The budget is expected to ensure sufficient implementation of synchronous salary policy reform from July 1, 2024.

(Baonghean.vn) - Reporting to the National Assembly, Minister of Finance Ho Duc Phoc said: The estimated revenue and expenditure of the State budget in 2024, together with the use of a part of the accumulated salary reform source, is expected to ensure enough to synchronously reform the salary policy from July 1, 2024.

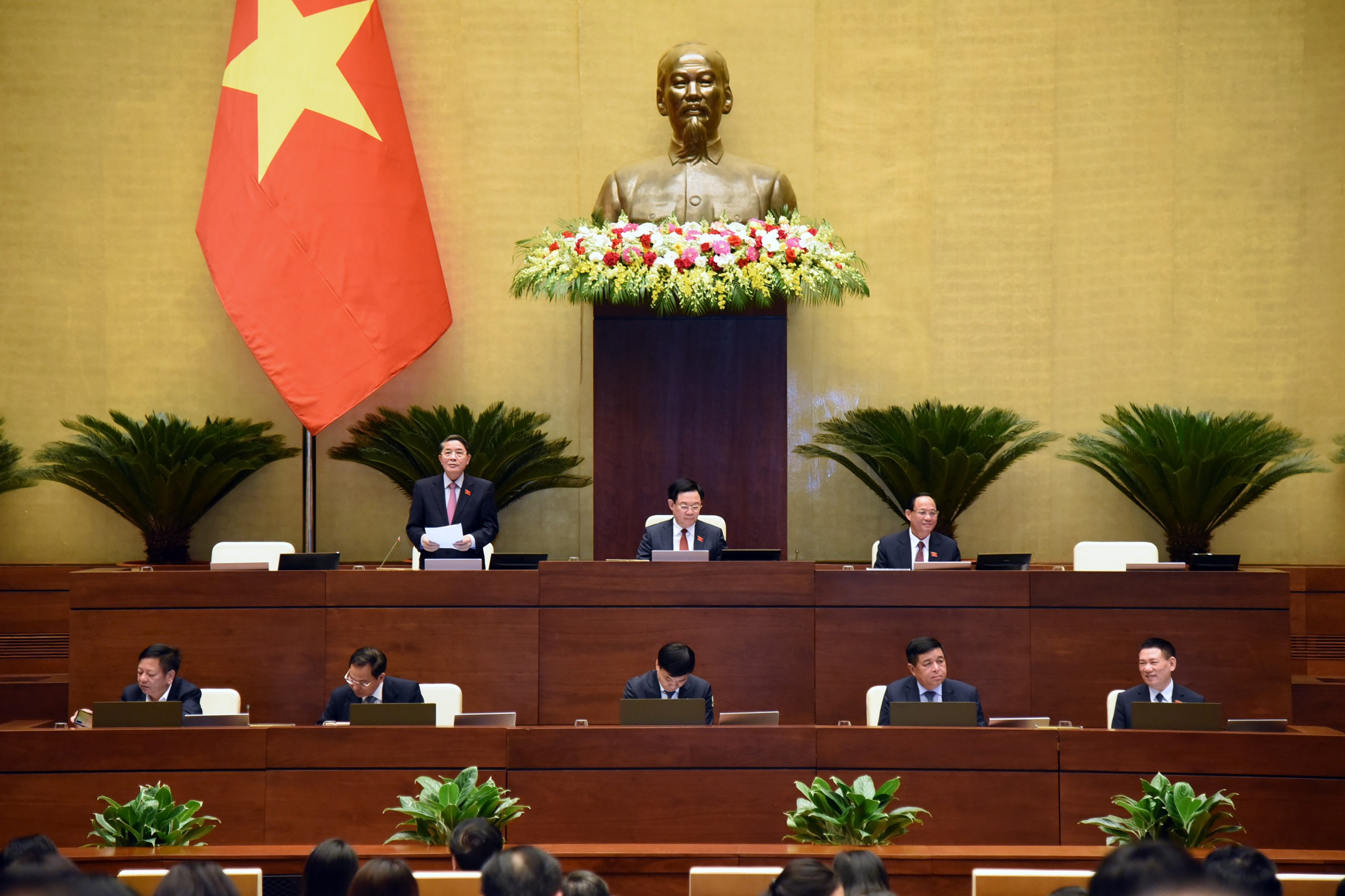

On the afternoon of October 23, under the chairmanship of National Assembly Chairman Vuong Dinh Hue, the 15th National Assembly continued its working program at the 5th Session. Vice Chairman of the National Assembly Nguyen Duc Hai chaired the meeting.

At the working session, authorized by the Prime Minister, Minister of Finance Ho Duc Phoc reported on a number of main contents on the implementation of the State budget in 2023, the State budget estimate, the Central budget allocation plan in 2024, and the State financial and budget plan for the 3 years 2024 - 2026.

Accordingly, the State budget implemented in the first 9 months of 2023 is equal to 75.5% of the estimate, the mobilization rate into the State budget is about 15.7% of GDP. Regarding State budget expenditure in 2023, the estimated implementation in the first 9 months is equal to 59.7% of the estimate.

Based on the assessment of State budget revenue and expenditure, the State budget deficit this year is estimated to be about 4% of GDP. However, by the end of 2023, the indicators of public debt, government debt, national foreign debt, and direct debt repayment obligations of the Government will be within the scope allowed by the National Assembly.

Minister of Finance Ho Duc Phoc said: The estimated state budget revenue in 2024 will increase by about 5% compared to the estimate and estimated implementation in 2023. The mobilization rate into the state budget will reach 15.3% of GDP.

Regarding the State budget deficit, closely following the 5-year Plan target according to the National Assembly Resolution, the State budget deficit estimate for 2024 is about 3.6% of GDP. By the end of 2024, the indicators of public debt, government debt, national foreign debt, and the Government's direct debt repayment obligations will be within the scope allowed by the National Assembly.

The Minister of Finance also reported to the National Assembly on the possibility of allocating resources to implement salary reform. Specifically, with the expected revenue and expenditure of the State budget in 2024, along with the use of a part of the accumulated salary reform resources of the central budget and local budget sources, it is expected to ensure enough to synchronously implement salary policy reform according to Resolution 27-NQ/TW from July 1, 2024.

Reporting on the 3-year State financial and budget plan for 2024-2026, Minister of Finance Ho Duc Phoc said: The plan was built with the expectation that the socio-economic situation would gradually improve, inflation would be controlled, and major balances would be ensured.

Presenting the audit report on this content, Chairman of the National Assembly's Finance and Budget Committee Le Quang Manh emphasized: Although our country's economy faces many difficulties and challenges, with the Government's efforts and determination, the management of the state budget has achieved many positive results.

At the same time, the head of the National Assembly's Finance and Budget Committee noted a number of issues such as: The state budget revenue situation is estimated to have met the estimate but in reality there are still many potential risks when domestic revenue decreases, showing that the economic situation is still difficult.

State budget revenue is greatly affected by tax and fee exemption policies, but the Government's report has not yet quantitatively assessed the effectiveness of these policies.

The Finance and Budget Committee also believes that the central budget's leading role is affected. Local budget revenue is uneven among localities, many localities estimate that their budget estimates will not be met, and localities need to strive to complete their estimates.

Regarding the 2024 State budget estimate, the Finance and Budget Committee believes that the revenue estimate increase of 5% compared to the estimated implementation in 2023 is quite positive in the context of expected economic growth of about 6% - 6.5%, inflation of about 4% - 4.5%. However, State budget revenue still contains risk factors and lacks sustainability when land revenue has a large increase.

Regarding the expenditure estimate, the Finance and Budget Committee noted the need to make a comprehensive assessment of the implementation of the salary reform policy and balance resources for 2024-2026, and forecast to 2030 to ensure feasibility and long-term sustainability in accordance with the spirit of Resolution 27-NQ/TW.

At the same time, it is necessary to implement synchronous solutions to increase sustainable budget revenue, avoid passivity in resource allocation; need flexible fiscal and monetary policies, and policies to encourage additional revenue sources in the next period; synchronously adjust the basic salary with innovation, reorganize the apparatus in the direction of streamlining, effectiveness, efficiency, and linked to job positions;...

Also in the working program on the afternoon of October 23, Government members, as assigned by the Prime Minister, presented mid-term assessment reports on the implementation of the 5-year socio-economic development plan for the 2021-2025 period and the economic restructuring plan for the 2021-2025 period; mid-term assessment reports on the implementation of the 5-year national financial plan and public borrowing and debt repayment for the 2021-2025 period; mid-term assessment reports on the implementation of the medium-term public investment plan for the 2021-2025 period; and reports on the implementation results of Resolution No. 43/2022/QH15 on fiscal and monetary policies to support the socio-economic recovery and development program. Leaders of the National Assembly agencies, including the Economic Committee and the Finance and Budget Committee, presented reports on the verification of the above contents.

In particular, the mid-term assessment of the implementation of the 5-year socio-economic development plan for the period 2021-2025 shows that after 2 years of being heavily impacted by the Covid-19 pandemic combined with the context of global economic and trade decline and many risks, our country's socio-economy has recovered and achieved positive results. In 2021, the GDP growth rate reached 2.56% when many economies had negative growth; in 2022, it recovered strongly, reaching 8.02%, much higher than the plan (6 - 6.5%); the first 9 months of 2023 reached 4.24%, the whole year is forecasted at about 5 - 5.5%; economic growth in 2024 - 2025 may recover better than in 2023.

However, achieving the average growth target of about 6.5% - 7% in the 2021 - 2025 period and higher than the average of the 5 years 2016 - 2020 (6.25%) is an extremely difficult task, especially in the context of the extremely complicated and unpredictable world situation.