Nghe An Social Policy Bank mobilizes many resources for effective lending

(Baonghean) - The capital transferred by Nghe An Social Policy Bank to the poor and policy beneficiaries creates an important "push" for them to escape poverty sustainably and become rich legitimately.

Rising from policy capital

The family of Ms. Nguyen Thi Thao in Giang Son Dong commune (Do Luong) is a near-poor household. The husband and wife do many jobs but the family's economy still does not improve.

In 2014, realizing the potential of Dong Lim hill near her home, Ms. Thao's family borrowed 44.2 million VND from the Social Policy Bank to plant acacia forest with an area of 2.21 hectares. In 2015, from the Near-Poor Household Program's capital, Ms. Thao continued to borrow 50 million VND to build a livestock barn with an area of 130 m2.

Up to now, Ms. Thao's farm has an area of nearly 10 hectares, including chicken farms, fish ponds, paper material development, etc.

|

| Nguyen Thi Thao's family farm in Giang Son Dong commune (Do Luong). Photo: Viet Phuong |

Currently, the flock has over 2,000 chickens, and at peak times, the farm has over 5,000 chickens. Each year, from the farm's economic development, the family's revenue reaches over 1 billion VND. This is truly the dream of many farming households in the district.

Also in Do Luong district, Mr. Pham Van Kieu's family in Luu Son commune started a business from the aluminum and glass industry. In 2017, from the Loan Program for newly escaped poor households of the Social Policy Bank, Mr. Kieu was given a loan of 50 million VND to buy an aluminum and glass machine. Currently, the model is effective, creating jobs for 4 workers with stable income.

To have capital for policy beneficiaries, the Do Luong District Social Policy Bank has had many solutions to mobilize. Mr. Nguyen Huu Ky - Director of the Do Luong District Social Policy Bank said: The unit takes advantage of capital from the Central Government and capital entrusted from the local budget; at the same time, promoting capital mobilization in the area.

|

| Pham Van Kieu's family in Hong Phong hamlet, Luu Son commune (Do Luong) borrowed 50 million VND from the People's Credit Fund to invest in aluminum and glass making machines. Photo: Viet Phuong |

In the first quarter of 2019, in addition to the capital provided by the higher level of 24,200 million VND, we increased mobilization in the area with capital reaching 79,770 million VND. At the same time, we maintained effective lending activities. Total outstanding debt by the beginning of April 2019 reached over 412 billion VND. Currently, the whole district has 15/33 communes with no overdue debt.

In Anh Son district, preferential credit capital from the Social Policy Bank continues to be invested in the right target and effectively. In the first quarter of 2019, the Transaction Office has increased by 22,118 million VND, contributing to helping the poor and other policy beneficiaries access investment capital for livestock and crop farming, serving production and developing industries, and shifting economic structure.

From there, the poor have capital to do business, have jobs, and gradually escape poverty. The organizations that receive the trust effectively manage the entrusted capital; urge the collection of due debts, handle overdue debts, and actively participate in the activities of the Savings and Credit Group to perform well the work of evaluating and disbursing revolving capital sources in a timely manner.

Diversified loan sources

Right from the beginning of the year, the provincial branch of the Social Policy Bank has directed the Transaction Offices to focus on implementing assigned tasks, focusing on doing a good job of collecting and handling overdue debts while providing loans to ensure outstanding debt growth.

|

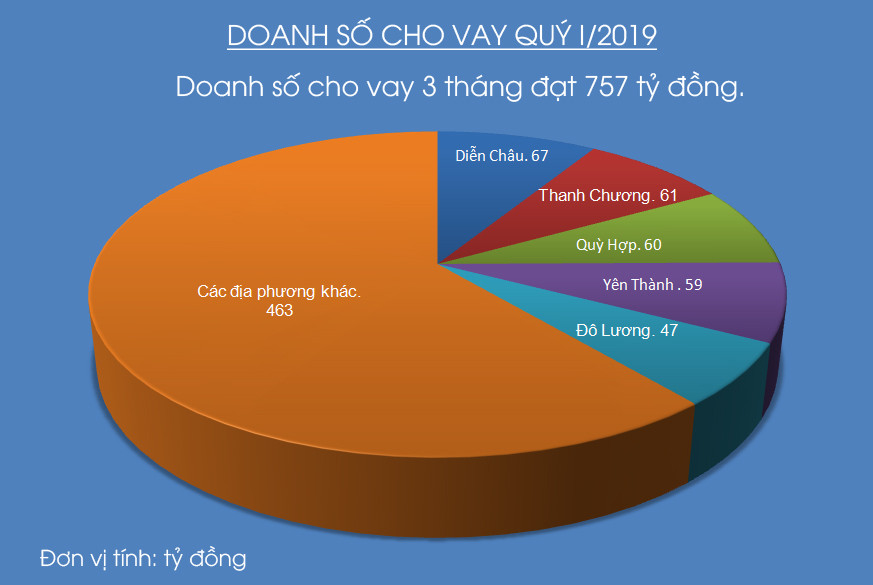

| Graphics: Lam Tung |

Along with lending activities, capital mobilization is focused on by the Provincial Social Policy Bank. The first quarter of 2019 reached 1,250 billion VND, an increase of 58 billion VND compared to the beginning of the year. Local budget capital reached 146 billion VND, an increase of 19.8 billion VND compared to the beginning of the year, reaching 166% of the plan.

Thanks to that, the 3-month loan turnover increased sharply, reaching 757 billion VND. Some transaction offices with high loan turnover include the districts: Dien Chau 67 billion VND, Thanh Chuong 61 billion VND, Quy Hop 60 billion VND, Yen Thanh 59 billion VND, Do Luong 47 billion VND...

Continuing to advise on the good implementation of Directive 40-CT/TW dated November 22, 2014 of the Secretariat, Party committees, authorities and organizations at all levels have participated and paid attention to policy credit activities. In addition, a number of enterprises in the area have also shown their responsibility for social security work, notably Song Lam Sugar Joint Stock Company has entrusted the Bank for Social Policies with 100 million VND for loans to develop economic models. Hoa Son cassava starch processing factory has also paid attention to the entrustment activities to help people in raw material areas with capital difficulties.

Currently, the Provincial Social Policy Bank is implementing social housing loans according to Decree 100/2015/ND-CP of the Government; implementing Resolution No. 12/NQ-HDQT of the Board of Directors of the Vietnam Social Policy Bank on applying loans to increase the maximum level for loans to poor, near-poor, newly escaped-poverty households and loans to poor ethnic and mountainous households according to Decision No. 2085/QD-TTg from 50 million VND to 100 million VND/household, with a maximum term of 120 months, achieving good results.

|

| Dien Chau Social Policy Bank transaction office disburses program capital to customers. Photo: Viet Phuong |

Transaction Offices coordinate with local authorities and entrusted organizations to review and closely appraise before and after lending, ensuring capital is directed to the correct address and subject as prescribed.

Preferential credit sources are focused on and enhanced, and at the same time, we actively mobilize capital sources to fully and promptly meet the disbursement capital needs of policy credit programs and ensure payment capacity in the entire system, focusing on capital mobilization at commune transaction points, consolidating lending resources for policy subjects.

.jpg)