Gold price today October 27, 2024: World gold price increased slightly, near the old peak

Gold price today October 27, 2024: World gold prices increased slightly and are finding their way back to their old peak. The price of 9999 gold rings is equal to 88.9 million VND/tael, stable at the highest peak of all time.

Domestic gold price today October 27, 2024

At the time of survey at 5:00 a.m. on October 27, 2024, the gold price on the trading floors of some companies was as follows:

The price of 9999 gold today is listed by DOJI at 87.9 million VND/tael for buying and 89.9 million VND/tael for selling.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 88.3-89 million VND/tael (buy - sell). Mi Hong gold price increased by 300 thousand VND/tael in the buying direction compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is also traded by the enterprise at 87-89 million VND/tael (buy in - sell out). Meanwhile, at Bao Tin Manh Hai, it is being traded at 87-89 million VND/tael (buy in - sell out).

The latest gold price list today, October 27, 2024 is as follows:

| Gold price today | October 27, 2024 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 87 | 89 | - | - |

| DOJI Group | 87 | 89 | - | - |

| Mi Hong | 88.3 | 89 | +300 | - |

| PNJ | 87 | 89 | - | - |

| Vietinbank Gold | 89 | - | - | |

| Bao Tin Minh Chau | 87 | 89 | - | - |

| Bao Tin Manh Hai | 87 | 89 | - | - |

| 1.DOJI- Updated: 10/27/2024 05:10 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 87,000 | 89,000 |

| AVPL/SJC HCM | 87,000 | 89,000 |

| AVPL/SJC DN | 87,000 | 89,000 |

| Raw material 9999 - HN | 87,800 | 88,200 |

| Raw materials 999 - HN | 87,700 | 88,100 |

| AVPL/SJC Can Tho | 87,000 | 89,000 |

| 2.PNJ- Updated: 10/27/2024 05:10 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 87,600 | 88,900 |

| HCMC - SJC | 87,000 | 89,000 |

| Hanoi - PNJ | 87,600 | 88,900 |

| Hanoi - SJC | 87,000 | 89,000 |

| Da Nang - PNJ | 87,600 | 88,900 |

| Da Nang - SJC | 87,000 | 89,000 |

| Western Region - PNJ | 87,600 | 88,900 |

| Western Region - SJC | 87,000 | 89,000 |

| Jewelry gold price - PNJ | 87,600 | 88,900 |

| Jewelry gold price - SJC | 87,000 | 89,000 |

| Jewelry gold price - Southeast | PNJ | 87,600 |

| Jewelry gold price - SJC | 87,000 | 89,000 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 87,600 |

| Jewelry gold price - Jewelry gold 999.9 | 87,500 | 88,300 |

| Jewelry gold price - 999 jewelry gold | 87,410 | 88,210 |

| Jewelry gold price - 99 jewelry gold | 86,520 | 87,520 |

| Jewelry gold price - 916 gold (22K) | 80,480 | 80,980 |

| Jewelry gold price - 750 gold (18K) | 64,980 | 66,380 |

| Jewelry gold price - 680 gold (16.3K) | 58,790 | 60,190 |

| Jewelry gold price - 650 gold (15.6K) | 56,150 | 57,550 |

| Jewelry gold price - 610 gold (14.6K) | 52,610 | 54,010 |

| Jewelry gold price - 585 gold (14K) | 50,410 | 51,810 |

| Jewelry gold price - 416 gold (10K) | 35,480 | 36,880 |

| Jewelry gold price - 375 gold (9K) | 31,860 | 33,260 |

| Jewelry gold price - 333 gold (8K) | 27,890 | 29,290 |

| 3. SJC - Updated: October 27, 2024 05:10 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 87,000 | 89,000 |

| SJC 5c | 87,000 | 89,020 |

| SJC 2c, 1C, 5 phan | 87,000 | 89,030 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 87,000 | 88,500 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 87,000 | 88,600 |

| 99.99% Jewelry | 86,900 | 88,200 |

| 99% Jewelry | 85,326 | 87,326 |

| Jewelry 68% | 57,631 | 60,131 |

| Jewelry 41.7% | 34,433 | 36,933 |

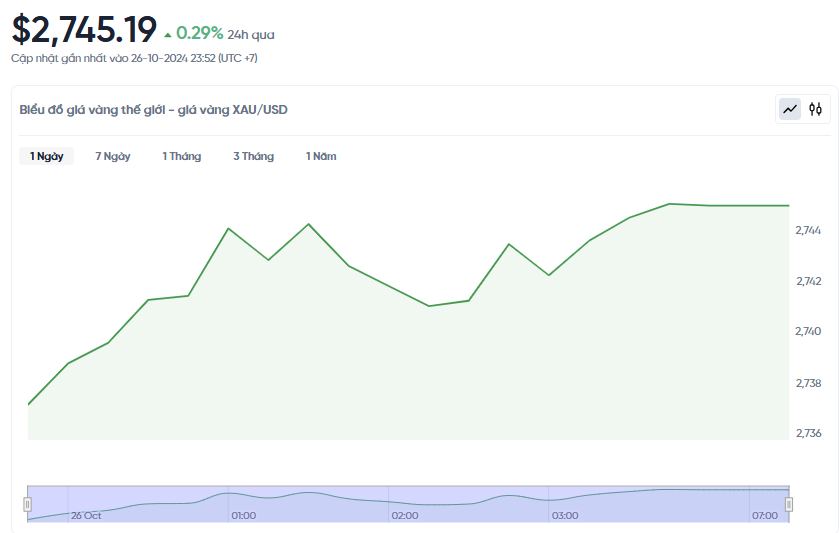

World gold price today October 27, 2024 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 5:00 a.m. today, Vietnam time, was 2,745.19 USD/Ounce. Today's gold price increased by 7.84 USD/Ounce compared to yesterday. Converted according to the USD exchange rate, on the free market (25,500 VND/USD), the world gold price is about 85.33 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 3.66 million VND/tael higher than the international gold price.

Gold ring buyers continue to "win big" as the price of gold continues to increase sharply through trading sessions, with each session increasing by millions of VND per tael. Currently, the buying and selling prices of gold rings are at their highest levels in history.

At the end of the weekend trading session (October 26), the buying price of gold rings ranged from 87 to 87.9 million VND/tael, while the selling price reached from 88.5 to 89 million VND/tael, depending on the trading unit.

Last week, the buying price of gold rings increased from 3 to 3.3 million VND/tael, while the selling price increased by about 3.2 to 3.3 million VND/tael. The gap between buying and selling prices now fluctuates from 1 to 1.5 million VND/tael, higher than the 1 to 1.3 million VND last week.

The rise in gold prices is largely due to the fact that central banks around the world have increased their gold purchases in the past few years, with thousands of tons of gold being purchased each year, according to data from the World Gold Council. Along with that, the trend of lowering interest rates by central banks, which started late last year, has created favorable conditions for gold prices to continue to climb. Recently, the US Federal Reserve (Fed) reduced its operating interest rate by another 0.5 basis points, further boosting the flow of money into gold.

Domestically, the price of gold rings and gold bars has also increased following the increase in the international market. In addition, traditional investment channels are no longer as attractive as before: low savings interest rates, unstable stock markets, and real estate requiring large capital. Therefore, gold has become the optimal choice, especially gold rings, when gold bars, although attractive, are difficult to buy due to strict control from the State Bank.

Over the past week, the world gold price has shown a strong recovery, quickly regaining its position after the mid-week sell-off and reaching a record price. Investors pay close attention to geopolitical fluctuations and upcoming political events.

Gold prices this week reflected a clear competition between short-term and long-term investors, as each side took advantage of price fluctuations to maximize profits.

Marc Chandler, CEO of Bannockburn Global Forex, predicts that gold prices may move sideways in the near term, while noting that downside risks are increasing. He said central banks are actively buying gold and concerns about inflation due to the policies of the upcoming US administration are the main drivers for the gold market. However, Chandler said that if gold prices surpass $2,700 an ounce, selling pressure may increase.

Colin Cieszynski, market strategist at SIA Wealth Management, expressed a negative view on gold prices next week, especially without supportive information from the BRICS Summit. He predicted that gold could correct slightly and remain neutral in the long term as fundamental factors such as currency depreciation and political risks continue to influence the market, especially with the US election approaching.

James Stanley, market strategist at Forex.com, said gold prices have struggled to break above $2,750 an ounce, but there is no clear sign that the rally is over.

Adrian Day, chairman of Adrian Day Asset Management, questioned whether the market was in for a deep correction. He said factors such as the US use of the dollar as a tool, concerns about the Chinese economy and banks, low interest rates and persistent inflation in North America and Europe remain the foundation for gold prices.

Darin Newsom, senior analyst at Barchart.com, predicts that gold prices may correct next week. However, he believes that in the long term, gold will still be affected by inflation risks and complex geopolitical situations.

Investors on Wall Street are also awaiting the US October jobs report, due next week. This report will influence expectations for the Fed's actions and US Treasury yields, which could cause volatility in gold prices.

Gold price forecast

In a recent Kitco News survey, nine experts gave their predictions for gold prices. Of those, five, or 56%, believe that gold prices will rise next week.

Two experts, or 22%, said gold prices would fall. The remaining two analysts, also 22%, remained neutral and did not predict any significant change.

An online Kitco poll of 213 Main Street investors received votes. Of those, 126, or 59%, predicted gold prices would rise. Forty, or 22%, predicted gold prices would fall. Forty, or 19%, expected gold prices to remain flat.

Ole Hansen, Head of Commodity Strategy at Saxo Bank, said that upcoming jobs data could be volatile for the gold market.

Mr. Hansen also said that while there could be a price correction, it would not be significant based on previous adjustments this year. For example, in June, the price of gold was adjusted to about $95, and the most recent adjustment was about $80.

He estimates current support levels for gold prices to be around $2,685 and $2,666 an ounce.