ATM transactions are decreasing

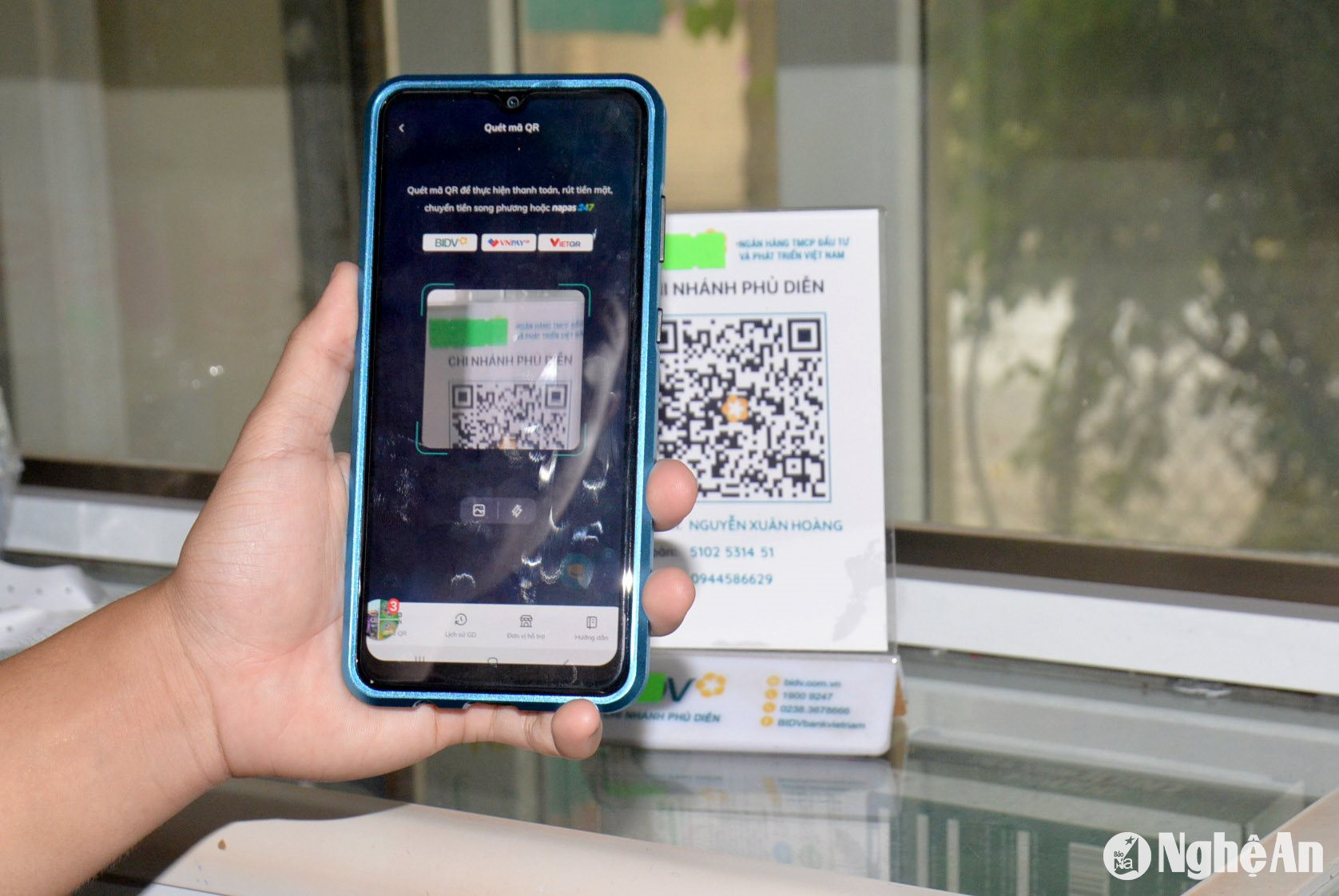

People's cashless payment activities through QR code scanning bring many conveniences, causing transactions at bank ATMs to decrease.

QR code and e-wallet payments anytime, anywhere

Previously, ATMs were often crowded with people coming and going to withdraw cash, especially during holidays and Tet, long lines of people stood waiting for their turn to withdraw money. Some people had to wait for hours for their turn. However, recently, observing the main roads of Vinh city, one can clearly see the deserted scene at bank ATMs, with only occasional people coming to make transactions.

Mr. Nguyen Huu Quang in Ha Huy Tap ward, Vinh city said that 4-5 years ago, ATM cards were quite popular. In urban areas, towns, district centers, communes, around hospitals, bus stations, supermarkets... there were ATMs, when you needed money you could withdraw it right away. However, the problem was that there were many customers coming to make transactions so all ATMs were crowded, sometimes you had to wait a long time, wasting a lot of time. Another inconvenience was that if you did not enter the correct password, your card would be swallowed, causing trouble.

Implementing the policy of not using cash, all industries and people apply digital transformation, all money is in electronic wallets, payment by scanning QR codes is much more convenient than transactions via ATM cards. In Vinh city today, most of the business and sales points... have QR codes for customers to pay. This is convenient because the operation is quick and accurate; moreover, it also avoids the risks of having to carry a lot of cash with you. Therefore, for many years now, Mr. Quang has not used ATM cards much, so he rarely goes to ATMs to withdraw money.

In towns and cities in the province, ATM withdrawal points are always deserted. Ms. Tran Thi Phuong in Tay Ho hamlet, Nam Thanh commune (Yen Thanh) said that since installing the banking app on smartphones, grocery stores, gas stations, restaurants, drug stores, hair salons, car washes, electricity bill payments... in the area all use the bank's QR code for payment, so people rarely go to ATMs to withdraw cash like before.

“In the past, when shopping and paying for electricity and water bills directly, I often had to go to the collection points to pay. Now, I use electronic banking services, which is very convenient. When I am at home or anywhere, I can pay for electricity, water, school fees for my children or shop online. Therefore, I have 3 ATM cards in my wallet, but I have rarely used them,” Ms. Phuong shared.

Paying by scanning QR codes has become a habit for most people, so for sellers who have not applied QR codes, it becomes outdated and inconvenient for customers.

Ms. Nguyen Thi Huong - a pharmacist selling medicine in the Roc market area, Trung Thanh commune (Yen Thanh) said that more and more customers come to buy medicine and pay via QR code, so in early 2024, she went to the bank to open an account and applied payment by QR code right at the pharmacy counter, which proved to be very convenient.

“Before QR code payment, I always had to prepare small change to give to customers. Now most customers pay by scanning QR codes, which is convenient for both parties. Paying by bank transfer helps me reduce the risk of losing cash or receiving counterfeit money,” said Ms. Huong.

Regarding cashless payments, Mr. Nguyen Van De - Chairman of the People's Committee of Long Thanh Commune (Yen Thanh) said: As a locality that meets the new rural model standards for digital transformation in 2024, people also update technology trends quite quickly. Stores selling from groceries to other items in Long Thanh Commune all have QR codes for customers to pay.

Currently, up to 90% of people in the commune use smartphones and broadband Internet connection; basically 100% of people of adult age have non-cash payment accounts to make purchases, sales, and other payment services. 100% of businesses in the commune have QR codes from banks to serve non-cash payments.

Decrease in ATM transactions is inevitable

Research at a number of bank branches in Yen Thanh, Dien Chau districts and other localities shows that the number and value of transactions at ATM withdrawal points have decreased significantly.

Representatives of some banks said that in recent years, people have been paying by scanning QR codes, so ATMs are quite deserted, there is no longer a situation of waiting in line like before. However, banks still maintain a stable amount of money in ATMs to serve customers.

Ms. Nguyen Thi Thu Thu - Director of the State Bank of Nghe An branch said: "Transactions via ATMs are made by banks connected to the system, so the State Bank of Nghe An branch does not have specific statistics on the number and value of transactions via ATM cards at present. However, with the increasing number of people paying without cash, it is certain that the number and value of transactions via ATM cards will decrease significantly compared to before. With practical benefits, cashless payments are an inevitable development trend in the 4.0 era".

According to information from the National Payment Corporation of Vietnam (NAPAS), in 2023, ATM transactions will continue to decrease by 16.9% in number of transactions and 19.5% in transaction value, with ATM transactions accounting for only 3.6% of total transactions through the system. It is expected that in 2024, the proportion of ATM transactions will decrease further. The above figures clearly reflect the decreasing demand for cash withdrawals from people and are being replaced by more convenient payment services such as NAPAS 247 fast money transfer and QR code scanning payment.

However, according to our records, currently in Nghe An, in mountainous districts, especially in highland areas, the rate of people making cashless payments is still low, because people are not yet proficient in using smartphones, or do not have the conditions to buy smartphones.

Therefore, all levels and sectors need to strengthen propaganda and guide people in mountainous areas to access technology and apply cashless payments with just simple operations, in order to limit the use of cash and avoid bad elements taking advantage to circulate counterfeit money./.

.jpg)