If there is no tax, how much does a car cost in Vietnam?

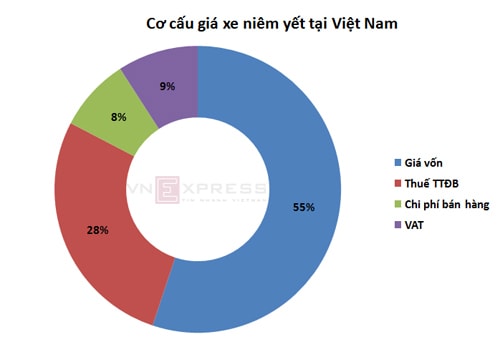

In the selling price of a car, about 55% is the cost price, and the remaining 45% is taxes and selling expenses, dealer profits.

In early September, the price of Honda CR-V cars at dealers continuously decreased, combined with the previous wave of price reductions originating from Truong Hai, causing many customers to be suspicious. With a reduction of 200-300 million, are dealers and car manufacturers making too much profit when selling cars in Vietnam? What is the real value of cars?

What is the real value of a car?

The real value that many customers mention is a colloquial term, not meaning quality but referring to the price of the car before adding or adding a very small percentage of taxes, fees and business profits. In economics, this understanding is closest to the concept of cost price. Simply put, it is the price that the manufacturing enterprise sells to the distributor.

|

For example, a company sells a car to a dealer for 500 million, after taxes and fees, the dealer sells it to a customer for 900 million, so the 500 million is the "real value" that the customer is expecting.

So what does the dealer add that makes the selling price to the customer much higher than the purchase price from the manufacturer? These are special consumption tax, VAT, sales costs, and business profits.

The order of calculating the dealer's selling price (list price) will be as follows:

Listed price = Cost price + Special consumption tax + Selling cost + VAT.

The selling cost in the above formula is understood to include the cost of operating the sales system, marketing, administration, and business profits.

In which, special consumption tax is calculated based on cost price; selling cost is usually about 10-15% of total (cost price + special consumption tax); VAT is calculated as 10% of total (cost price + special consumption tax + selling cost).

Assuming a car model has a cost price of 500 million, in the 2-2.5 liter segment, subject to 50% special consumption tax, 10% sales cost, 10% VAT, the dealer's selling price is as follows:

| Cost of goods sold | Tax TTDB | Cost sell | VAT | Dealer price | |

| Amount (million) | 500 | 250 | 75 | 82.5 | 907.5 |

| Rate (%) | 55 | 28 | 8 | 9 | 100 |

With this calculation, the dealer price is almost double the cost price. With a cost price of about 500 million, the dealer sells for more than 900 million to ensure profit.

|

According to industry experts, the dealer's profit margin is usually around 5% of the car's price. That is, if the car costs 1 billion, the dealer makes a profit of 50 million. This figure can also change depending on many factors such as the sales policy of each company and the "hotness" of each car model on the market.

The selling price on the market is much higher than the price the car company sells to the dealer because it has to pay additional taxes. This amount goes to the state budget and is not the dealer's share, so a high price does not mean the dealer makes a lot of profit.

Continuous discount, dealer sells at a loss

Dealers usually have tens of millions to negotiate prices with customers. When a car model is popular, the price will increase and the dealer will have more profit, this is a normal rule of the market, in all industries, not just automobiles. On the contrary, when car sales are slow, dealers have to accept a reduction in profit, even a loss, to sell the car, to recover capital for the next import batch.

In the case of the Honda CR-V or Mazda CX-5, most experts believe that Honda and Mazda dealers will suffer losses. This discount will usually be partially supported by the manufacturer, but in general, dealers must accept it to maintain business in the long term.

This comment is also consistent when Truong Hai representative said that this company has been suffering losses for a long time to reduce prices to achieve the desired sales, while Honda is "sacrificing dealer profits".

The current price of CX-5 or CR-V is lower than Thailand, Indonesia and some countries in the region. Car prices in these countries are lower than in Vietnam for two reasons: car production costs are about 20% lower than in Vietnam and they are not subject to many large taxes, especially special consumption tax because the governments of these countries do not classify cars as luxury goods that need to be restricted.

According to VNE

| RELATED NEWS |

|---|