How will the real estate loan interest rate of the 120,000 billion VND package be adjusted?

It is expected that by June 30, the loan interest rate during the support period will be 8.2%/year for home buyers, 8.7%/year for investors and will be adjusted periodically every 6 months.

According to Ms. Ha Thu Giang - Director of the Department of Credit for Economic Sectors, SBV - recently, SBV has held many meetings to reach consensus with 4 state-owned commercial banks (Agribank, BIDV, VietinBank and Vietcombank) to develop the program content. These are also the 4 banks selected by SBV to implement the 120,000 billion VND credit package using capital mobilized from banks.

Borrowers include customers who are project investors.social housing(NOXH), housing for workers, old apartment renovation projects and home buyers at these projects.

Ms. Ha Thu Giang said, to get a loancredit packageIn this case, customers need to meet the conditions to be eligible for support policies on social housing, housing for workers or renovated old apartments, according to the provisions of law.

At the same time, borrowers must also meet the loan conditions according to current regulations of commercial banks and comply with regulations related to lending laws.

|

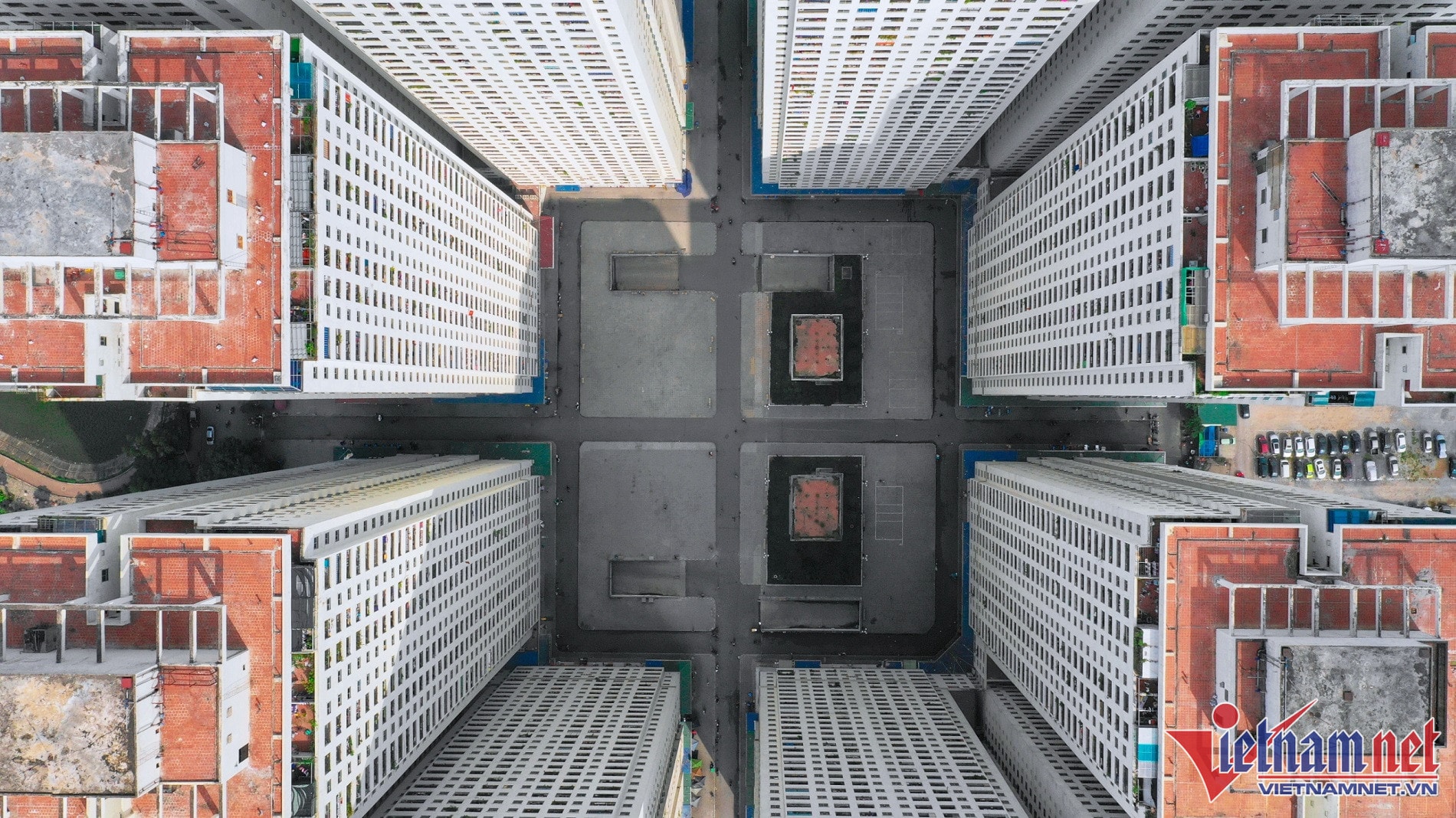

Illustration photo (Hoang Ha). |

“In principle, each home buyer will only be able to participate in this program once. The program will be implemented until the disbursement turnover reaches 120 trillion VND but not later than December 31, 2030. The loan interest rate will be 1.5-2% lower than the average medium and long-term interest rate of 4 state-owned commercial banks in each period,” said Ms. Ha Thu Giang.

Accordingly, by June 30, the loan interest rate during the support period is expected to be about 8.7%/year for investors and 8.2%/year for home buyers. Every 6 months, the State Bank will announce the loan interest rate during the support period.

About the time of applicationinterest rate support, with investors applying interest rate support for a period of 5 years, with home buyers it is 5 years.

According to the State Bank of Vietnam's estimates, this program contributes to reducing interest rates on both the supply and demand sides with a total reduction of 3.5-5%. This reduction contributes to reducing the cost of social housing while increasing people's access to housing. This is one of the indirect solutions to reduce the imbalance between supply and demand of housing.

Regarding real estate credit, Ms. Ha Thu Giang said that by the end of February 2023, outstanding real estate loans reached over VND 2.6 million billion, an increase of 2.9% compared to 2022.

Regarding the difficulties of the real estate market, in the first quarter, the Government, the State Bank and the Ministry of Construction held many conferences to listen to recommendations from relevant parties.

Thereby, the difficulties of the real estate market have been identified. Among them, there are difficulties in balancing supply and demand, difficulties in legal issues, prices, etc. To solve these difficulties, coordination from ministries, branches and localities is needed to have specific solutions, thereby promoting the sustainable development of the real estate market./.

.jpg)

.jpg)