Tax industry wants e-commerce platforms to provide seller revenue

The Ministry of Finance is proposing that e-commerce platforms, delivery units... provide revenue information of online sellers for taxation purposes.

According to the provisions of the Tax Administration Law No. 38 and Decree 126, the leaders of the Tax authorities have repeatedly mentioned the need to strengthen the responsibility of organizations in declaring and paying taxes on behalf of business individuals. This message continues to be expressed more specifically in the draft Circular on guidance and tax management for business households and business individuals that is being consulted.

Ms. Ta Thi Phuong Lan - Deputy Director of Tax Management for Small, Medium Enterprises and Business Households (General Department of Taxation) said that the Tax sector will change its management mindset with business households and individual businesses. Instead of working directly with each individual, they will have the lead from the relevant organization and payment cash flow.

In the draft Circular, intermediary units are required to declare information and even pay taxes on behalf of individuals and business households (if they hold cash flow). Thus, thee-commerce platformsuch as Tiki, Shopee, Lazada, Sendo or delivery units will be responsible for providing information of shop owners (if residing in Vietnam) to the Tax authorities. This draft Circular does not apply to foreign suppliers.

|

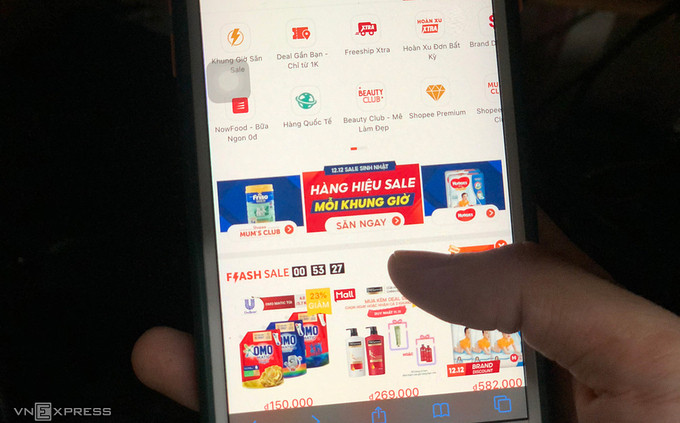

| Many people participate in e-commerce sales. Photo: Quynh Trang |

This helps the Tax authority access the actual revenue of business households and individuals through a third party such as an e-commerce platform or delivery party.

Many business households have long registered for tax in the form of lump-sum tax payment. The Tax Department has grasped the business location and warehouse, but the reflected revenue may not be complete. Therefore, the Department's leaders assess that information from e-commerce platforms is a reliable source for the tax department to adjust the revenue oftaxpayers, thereby collecting taxes more accurately and completely.

E-commerce platforms said they are temporarily studying the draft so they cannot comment on this proposal.

As for individuals doing business on social networks like Facebook,Local tax authorities exploit data published on sales pages and fanpages to identify individuals doing online business, thereby finding ways to collect taxes.

Sharing at a conference, Ms. Nguyen Thi Cuc - President of the Tax Consulting Association once pointed out the fact that traditional businesses still have to rent offices, stores and bear many additional costs, but they still declare and pay taxes in full. Meanwhile, modern e-commerce businesses, with lower costs and higher profits, avoid taxes.

Therefore, according to Ms. Cuc, approaching other sources for information on e-commerce tax collection is completely appropriate to ensure equality between e-commerce and traditional businesses.

In addition, the draft Circular also clearly states new tax collection methods for large business households.

Previously, all business households paid the same lump-sum tax. However, the new Circular will require large business households to pay tax by self-declaration based on accounting books, instead of paying lump-sum tax as before.

According to Management Law No. 38, a business household is considered a large household if it meets the criteria of small and micro enterprises with a revenue of 3 billion or more (for trade) and 10 billion or more (for production) or households that have a need to use invoices regularly. Currently, large households also account for about 6-7% of the total number of 2 million business households nationwide.

Tax leaders said that for a long time, many business households have been taking advantage of and hiding under the guise of business households to legalize input invoices for businesses or smuggled goods. Therefore, the tax sector must tighten this loophole by changing the form of tax declaration.

.jpg)