Car prices in 2018 - the anxiety of Vietnamese people

Import tax from ASEAN to 0% is a clear sign to reduce car prices, but policies on special consumption tax and registration fees may be the opposite.

At the end of the first half of 2017, the total auto industry sales decreased slightly by 1% compared to the same period in 2016. Representatives of all companies admitted that the waiting mentality of customers is a factor that greatly affects business results. As 2018 approaches, the question of "will car prices decrease or increase, much or little" makes customers more uncertain.

Regulators can drive car prices up or down by adjusting taxes and fees in the opposite direction. In 2018, what taxes and fees can affect car prices?

Import tax from ASEAN to 0%

According to the commitment in the ASEAN Free Trade Agreement (ATIGA), cars with a localization rate of 40% or more within the bloc will enjoy an import tax rate of 0%. This means that by 2018, Vietnam can import cars from Thailand, Indonesia, Malaysia... with a tax rate of 0%, a sharp reduction from the tax rate in 2017 of 30%. At that time, car prices will decrease significantly. If calculated according to the tax-on-tax formula, car prices will decrease by about 23% if the tax is reduced from 30% to 0%.

|

Imported ASEAN car models like Fortuner can reduce prices when tax is 0%. |

For a car to be eligible for such a discount, it must meet two criteria: being produced by an ASEAN member and having a 40% localization rate within the bloc. This means that cars imported from ASEAN but with a localization rate lower than 40% or cars imported from a non-ASEAN country such as Korea, Japan, Europe, etc. will not be eligible for this preferential rate.

According to manufacturers, currently in the Vietnamese market, the number of these car models is quite small, but the number may increase next year when companies bring many new products to the country.

Proposal for new special consumption tax (SCT)

The Ministry of Industry and Trade recently proposed to exempt special consumption tax on the value created domestically for each car model. This proposal pushes the car market into two extremes, the price of domestically assembled cars decreases, the price of imported cars increases.

While imported cars have almost zero domestic value, assembled cars can increase this ratio over time. The higher the domestic content, the less tax paid, the lower the price of the car. At this point, the gap between the price of assembled cars and imported cars is even greater.

|

Grand i10 and domestically assembled models benefit from the new special consumption tax proposal. |

However, answering the press within the framework of the Vietnam Motorshow 2017, Mr. Pham Van Dung, General Director of Ford Vietnam, said that this proposal is difficult to implement because it violates Vietnam's commitments at the WTO as well as free trade agreements. Taxing special consumption tax differently between imported and assembled cars means violating the rule of "non-discrimination between imported and domestic goods".

Mr. Dung's proposal as well as VAMA's is to reduce component tax and support manufacturing investors during the integration period to create a level playing field.

But with the plan to become a center for car exports to the region, some experts predict that to avoid violations, Vietnam will still apply the special consumption tax tool but adjust it in a different form to avoid conflicts with international commitments, but still in the direction of supporting assembled cars, making it difficult for imported cars.

New registration fee

According to Decree 140/2016 on registration fees applied from January 1, 2017, from 2018, localities can increase the registration fee from the current 10%-12% to 15%. Increasing the registration fee does not affect the listed price of the car but increases the total cost that customers have to pay to be able to roll. Both imported and assembled cars are affected equally in this case.

|

Ford Ranger model at Vietnam Motorshow 2017 exhibition taking place in Saigon. Ranger will not enjoy 0% tax from 2018 because it is enjoying the 5% preferential rate for pickup trucks. If there is no change in policy, the price of pickup trucks will remain the same. |

Even pickup trucks, a type of car that has long enjoyed preferential import tax (5%), special consumption tax (15%-25%), and registration fee (2%), are also facing the risk of price increases due to the new proposal of the Ministry of Industry and Trade.

Accordingly, the tax and fee rates applied to pickup trucks are proposed to be calculated the same as passenger cars, increasing to 30% import tax (in 2017), 40%-110% special consumption tax depending on engine capacity, and 10% registration fee. This calculation method could cause pickup truck prices to double compared to current prices.

Combined impact of taxes and fees

Even when import tax, special consumption tax, VAT, and registration fee have been calculated, the management still has many types of fees that can interfere with the cost of buying a car for Vietnamese people. These can be license plate fees, inspection fees, road maintenance fees, insurance... or even fees that do not exist in Vietnam such as parking space certification fees...

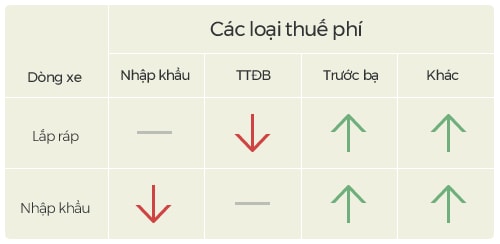

The total impact of taxes and fees in early 2018 on assembled and imported cars is expected to follow the direction below. Downward arrows mean decrease, upward arrows mean increase and dashes mean no impact. Excluding the factor of the manufacturer's will at each point in time.

|

The quantity and rate of price increase/decrease of assembled and imported cars are similar with two types of increase, one type of decrease and one type of no impact. With this summary table, it can be seen that the price of cars will increase or decrease depending on the impact of each type of tax and fee.

For example, an assembled car currently costs 500 million. If the new special consumption tax is applied, the tax reduction is 50 million, the increase in registration fee and other expenses is 30 million, the car price will decrease by 20 million. Conversely, if registration fee and other expenses increase by about 60 million, the car price will increase by 10 million. The same goes for imported cars.

Reactions of car companies in Vietnam

Representatives of joint venture companies in Vietnam said that the price change, whether it will increase or decrease, is still speculative and cannot be concluded accurately. However, the actions of each company show a clear import orientation.

|

Honda Jazz is a car model imported from ASEAN for sale in 2018. |

At the end of 2016, Honda replaced Civic assembly with imported, similar to Toyota's Fortuner. At the Vietnam Motor Show 2017 taking place in Ho Chi Minh City, a series of imported car models in all segments, ready to compete in 2018 such as Toyota Wigo, Avanza, Alphard; Honda Jazz, Suzuki Fit, Chevrolet Traiblazer...

The director of a large joint venture company said that the promotional discount to stimulate demand in 2017 in Vietnam has returned to the average price in the region, so it is unlikely that there will be further reductions in 2018.

"Given the policy fluctuations, the job of companies in 2018 may be to focus on stabilizing prices like this year rather than calculating whether to increase or decrease," he said.

For customers, receiving a "mountain" of unconfirmed information brings a constant state of waiting, accompanied by anxiety because of historical evidence - car prices in Vietnam have never dropped significantly.

According to VNE