area was relatively isolated from the US domestic oil and gas network.