Nghe An Tax Industry aims for professionalism, modernity, discipline and efficiency

(Baonghean) -On September 10, 1945, Comrade Vo Nguyen Giap, Minister of the Interior, on behalf of the President of the Provisional Government, signed Decree No. 27 on "establishing a Department of Customs and Indirect Taxes", laying the first foundation for the birth, growth and development of the Vietnam Tax Industry. Responding to the wishes of all tax officials and civil servants, on August 6, 2010, Prime Minister Nguyen Tan Dung signed Decision No. 1370/QD-TTg to take September 10 every year as "Traditional Day of the Vietnam Tax Industry". In Nghe An, the Tax Department was only established 25 years ago, but inherited and promoted the tradition of the Vietnam Tax Industry, always excellently completing the collection task, operating increasingly professionally and effectively...

On the first day of gaining independence, the national treasury left by the feudal government had only 1,250,000 Indochinese piastres, of which 580,000 were torn coins waiting to be destroyed. The fate of the nation was like "a thousand pounds hanging by a thread", the Provisional Revolutionary Government abolished many taxes of the old regime to reduce difficulties for the people; at the same time, to ensure the spending needs for the State, to serve the people, for the benefit of the people, the Government appealed to the national pride, the patriotism of the people, launched many movements to mobilize people's resources for the Budget to serve the revolution that the history of the nation still records such as: "Independence Fund", "Golden Week", "Rice jars to feed the army", "Resistance bonds", "National bonds"... thanks to which the young revolutionary government overcame budget difficulties to lead the revolution to success.

Vietnam's tax policy system has been built and gradually synchronized, improved, and more suitable to the country's development situation and orientation, in line with international practices and standards, especially in the context of increasingly expanding international economic integration; becoming a tool to promote economic development, political stability, social justice and effective allocation of resources for the goal of sustainable development.

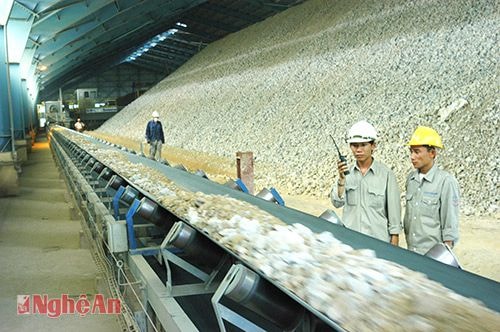

|

| Production line at Hoang Mai Cement Factory. Photo: Sy Minh |

In the past 10 years, international tax cooperation with countries and international and regional organizations has been increasingly implemented. As of July 2015, Vietnam has signed 72 Tax Agreements with countries and territories around the world, of which 60 Agreements have come into effect; has concluded negotiations and completed procedures for the official signing of 13 Tax Agreements and Protocols of Tax Agreements; has organized and implemented many tax cooperation activities in both breadth and depth with countries and international and regional organizations such as: Laos, Korea, Cuba, IFC, OECD, SGATAR, JICA,... Through participating in tax forums organized by international organizations, the Vietnamese Tax sector has learned experiences, cooperated in all aspects, approached issues of standards and times in tax policy making as well as tax management.

Regarding the Nghe An tax sector, it was established on August 21, 1990 (at that time, the Nghe Tinh Tax Department) on the basis of merging 3 organizations: the Department of Industrial and Commercial Tax; the Department of State Revenue; the Department of Agricultural Tax. And, the Nghe An tax sector was officially established on August 27, 1991 (after the separation of the province), according to Decision No. 308 of the Minister of Finance. The Nghe An Tax Department has been around for 25 years now, and the tax sector has made every effort to always excellently complete the assigned budget collection task.

The province highly appreciates the role of advising local Party committees and authorities on the preparation of State budget revenue estimates and tax management in the area; organizing the implementation of annual tax revenue estimates; implementing tax management measures according to the provisions of law of the Nghe An Tax sector. The tasks of propagating, guiding, disseminating, explaining the State's tax policies, and supporting taxpayers are also well performed by the sector. That creates conditions for businesses to develop, nurture revenue sources, and the budget revenue is increasingly increased.

In recent years, the Party Committee and people of Nghe An have been striving and making strong and accelerated developments, especially after 2 years of implementing Resolution 26 of the Politburo on the development direction of Nghe An to 2020. With the attention, direction and support of the Central Government, the efforts of Party committees, authorities at all levels, the political system, the spirit of overcoming difficulties and competing to get rich of the business community, entrepreneurs and people of the province, the image and appearance of Nghe An have been rapidly renewed and developed, leaving new and good impressions. Nghe An has an international airport, Cua Lo Port has welcomed 23,000-ton ships, a modern and synchronous system of overpasses and roads; With the largest dairy farm in Southeast Asia, TH Group was recognized as the Asian record "Largest concentrated dairy farm" applying high technology, PCI index in 2014 increased 18 places compared to 2013 (from 46th to 28th), attracting investment in the past 2 years achieved the highest results with many large projects: 2 Hoa Sen Steel Plants, Song Lam Cement, 12/9 Cement; VSIP Nghe An Industrial Service and Urban Area Project; Wood Processing Factory, Masan Food Factory, Royal Foods Thai Seafood Processing Factory, Muong Thanh - Song Lam Hotel System,... have created a wave of investment in Nghe An at high speed. The number of registered enterprises in the whole province has reached 13,537 units so far, the programs and projects are being vigorously implemented, Nghe An has formed centers such as finance and banking, education and training, vocational training, healthcare, culture and sports in the North Central region... The whole province has 77 communes that have completed 19/19 new rural criteria, of which 51 communes have been recognized; by the end of 2015, there will be 114 communes that have achieved new rural standards (accounting for 27%).

That economic achievement is also thanks to the great contribution of the business community, enterprises, people, and the important role of the provincial Tax sector, especially in the issue of "accompanying enterprises and taxpayers". At the same time, it also returns to better serve the people's lives, production and business activities of enterprises and strongly improves the investment environment, thereby attracting new resources for the province's revenue in the coming term.

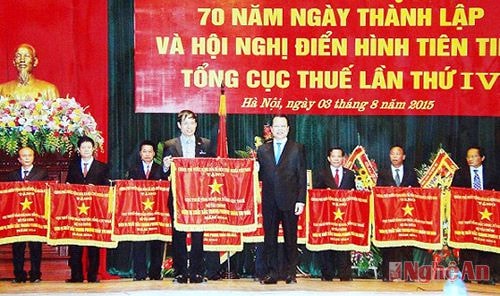

|

| Nghe An Tax Department receives the Government's Emulation Flag. Photo: PV |

Over the past 25 years, especially in recent years, Nghe An Tax Department has always overcome difficulties and fulfilled its political tasks well. From 1991 to 2015, Nghe An Tax Department's budget revenue always exceeded the assigned estimate, the revenue of each year was higher than the previous year with an average growth rate of nearly 25%/year. If in 1991, the state budget revenue only reached 68,901 billion VND, then by 2015, the Tax sector committed to working with other sectors to complete the term's target with a revenue of 10,000 - 10,500 billion VND. Nghe An Tax sector has also managed revenue sources well, effectively implemented anti-revenue loss prevention, had many initiatives and projects to improve work, and highly applied them to performing tasks.

In particular, Nghe An Tax Department is the leader in the country in implementing electronic tax declaration and payment services. Nearly 100% of businesses in the area are currently performing tax declaration online and 92% of businesses have successfully registered for electronic tax payment services. Nghe An Tax Department has been coordinating with the Department of Science and Technology, the Department of Measurement and Quality and the Market Management Agency to take effective measures to prevent tax losses in the petroleum business sector; coordinating with the Provincial Police in the Project to prevent false declarations, tax fraud and evasion of businesses with import-export and transfer pricing activities such as wood, petroleum, etc.

Nghe An Tax Department also shows itself to be a disciplined, disciplined collective, operating professionally and effectively, taking the lead in administrative reform, applying information technology in management and operation; having a clean and strong Party organization, a strong and comprehensive government and mass organization, building a team of tax departments that are both red and professional.

In the coming time, to better complete the assigned political tasks, the Nghe An Tax sector needs to continue to focus on administrative reform, especially at the grassroots level; tighten discipline; strengthen training to improve responsibility and professional expertise for officials, creating strength in the whole sector; apply information technology to better serve businesses and entrepreneurs, manage revenue sources well, and reduce tax arrears. At the same time, effectively advise the Party Committee and government to attract resources and rapidly increase revenue in the area.

H.D.P

| RELATED NEWS |

|---|