Investors are not optimistic about gold prices next week.

Analysts predict that market volatility following the US June jobs data will continue to negatively impact gold prices next week.

It is difficult to predict the gold price trend next week when analysts believe that the gold market will still fluctuate after the US employment index in June was announced lower than expected. In addition, the results of the referendum in Greece today (July 5) will also have certain impacts on the world gold price.

On the Comex floor, gold prices are ending the second consecutive week with negative signals. In the short term, most retail investors share the view that gold will continue to trend down as the market has not yet established stability.

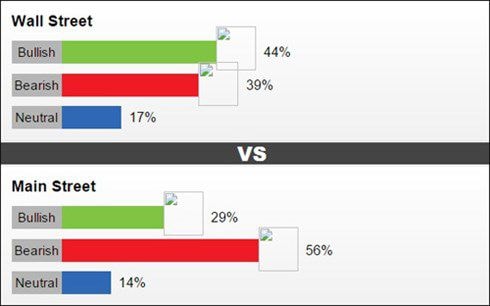

The results of Kitco News' online survey of the public showed that 56% of the public said they expected gold prices to continue to fall next week. Meanwhile, only 29% of the opinions said they expected gold prices to increase, the rest were neutral.

A survey of market experts including gold dealers, investment banks, futures traders and technical chart analysts found that 44% expressed optimism about gold next week, only 39% said gold prices are falling and will continue to fall, and 17% were neutral about gold.

|

| Kitco News releases the results of its gold price survey next week. |

Colin Cieszynski, senior market strategist at CMC, said he expects gold to rise next week as data does not support a Fed rate hike in September. In addition, a weakening dollar index will also help push gold higher.

Ole Hansen, head of commodity strategy at Saxo Bank, agreed that gold could rebound next week as he expects the Fed to be less “hawkish” after the US June jobs report. He added that there is some technical support for the precious metal as prices have fallen below $1,163 an ounce.

Other analysts are not expecting much from the June jobs data to change the outlook for gold prices for now. Dahdah Bernard, precious metals strategist at Natixis, said that gold remains in a tight spot for the foreseeable future. He also added that there is little hope of an immediate reaction in the gold market after the Greek referendum on whether to accept a bailout offer from European creditors.

With gold prices falling to a three-month low, it is no surprise that retail investors will remain bearish on gold in the coming weeks. In fact, retail investors are increasingly bearish on the gold market.

Geno from Vancouver (Canada) said that with the current data, the gold market in the short term is unlikely to improve, if not to say that gold prices still have many opportunities to decrease. "I do not see any opportunity for gold prices to increase during this time," Geno expressed his opinion.

While the June jobs report of more than 200,000 jobs is still a relatively good number, it won’t change expectations for a rate hike in September, said Bart Melek, chief commodity strategist at TD Securities. Melek added that he expects gold prices to rise slightly next week to remain range-bound after previously falling too low.

Meanwhile, Phillip Streible, senior market strategist at RJO Futures, said investors are becoming increasingly frustrated with gold as it has not been able to gather positive data for the market. However, geopolitical uncertainty in Europe and Greece is also likely to be a long-term gold investment.

Many analysts are disappointed that Greece's debt default and the imposition of capital controls have had little impact on gold prices. Sean Lusk, head of commercial funds at Walsh Trading, said that gold appears to be losing its appeal to investors as the US dollar and US government bonds are becoming safe haven assets./.

According to VOV.VN

.png)