Banks warn of many new fraudulent transaction tricks

According to banks, the current situation of transaction fraud is increasingly sophisticated, making it difficult for customers to recognize counterfeits, which is why there have been many cases of fraud recently.

|

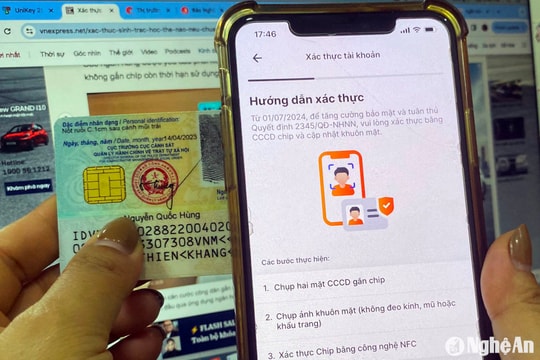

Banks warn of one of the scammers' tricks to steal information. |

Specifically, for customers who are owners of online sales units, the subject will pretend to be abroad and need to buy goods and services online for relatives. Then, the subject will request payment by transferring money via money transfer services (Moneygram, Western Union...) and then send the seller a message with a link to access the fake website. When the store owner accesses it, he will be asked to provide electronic banking security information, which the subject will take advantage of and conduct fraudulent transactions.

For customers using e-wallets such as Zalo, MoMo, Payoo... posting questions on the website, fanpage of the provider, the scammer will impersonate the service provider's staff to contact the customer and ask about problems when using. Then, the scammer tricks the customer into providing electronic banking service security information as a required step to fix the error and then takes advantage of this information to make fraudulent transactions.

|

| Recently, in Vietnam, there have been continued cases of fraud and property appropriation through electronic banking transaction channels. |

Another scam is for customers who need to borrow credit online, the subject impersonates an online lender, asks the customer to provide documents and electronic banking service information and then takes advantage of this information to carry out fraudulent transactions.

Or the scammer will fake a notification that the customer's E-Banking account has been illegally accessed or is about to expire and ask the customer to provide personal information to reconfirm via a fake link.

Or the scammer fakes the application screen, the login screen has the same interface as the real website by sending an email from an email address impersonating the bank to the customer, containing a fake link to trick the customer into logging in, thereby appropriating the security information to use the service.

To avoid being scammed in banking transactions, recently, many banks have continued to issue warnings on prevention and solutions, especially during holidays, because transaction offices are not working.

|

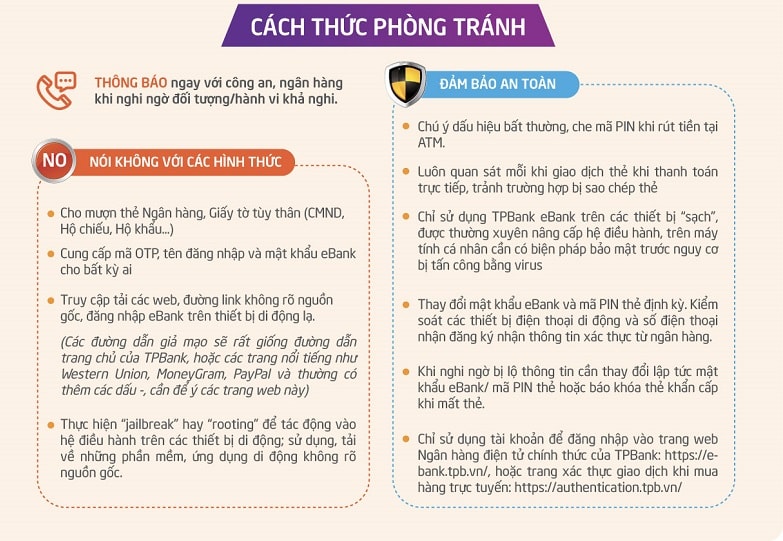

Banks guide how to avoid fraud when making transactions. |

Accordingly, banks recommend that customers absolutely do not provide any service security information, such as: Login name, access password, one-time OTP transaction authentication code sent via text message or Smart OTP application activation code, email address and personal information to anyone and in any form; do not access untrusted website links.

In addition, customers should regularly secure and change their passwords to access electronic banking services or cards at least once every 3 months; do not take photos of cards or card information (full card number, expiration date, CVV2 security code on the back of the card) and send them via email or post them on social networking sites; prioritize using computers, personal devices and use anti-virus software when accessing electronic banking services; choose to log out or exit the system or screen when completing a transaction; remember and immediately call the Customer Service Center's phone number when suspecting fraud or wanting to confirm bank information.

In addition, banks also recommend that users carefully check the name of the bank they need to transact with to see if it is fake before making online transactions (fake links often only change a few characters that are difficult for users to recognize); do not save passwords in notes on the phone or unsecured documents. The amount of money in the payment account should not be too much, it should be transferred to savings accounts.

In case of suspicion of being scammed by the above methods, users should change account information, password, and set up security configurations for their accounts.