Huge profits, life insurance compensation 'dripping'

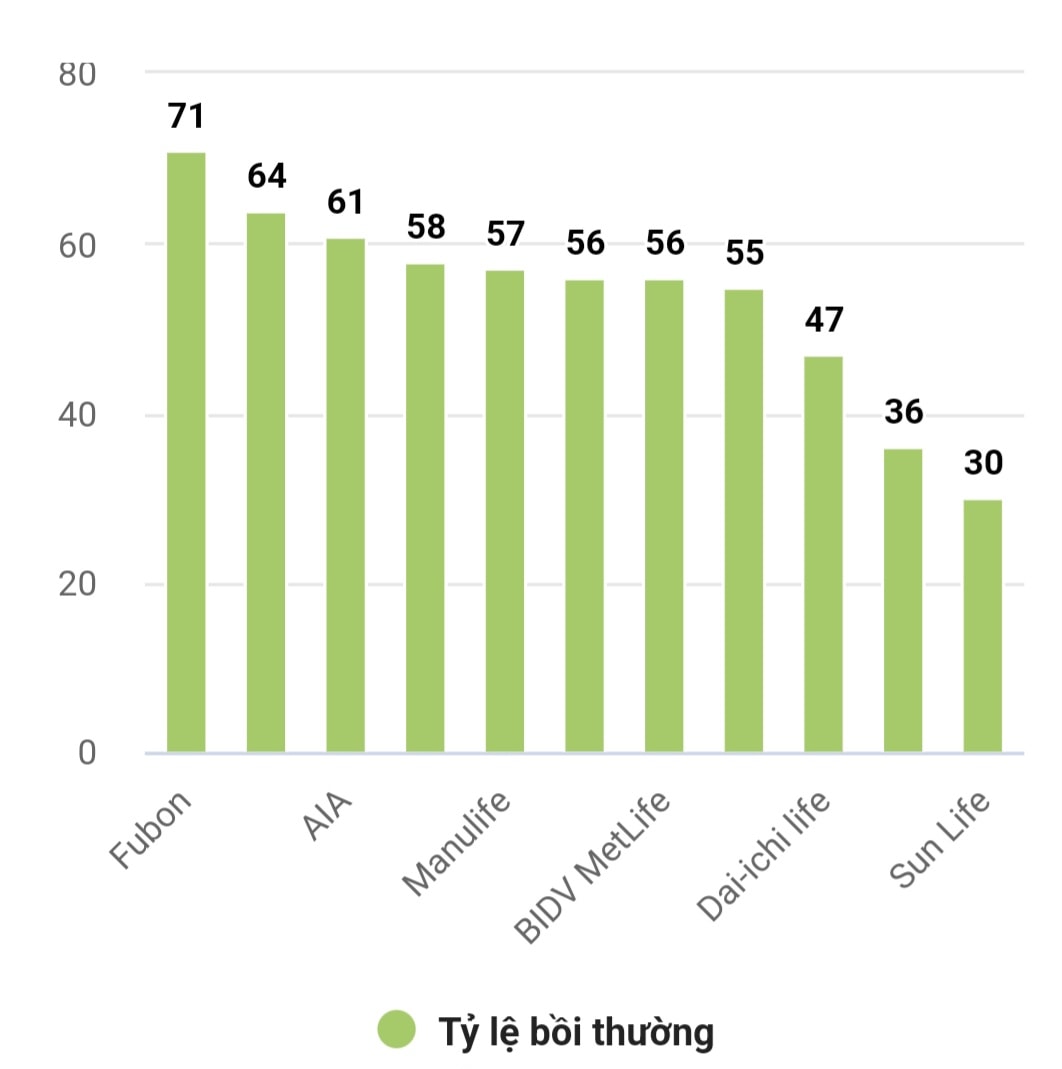

The compensation ratio/total original premium revenue of insurance companies in the past year has had quite a big difference.

According to the 2022 financial reports of a series of life insurance companies, the compensation ratio/total original insurance premium revenue has a quite large difference.

Sun Life Vietnam is the company with the lowest compensation rate. The compensation and insurance payment rate reaches 30% of total revenue.

Fubon Vietnam leads the market in compensation and insurance payment ratio, reaching 71%.

|

Compensation rates between insurance companies vary greatly. |

The original insurance premium revenue of this company only reached 130 billion VND, while it had to spend up to 93 billion VND to compensate and pay insurance money to customers.

Behind Fubon Vietnam in terms of compensation rates are: Cathay Life (64%), AIA (61%), Hanwha Life (58%), Manulife (57%), BIDV Metlife (56%), Prudential (56%), Chubb Life (55%), Dai-ichi Life (47%), Generali (36%), and Sun Life (30%).

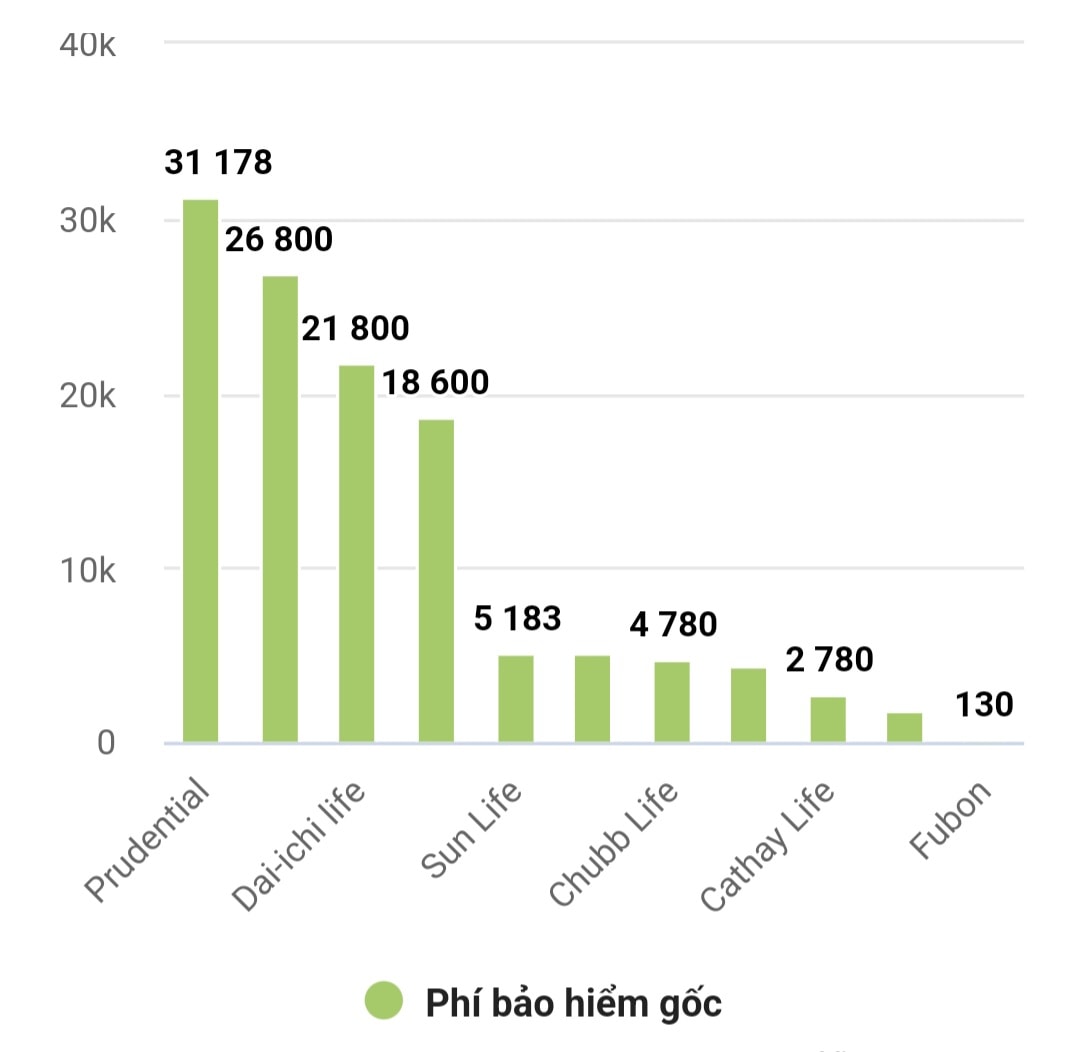

In terms of original insurance premium revenue, Prudential Vietnam leads with VND31,179 billion. Second is Manulife Vietnam with VND26,803 billion. Next is Dai-ichi Life with VND21,800 billion and AIA with VND18,600 billion.

Meanwhile, Sun Life and Generali only reached more than 5,000 billion VND.

As VietNamNet has previously reported, financial revenue (interest on bank deposits, dividends, bond yields, etc.) accounts for a large proportion of the revenue structure of insurance companies.

|

Compensation rates in 2022 of insurance companies. Vietnamnet chart |

Manulife and Prudential are the two leading enterprises in financial revenue in 2022, reaching VND 4,820 billion and VND 4,025 billion, respectively.

AIA, Dai-ichi Life and Cathay Life also joined the trillion-dollar financial revenue club. Of which, AIA and Dai-ichi Life reached VND2,480 billion, and Cathay Life reached VND1,500 billion.

Bao Viet Life and MB Ageas Life have not yet published financial reports.

There are 19 life insurance companies in the market.

According to the General Statistics Office, life insurance premium revenue was estimated at VND39,588 billion in the first quarter, up slightly by 3.1% over the same period last year. This increase is considered the lowest in many years, in the context of the insurance market facing a crisis of confidence.

Faced with the "chaotic" situation of the insurance market, the Ministry of Finance has established a 24/7 hotline to receive and handle information reflecting on insurance.

|

Original premium revenue of insurance companies. Vietnamnet chart |

By the end of March, this agency had received 175 petitions and feedbacks via phone and 218 petitions and feedbacks via email.

On April 10, the Department of Insurance Management and Supervision issued an official dispatch requesting to strengthen inspection and supervision of the implementation of insurance agency contracts, and evaluate the quality of consulting, introducing, and offering insurance products by insurance agents.

At the same time, life insurance companies must seriously handle the responsibilities of insurance agents in case of violations of legal provisions in performing activities authorized by the insurance company.

.jpg)