Bank profits "huge"

While many businesses are struggling because of interest rates, many banks have announced huge profits from lending. Compared to the same period in 2010, many banks' interest income increased by 80% despite the State Bank continuously tightening credit growth.

The "huge" profits come not only from lending in the residential market but also from inter-bank lending and deposit activities...

High interest rates despite low credit growth

Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank)'s third quarter after-tax profit reached VND1,394 billion, the first nine months' accumulated profit reached VND4,128 billion, an increase of 49% over the same period in 2010. Vietcombank's third quarter after-tax profit was VND1,025 billion, the nine-month accumulated profit after-tax reached VND3,308.6 billion. Saigon Thuong Tin Bank's separate third quarter financial report showed that its net profit reached VND456 billion, the nine-month accumulated profit reached VND1,593 billion.

Eximbank also had a net profit of VND759 billion in the third quarter, with a nine-month cumulative profit of VND2,028 billion. In the third quarter, Techcombank achieved a profit after tax of VND619.22 billion, up 39.3% over the same period last year, and a nine-month cumulative profit of VND1,693.7 billion, up 42.4% over the same period; outstanding loan growth by the end of the third quarter was 12%, higher than the average of 8% of the banking system. ACB achieved a nine-month profit after tax of VND2,101 billion, up more than 15% over the same period last year.

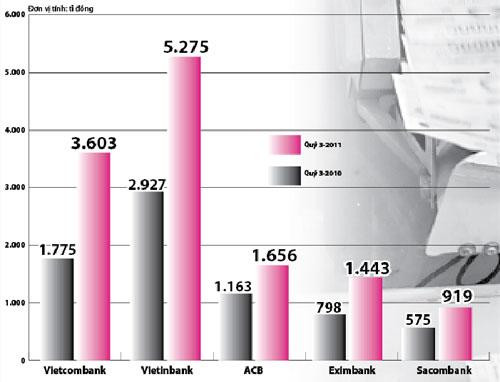

Net interest income figures in the third quarter of 2011 of some banks compared to the same period last year

Most of the banks have very high net interest income growth. Vietcombank's net interest income in the third quarter more than doubled compared to the same period last year, reaching 3,603 billion VND. In the third quarter of 2010, Vietcombank's net interest income only reached 1,770 billion VND. VietinBank's net interest income in the third quarter was 5,275 billion VND. Eximbank's net interest income in the third quarter was 1,443 billion VND, up 80% compared to the same period in 2010. ACB's net interest income in the third quarter was 1,656 billion VND, up 42.4% compared to the same period in 2010. Sacombank's net interest income in the third quarter also increased 63% compared to the same period, reaching 1,500 billion VND.

Why the big profit?

Mr. Nguyen Phuoc Thanh, General Director of Vietcombank, said that the net interest income of banks is interest from lending activities, including lending to customers in the residential market, lending in the interbank market, interest from bonds, deposits... In which the largest source of income is from lending in the interbank market and income from deposit activities. Meanwhile, income from lending in the residential market and enterprises only accounts for a modest profit ratio because credit growth in 2011 was controlled at a low level. On the other hand, although the interest rate ceiling was controlled at 14%/year, in reality, before September 2011, banks had to pay depositors up to 17-18%/year, so lending over 20%, banks also found it difficult to earn large profits.

According to a bank leader, throughout September, the interbank market was as tense as a bowstring and that was also an opportunity for banks with abundant capital to take advantage of business opportunities. Before September, when the interbank market was quiet, this source of capital still generated good profits thanks to its "transformation" in the form of deposits at small banks with interest rates of up to 18-19%/year.

Many banks make big profits from lending activities in the interbank market.

Worry about bad debt

Despite impressive business results, according to some experts, banking operations are potentially unstable. Expert Dinh The Hien said that a specific analysis will easily show that although credit growth of many banks is very low, the highest is only over 10%, but net income from interest (interest earned from lending activities, such as lending to customers, other banks, bonds...) of these banks has increased very strongly.

Meanwhile, other activities such as capital and service business do not bring much profit, some banks even suffer losses. Mr. Hien said that with low credit growth as in the past, the increase in net interest income of banks is mainly due to the difference between lending interest rates and capital costs, this difference is certainly borne by borrowers. However, according to many experts, banks pushing the burden of interest costs onto businesses is also a double-edged sword, bad debt of banks will continue to increase sharply once businesses, especially real estate businesses, cannot repay their debts.

In fact, bad debts of most banks increased sharply in the third quarter of 2011. Most of these bad debts came from loans for investment and real estate business. However, capital was then stuck due to a serious decline in market liquidity, many businesses could not pay the principal and interest rates were too high, these loans turned into bad debts of banks.

According to Tuoi Tre