700% Interest Rate: Blindly Borrowing, Tragic Situation of Selling House to Avoid Debt

Black credit has exploded with exorbitant interest rates of up to 700% - a risk that could cause serious consequences for society. With sophisticated lending methods, many customers who have just borrowed money have had to struggle to pay off their debts, lost their fortunes or suffered enough "terror" from debt collectors.

Interest rates are getting higher and higher.

According to estimates by financial and banking experts, the scale of black credit currently accounts for about 6-8% of the total outstanding debt of the economy, with an amount of 400,000-500,000 billion VND. Although the scale is not too large, the social consequences are huge.

In Vietnam, there are currently three main types of black credit: lump sum loans (paying principal and interest daily); hot loans (paying interest daily, paying principal at a set time) and loans for buying lottery tickets and playing the lottery. In particular, hot loans have extremely high risks, due to having to bear "cutthroat" interest rates, up to over 100%/year.

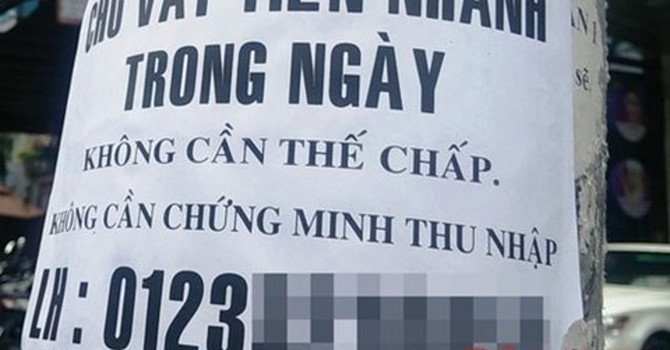

According to the authorities, the problem of black credit is increasingly spreading and becoming extremely complicated and difficult to control. In recent years, advertisements have appeared everywhere in alleys, on walls, telephone poles,... in residential areas, inviting people to borrow money with extremely simple procedures and low interest rates. Many leaflets and lending websites are aimed directly at the subjects, with simple procedures, regardless of the monthly income of the borrower.

|

| Loan shark advertisements are everywhere. |

It is alarming that lending interest rates are getting higher and higher. In Hanoi, 3 years ago, lending interest rates were only 1,000 - 2,000 VND/million/day for secured loans and 2,500 - 4,000 VND/million/day for unsecured loans.

Currently, the common interest rate is around 3,000 - 5,000 VND/million/day for loans with collateral and 6,000 - 9,000 VND/million/day for loans without collateral.

Therefore, many customers, after borrowing money, have to work hard to pay off their debts and go bankrupt. A customer who borrowed 75 million VND from black credit to solve urgent work with an interest rate of 5,500 VND/million/day said that after 5 months, the interest alone had to be paid up to 62 million VND, not to mention the principal still intact. Like that, every month he has to work hard to pay off the debt, not knowing when it will be finished.

Despite the exorbitant interest rates, black credit is still growing strongly because many people need money urgently but do not know where to turn, so they have to "blindly jump in". Many of them are people in difficult circumstances, know the high interest rates but have no other choice, and have to follow them for their livelihood.

The 2018 World Cup, which took place over a month ago, was a time when black credit exploded to serve those who were passionate about betting. Hundreds of thousands of people participated, with betting amounts of up to thousands of billions of VND, most of them lost money, many cases were so desperate that they led to illegal acts.

More dangerously, black credit is growing rapidly through online lending. At the regular Government press conference in early September, the State Bank leader also acknowledged the transformation of black credit through online lending.

Most online lending companies today offer interest rates of around 39%/month, equivalent to 468%/year. Some companies list an interest rate of 1.65%/month (19.8%/year) but charge loan management fees and consulting appraisal fees... which increase the cost many times. For example, they only offer loan interest rates of 8-20%/year (to comply with the provisions of the Civil Code) but with service fees and loan management fees, this company collects from customers plus interest, up to 720%/year.

Tragedy awaits

At the end of the year, the greater the need for money, the more black credit explodes. Many forms of loan sharks simultaneously "play tricks" by offering low interest rates, incentives, and attractive incentives... to attract gullible people. Many people, due to difficult family circumstances, have to pay off debts at the end of the year, and those with a gambling streak who want to win or lose easily "fall into the trap" of black credit.

|

| At the end of the year, the greater the demand for loans, the stronger the outbreak of black credit, leading to many consequences. |

Some loan sharks said that in the months leading up to Tet, they have to prepare hundreds of billions of dong to meet the increased demand for loans. As the demand for loans increases, interest rates also increase. For loans without collateral, interest rates can be pushed up to 10,000 dong/million/day in the last months of the year, making it difficult for borrowers to escape the disaster.

Recently, in many places, black credit has blatantly forced property like robbery, causing great indignation among the people. On the contrary, when frustrated by threats, many victims of loan sharking have committed spontaneous crimes, becoming criminals.

To cope, black credit operates very sophisticatedly. When someone comes to borrow money, the lending institutions never make a loan contract but only make a civil contract to buy and sell assets. For example, if the borrower has a motorbike worth 40 million VND, the lender will make a "sale contract" for the motorbike, then rent it back to the owner at an "exorbitant" price.

Many black credit organizations also disguise themselves as businesses, committing crimes by lending large amounts of unsecured loans, then forcing people to sign property purchase contracts to appropriate them.

According to economic experts, the reason why black credit is "healthy" and developing rapidly is because the legal corridor is not tight. For example, according to the provisions of the Civil Code, lending outside the banking sector cannot exceed 20% of loans within the term. Meanwhile, the Law on Credit Institutions (CIs) allows CIs and their customers to agree on interest rates in credit contracts, according to the provisions of the law.

Black credit is now openly advertised and everywhere, overwhelming concrete drilling and cutting in every street corner. If concrete drilling and cutting can be threatened with having your phone number cut off because it is unsightly and offensive, then black credit is not interfered with by any authorities.

Therefore, in the Resolution of the September Regular Session, the Government assigned the Ministry of Public Security to preside over and coordinate with relevant ministries and branches to tighten management to stop illegal credit activities, usury, debt collection, debt collection, illegal arrest... This is considered a strong measure against the problem of illegal credit, which is evolving in a very complicated and unpredictable manner.