Gold price today February 8, 2025: Domestic gold price does not decrease after God of Wealth day

Gold price today February 8, 2025: World gold price closed at a very high level of 2,860 USD/ounce, causing domestic gold price to not decrease after God of Fortune's day like every year.

Domestic gold price today February 8, 2025

At the time of survey at 4:30 a.m. on February 8, 2025, the gold price on the trading floors of some companies was as follows:

DOJI listed the price of 9999 gold today at 86.8 million VND/tael for buying and 90.3 million VND/tael for selling. No change in both buying and selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 87.2-88.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 200 thousand VND/tael for buying and increased by 100 thousand VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by businesses at 86.8-90.3 million VND/tael (buying - selling), unchanged in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 86.8-90.3 million VND/tael (buy - sell), unchanged in both buying and selling directions compared to yesterday.

The latest gold price list today, February 8, 2025 is as follows:

| Gold price today | February 8, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 86.8 | 90.3 | - | - |

| DOJI Group | 86.8 | 90.3 | - | - |

| Mi Hong | 87.2 | 88.5 | +200 | +100 |

| PNJ | 86.8 | 90.3 | - | - |

| Vietinbank Gold | 90.3 | - | ||

| Bao Tin Minh Chau | 86.8 | 90.3 | - | - |

| Phu Quy | 86.8 | 90.3 | - | - |

| 1.DOJI- Updated: 2/8/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 86,800 | 90,300 |

| AVPL/SJC HCM | 86,800 | 90,300 |

| AVPL/SJC DN | 86,800 | 90,300 |

| Raw material 9999 - HN | 86,600 | 89,400 |

| Raw materials 999 - HN | 86,500 | 89,300 |

| AVPL/SJC Can Tho | 86,800 | 90,300 |

| 2.PNJ- Updated: 2/8/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 86,700 | 90,100 |

| HCMC - SJC | 86,800 | 90,300 |

| Hanoi - PNJ | 86,700 | 90,100 |

| Hanoi - SJC | 86,800 | 90,300 |

| Da Nang - PNJ | 86,700 | 90,100 |

| Da Nang - SJC | 86,800 | 90,300 |

| Western Region - PNJ | 86,700 | 90,100 |

| Western Region - SJC | 86,800 | 90,300 |

| Jewelry gold price - PNJ | 86,700 | 90,100 |

| Jewelry gold price - SJC | 86,800 | 90,300 |

| Jewelry gold price - Southeast | PNJ | 86,700 |

| Jewelry gold price - SJC | 86,800 | 90,300 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 86,700 |

| Jewelry gold price - Jewelry gold 999.9 | 86,700 | 89,200 |

| Jewelry gold price - 999 jewelry gold | 86,610 | 89,110 |

| Jewelry gold price - 99 jewelry gold | 85,910 | 88,410 |

| Jewelry gold price - 916 gold (22K) | 79,310 | 81,810 |

| Jewelry gold price - 750 gold (18K) | 64,550 | 67,050 |

| Jewelry gold price - 680 gold (16.3K) | 58,310 | 60,810 |

| Jewelry gold price - 650 gold (15.6K) | 55,630 | 58,130 |

| Jewelry gold price - 610 gold (14.6K) | 52,060 | 54,560 |

| Jewelry gold price - 585 gold (14K) | 49,830 | 52,330 |

| Jewelry gold price - 416 gold (10K) | 34,760 | 37,260 |

| Jewelry gold price - 375 gold (9K) | 31,100 | 33,600 |

| Jewelry gold price - 333 gold (8K) | 27,090 | 29,590 |

| 3. SJC - Updated: 02/08/2025 04:00 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 86,800 | 90,300 |

| SJC 5c | 86,800 | 90,320 |

| SJC 2c, 1C, 5 phan | 86,800 | 90,330 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 86,800 | 89,800 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 86,800 | 89,900 |

| 99.99% Jewelry | 86,700 | 89,400 |

| 99% Jewelry | 85,514 | 88,514 |

| Jewelry 68% | 57,948 | 60,948 |

| Jewelry 41.7% | 34,433 | 37,433 |

The domestic gold price did not decrease after the God of Wealth Day. This development is contrary to previous years, when the domestic gold price often plummeted in the afternoon of the God of Wealth Day and continued to decrease sharply in the following days. The domestic gold price often decreased after the God of Wealth Day when people's demand for gold decreased.

The difference in gold price fluctuations this year surprised many investors, as many shared that they waited for gold prices to decrease after God of Wealth to buy.

According to analysts, the price of SJC gold bars and gold rings continues to maintain high levels because in the international market, precious metals continue to reach new peaks.

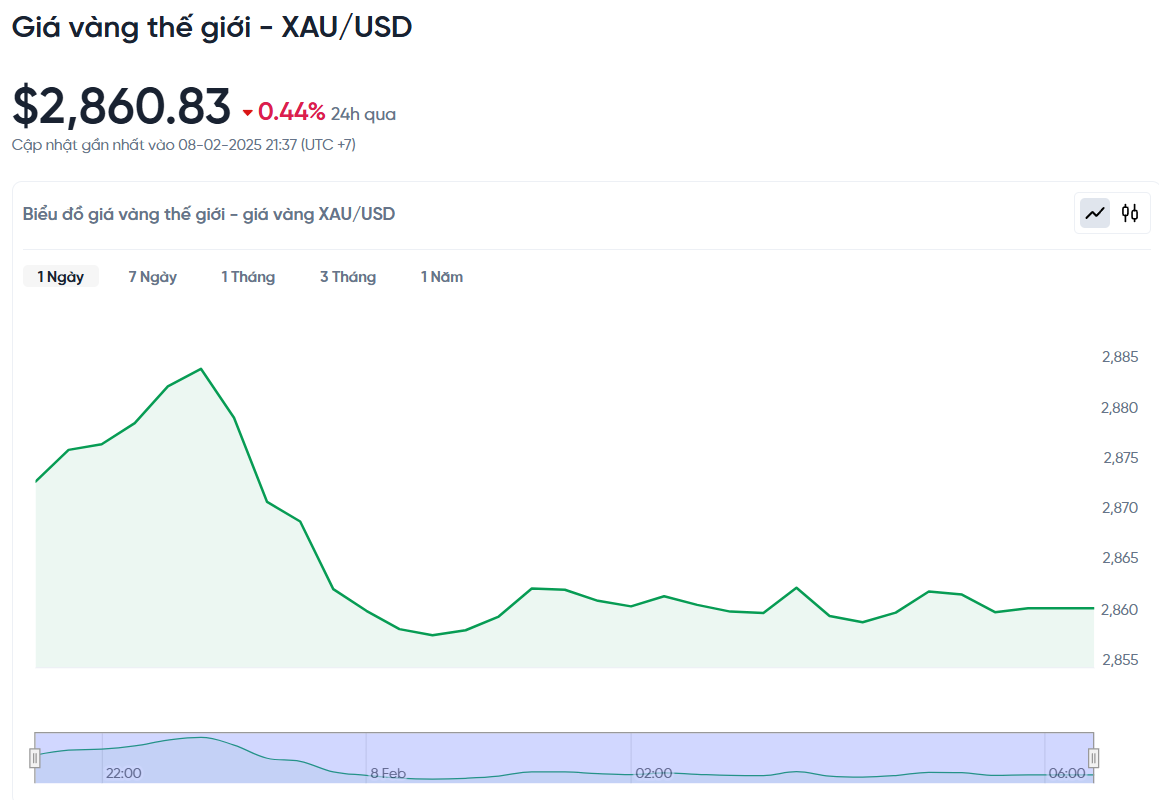

World gold price today February 8, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 am today, Vietnam time, was 2,860.83 USD/ounce. Today's gold price decreased by 2.94 USD compared to yesterday. Converted according to the USD exchange rate, on the free market (25,680 VND/USD), the world gold price is about 89.52 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 780 thousand VND/tael higher than the international gold price.

Last week, the world gold price continued to fluctuate strongly as concerns about inflation and trade tensions pushed investors to seek this precious metal as a safe haven. Gold prices continuously set new highs, showing great demand from the market.

One of the key factors driving the rise in gold prices is inflation concerns. According to a report from the University of Michigan, inflation expectations over the next year have increased by 1%, causing investors to seek gold as a store of value.

Financial expert Adrian Day said that gold is a hedge against financial instability, whether it is inflation, deflation or recession. In recent times, the US consumer price index (CPI) and personal expenditure (PCE) have both been on an upward trend, indicating that inflation is still persistent. At the same time, the stock market is showing signs of weakness and the public debt is increasing, creating a perfect environment for gold prices to continue to rise.

According to the World Gold Council, total global gold demand has reached 4,974 tonnes in 2024. This is the third consecutive year that central banks have bought more than 1,000 tonnes of gold, with leading countries including China, Poland and Türkiye. The reason is that countries are looking to reduce their dependence on the US dollar, especially in the context of many fluctuations in the world economy and politics.

With central banks continuing to buy gold at record levels and global capital flows shifting dramatically, gold prices still have plenty of room to move higher.

Next week, the gold market will be influenced by a number of important events. First, Federal Reserve Chairman Jerome Powell's testimony before the US Congress on Tuesday and Wednesday may provide clues on upcoming monetary policy.

Additionally, important economic reports such as the US Consumer Price Index (CPI) on Wednesday, producer inflation (PPI) figures on Thursday, and retail sales report on Friday will also have a big impact on gold prices.

In addition, gold purchases by central banks, especially from China, could continue to support gold prices in the coming period. If central banks continue to accumulate gold, gold prices will have more momentum to rise higher.

Gold price forecast

Spot gold prices have been continuously setting new records, surpassing the threshold of 2,880 USD/ounce this week, moving closer to the important milestone of 3,000 USD/ounce.

Veteran fund manager Adrian Day, CEO of Adrian Day Asset Management, believes this is just the beginning. “I wouldn’t be surprised if gold prices hit $3,500 to $4,000 an ounce in the next 12 months,” he told Kitco News.

It is forecasted that domestic gold prices in the first two quarters of the year may increase to VND90 million/tael for gold rings and VND92-93 million/tael for SJC gold bars. However, if the world gold price is under pressure to decrease from the third quarter onwards, domestic gold prices may also adjust accordingly.

According to Mr. Nguyen Quang Huy, CEO of the Faculty of Finance and Banking (Nguyen Trai University), there are two main scenarios for gold prices in 2025. In the baseline scenario, if the world economy maintains its growth momentum but instability remains, gold prices could fluctuate between 2,800 and 3,000 USD/ounce. If the economy falls into a deep recession or there is a major political incident, gold prices could reach 3,200 USD/ounce or higher.