Vietnam's economy in the coronavirus spiral

Forecasts are leaning towards the possibility that Vietnam's GDP growth in 2020 will slow down by about 1%, but this may still be the most optimistic scenario.

A week ago, when developing the growth scenario, the Government report, the Ministry of Planning and Investment forecast that the worst-case scenario for GDP in 2020 would be only 6.09% (if the nCoV epidemic is contained by the end of the second quarter), which is 0.7 percentage points lower than the target assigned by the National Assembly and nearly 1 percentage point lower than in 2019.

But in today's report (February 12), the scenarios have gotten worse. The Ministry forecasts that in the worst case scenario, Vietnam's GDP will only increase by 5.96% in 2020 - the lowest level in the past 7 years. The Ministry also forecasts that Vietnam will be among the 4 countries most affected, after Singapore, Thailand and Hong Kong.

The updated scenario is somewhat closer to experts' forecasts than before. According to estimates by Dr. Pham The Anh, Chief Economist of the Vietnam Institute for Economic and Policy Research (VEPR), Vietnam's economic growth this year could fall by up to 1 percentage point. Meanwhile, ANZ also forecasts a decline of 0.8 percentage points in the first quarter due to the impact of the coronavirus.

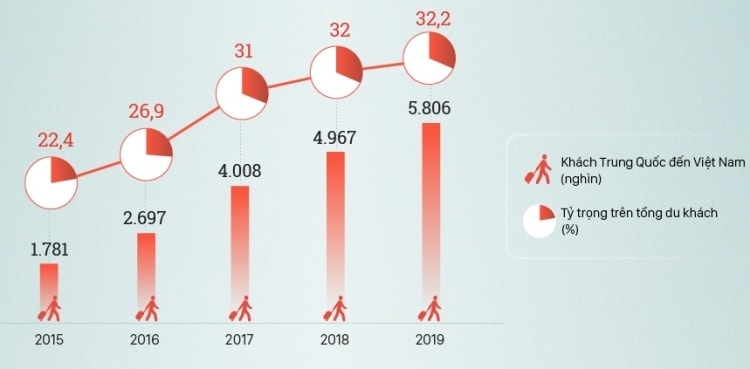

Regarding tourism and aviation, according to calculations by the Ministry of Planning and Investment, if the epidemic is contained by the end of the second quarter, the number of Chinese visitors to Vietnam in the first half of the year could decrease by 2.3 million, while visitors from other countries could also decrease by 50-60%.

|

Chinese tourists to Vietnam in the past 5 years. Graphics:Ta Lu |

"Chinese visitors spend an average of about 743.6 USD per visitor, visitors from other countries spend about 1,141 USD, if the epidemic lasts until the end of the second quarter, the loss will be about 5 billion USD," said the Ministry of Planning and Investment.

But according to initial predictions from the National Tourism Advisory Board (TAB), the tourism industry could lose 7 billion USD in the first quarter and if it lasts until the second quarter, the loss could exceed 15 billion USD.

Tourism is affected, aviation is not out of the "storm". Currently, 11 Chinese airlines operate 240 flights per week to Vietnam. In contrast, Vietnam Airlines, Jetstar Pacific and Vietjet operate 72 routes to 48 destinations in China with a frequency of 401 flights per week.

OutsideThese two areas, according to Dr. Pham The Anh,Agricultural exports and business activities with input factors dependent on China are also the first "victims".

|

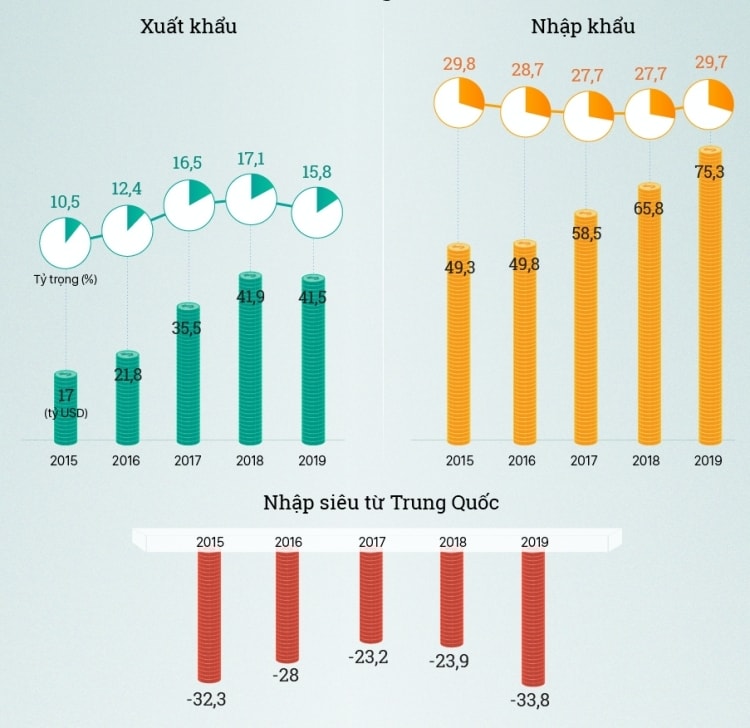

Trade activities between Vietnam and China. Graphics:Ta Lu |

According to the assessment of KB Securities Vietnam Company, consumption in China is also likely to stagnate, reducing the demand for imported goods. China is the main consumer market for Vietnamese agricultural products with a turnover of nearly 6 billion USD in 2019, accounting for 35%.

In 2019, Vietnam had a trade deficit of nearly 34 billion USD with China, led by phones and electronic components, textile and footwear materials. As one of the countries heavily dependent on input materials from China, the impact of the epidemic on Vietnam's production activities is not small. According to a survey by the Private Economic Development Research Board (Board IV), many businesses said they could only "hold on" for another week due to the difficult situation of production materials and cross-border transportation.

Faced with challenges to economic growth, the question is what Vietnam should do to cope.

Around the world, many countries have launched relief packages, trying to limit the impact of the corona virus. China plans to launch a $174 billion relief package to save its "feverish" economy, of which $22 billion will be used to directly support economic activities. Thailand announced a cut in its base interest rate to a record low, hoping to limit the impact of the epidemic.

|

Textile workers rush to produce masks to prevent epidemics. Photo:Ngoc Thanh. |

However, for Vietnam, using monetary expansion is considered inappropriate. According to Dr. Pham The Anh, "pumping money" will not be feasible due to differences in growth structure.

"The main impact comes from China. Pumping money does not help attract more Chinese tourists to Vietnam, does not help export more agricultural products, and certainly does not help manufacturing enterprises have enough input materials," said Dr. The Anh.

Meanwhile, Vietnam's growth in recent years has depended partly on money supply, and room for policy is no longer as abundant as in other countries.

"Vietnam's credit-to-GDP ratio has reached 150%, money supply-to-GDP is about 170%, much higher than other countries in the region. This somewhat limits room for policy." Not to mention, monetary expansion also puts pressure on inflation, which has increased rapidly since the end of 2019 due to the impact of African swine fever.

Instead of using monetary policy, the Chief Economist of VEPR said that Vietnam should seek to diversify revenue sources, creating a more sustainable growth structure, although it is not easy in the short term.

According to the recommendation of the IV Committee, the Government should support the tourism industry by exempting visas for EU countries and expanding some other important markets such as New Zealand and Canada. This solution is to reduce the impact of the decline in Chinese tourists.

In addition, given the difficult situation of many businesses, there should be stimulus packages such as tax reduction, late payment, and no penalty for businesses that have not paid taxes after the pandemic for about 12 months. At the same time, the banking system needs to have support solutions such as debt extension, debt restructuring, and loan incentives.

According to a quick survey by the IV Board from a number of companies that depend on Chinese raw materials, they proposed that the Government work with the Chinese side to speed up import and export activities, ensuring that when raw materials are brought to the border gate, they will be cleared. Some large manufacturing facilities are even having difficulty proposing salary agreements when suspending workers.

"If possible, we would like to negotiate a severance pay level at the regional minimum wage, which is still very high in the current business context, while there are thousands of workers," said a business representative.