Gold price today December 29, 2024: World gold and domestic gold are stable

Gold price today December 29: World gold price increased slightly. Domestically, gold bar price is stable near 85 million VND, the difference with foreign gold is over 2 million VND.

Domestic gold price today December 29, 2024

At the time of survey at 4:30 a.m. on December 29, 2024, the gold price on the trading floors of some companies was as follows:

DOJI listed the price of 9999 gold today at 83.7 million VND/tael for buying and 84.7 million VND/tael for selling.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey listed the price of SJC gold at 84.1-84.7 million VND/tael for buying and selling.

SJC gold price at Bao Tin Minh Chau Company Limited is also traded by the enterprise at 82.7-84.7 million VND/tael (buy in - sell out). Meanwhile, at Bao Tin Manh Hai, it is also being traded at 82.7-84.7 million VND/tael (buy in - sell out).

The group of state-owned joint stock commercial banks (Vietcombank, Vietinbank, Agribank, BIDV) listed the price of SJC gold bars at 84.7 million VND/tael.

The latest gold price list today, December 29, 2024 is as follows:

| Gold price today | December 29, 2024 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 82.7 | 84.7 | - | - |

| DOJI Group | 82.7 | 84.7 | - | - |

| Red Eyelashes | 84.1 | 84.7 | - | - |

| PNJ | 82.7 | 84.7 | - | - |

| Vietinbank Gold | 84.7 | - | ||

| Bao Tin Minh Chau | 82.7 | 84.7 | - | - |

| Bao Tin Manh Hai | 82.7 | 84.7 | - | - |

| 1.DOJI- Updated: 2024-12-29 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 82,700 | 84,700 |

| AVPL/SJC HCM | 82,700 | 84,700 |

| AVPL/SJC DN | 82,700 | 84,700 |

| Raw material 9999 - HN | 83,850▼50K | 84,100 |

| Raw material 999 - HN | 83,750▼50K | 84,000 |

| AVPL/SJC Can Tho | 82,700 | 84,700 |

| 2.PNJ- Updated: 2024-12-29 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 83,800 | 84,700 |

| HCMC - SJC | 82,700 | 84,700 |

| Hanoi - PNJ | 83,800 | 84,700 |

| Hanoi - SJC | 82,700 | 84,700 |

| Da Nang - PNJ | 83,800 | 84,700 |

| Da Nang - SJC | 82,700 | 84,700 |

| Western Region - PNJ | 83,800 | 84,700 |

| Western Region - SJC | 82,700 | 84,700 |

| Jewelry gold price - PNJ | 83,800 | 84,700 |

| Jewelry gold price - SJC | 82,700 | 84,700 |

| Jewelry gold price - Southeast | PNJ | 83,800 |

| Jewelry gold price - SJC | 82,700 | 84,700 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 83,800 |

| Jewelry gold price - Jewelry gold 999.9 | 83,700 | 84,500 |

| Jewelry gold price - Jewelry gold 999 | 83,620 | 84,420 |

| Jewelry gold price - Jewelry gold 99 | 82,760 | 83,760 |

| Jewelry gold price - 916 gold (22K) | 76,500 | 77,500 |

| Jewelry gold price - 750 gold (18K) | 62,130 | 63,530 |

| Jewelry gold price - 680 gold (16.3K) | 56,210 | 57,610 |

| Jewelry gold price - 650 gold (15.6K) | 53,680 | 55,080 |

| Jewelry gold price - 610 gold (14.6K) | 50,300 | 51,700 |

| Jewelry gold price - 585 gold (14K) | 48,180 | 49,580 |

| Jewelry gold price - 416 gold (10K) | 33,900 | 35,300 |

| Jewelry gold price - 375 gold (9K) | 30,440 | 31,840 |

| Jewelry gold price - 333 gold (8K) | 26,640 | 28,040 |

| 3. SJC - Updated: 12/29/2024 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L, 1KG | 82,700 | 84,700 |

| SJC 5c | 82,700 | 84,720 |

| SJC 2c, 1c, 5c | 82,700 | 84,730 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 82,700 | 84,500 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 82,700 | 84,600 |

| Jewelry 99.99% | 82,600 | 84,200 |

| Jewelry 99% | 80,866 | 83,366 |

| Jewelry 68% | 54,411 | 57,411 |

| Jewelry 41.7% | 32,264 | 35,264 |

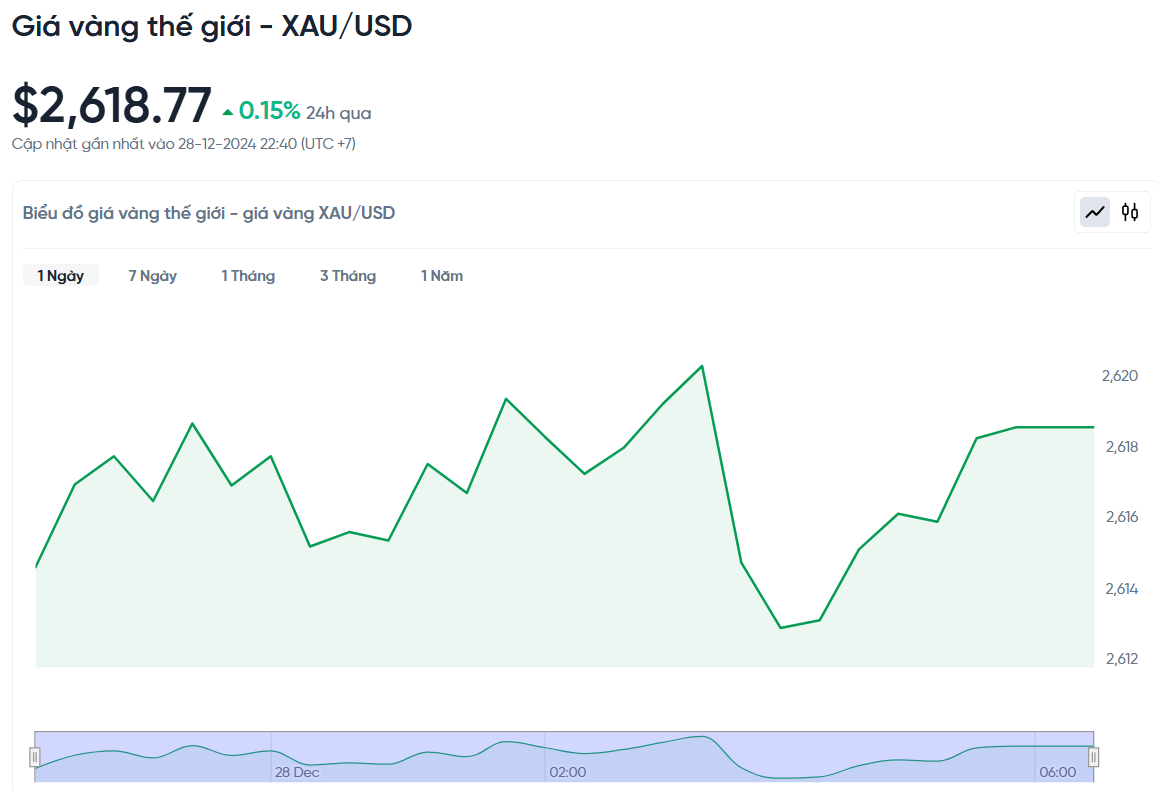

World gold price today December 29, 2024 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 5:00 a.m. today, Vietnam time, was 2,618.77 USD/Ounce. Today's gold price increased by 4 USD/Ounce compared to yesterday. Converted according to the USD exchange rate, on the free market (25,850 VND/USD), the world gold price is about 82.52 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 2.18 million VND/tael higher than the international gold price.

According to the World Gold Council (WGC), if the market remains as it is now, gold prices will increase more slowly in 2025 than this year. However, if interest rates do not decrease as expected but increase again, gold prices may face many difficulties.

Gold prices have been supported in recent years by strong demand from central banks and by people seeking a safe haven from global economic and political turmoil. Factors such as high debt levels in Europe, tensions in the Middle East, Eastern Europe and elsewhere have also contributed to the rise in gold prices.

Recently, the world gold price increased due to the demand for safe havens, especially after the news that US President Joe Biden proposed to increase arms aid to Ukraine. However, the gold price then decreased as the market waited for signals about the US economic situation under President-elect Donald Trump and the interest rate policy of the US Federal Reserve (Fed) next year.

Gold is often seen as a hedge against political risks and inflation. However, when interest rates are high, gold becomes less attractive. Since the beginning of the year, the world gold price has increased by about 28%, even reaching a record high of $2,790/ounce on October 31.

In 2025, when Donald Trump returns to the White House, the market will closely monitor his economic policies, especially tax policy and the impact on the Fed's interest rates. This year, the Fed has cut interest rates three times and is expected to cut more slowly next year.

According to Mr. Ajay Kedia, Director of Kedia Commodities, 2025 will be a volatile period for the gold market. He predicts that gold prices will increase in the first half of the year due to geopolitical tensions, but may decline in the second half due to profit-taking.

As 2024 draws to a close, the domestic and global gold markets are cautiously focused on the return of Mr. Trump and the impact of his economic policies. Although the Fed may cut interest rates less, many analysts remain optimistic about the outlook for gold thanks to geopolitical tensions, central bank demand and risks from Mr. Trump's tariff policies.

Gold Price Forecast

Many analysts remain bullish on gold in 2025, even though the US Federal Reserve may cut interest rates less than expected. The main reasons are that global geopolitical tensions remain high, central banks continue to buy gold reserves, and political uncertainty may persist when Donald Trump returns to the White House in January 2025. In addition, Trump's proposed tariff and trade policies risk triggering a trade war, making gold a more attractive safe-haven asset.

If gold maintains its current rally, central bank buying could push the price of gold to $3,000 an ounce next year, according to Bob Haberkorn, senior market strategist at RJO Futures.

Looking ahead to 2025, demand for gold from China is expected to remain strong, providing significant support for gold prices. Hamad Hussain, assistant climate and commodity economist at Capital Economics, said a weak economy and a weakening yuan would boost demand for gold in China. He stressed that the difficult real estate situation would be a major barrier to economic growth, prompting people to seek gold as a safe haven.

Meanwhile, commodity experts at TD Securities predict spot gold prices will reach $2,675 an ounce in the first quarter of 2025 and peak at $2,700 an ounce in the second quarter. After that, gold prices may decline slightly to $2,625 an ounce in the third and fourth quarters.

Overall, gold remains a safe haven amid volatile global economic and political conditions, especially as factors such as geopolitical tensions, trade policies and demand from central banks continue to support prices.