Nghe An: 7,212 billion VND for policy beneficiaries to borrow capital

(Baonghean.vn) - In 2018, the Nghe An branch of the Vietnam Bank for Social Policies strives to complete the growth target of 20 billion VND in capital entrusted from the local budget.

On the afternoon of January 31, under the chairmanship of comrade Le Xuan Dai - Member of the Provincial Party Committee, Permanent Vice Chairman of the Provincial People's Committee, Head of the Board of Directors, the Representative Board of the Bank for Social Policies of Nghe An province held the 54th regular meeting to evaluate the results of 2017 and deploy tasks for 2018.

|

| Vice Chairman of the Provincial People's Committee Le Xuan Dai chaired the meeting. Photo: Thu Huyen |

In 2017, Nghe An Social Policy Bank Branch promptly took advantage of the attention of the Central Bank, actively advised to increase local support resources, and at the same time promoted capital mobilization from organizations and individuals in the area. Capital reached 7,212 billion VND, an increase of 7% compared to 2017, basically meeting the actual needs of the locality. Capital mobilized in the area reached 925 billion VND, an increase of 323 billion compared to the beginning of the year, reaching 181% of the assigned plan.

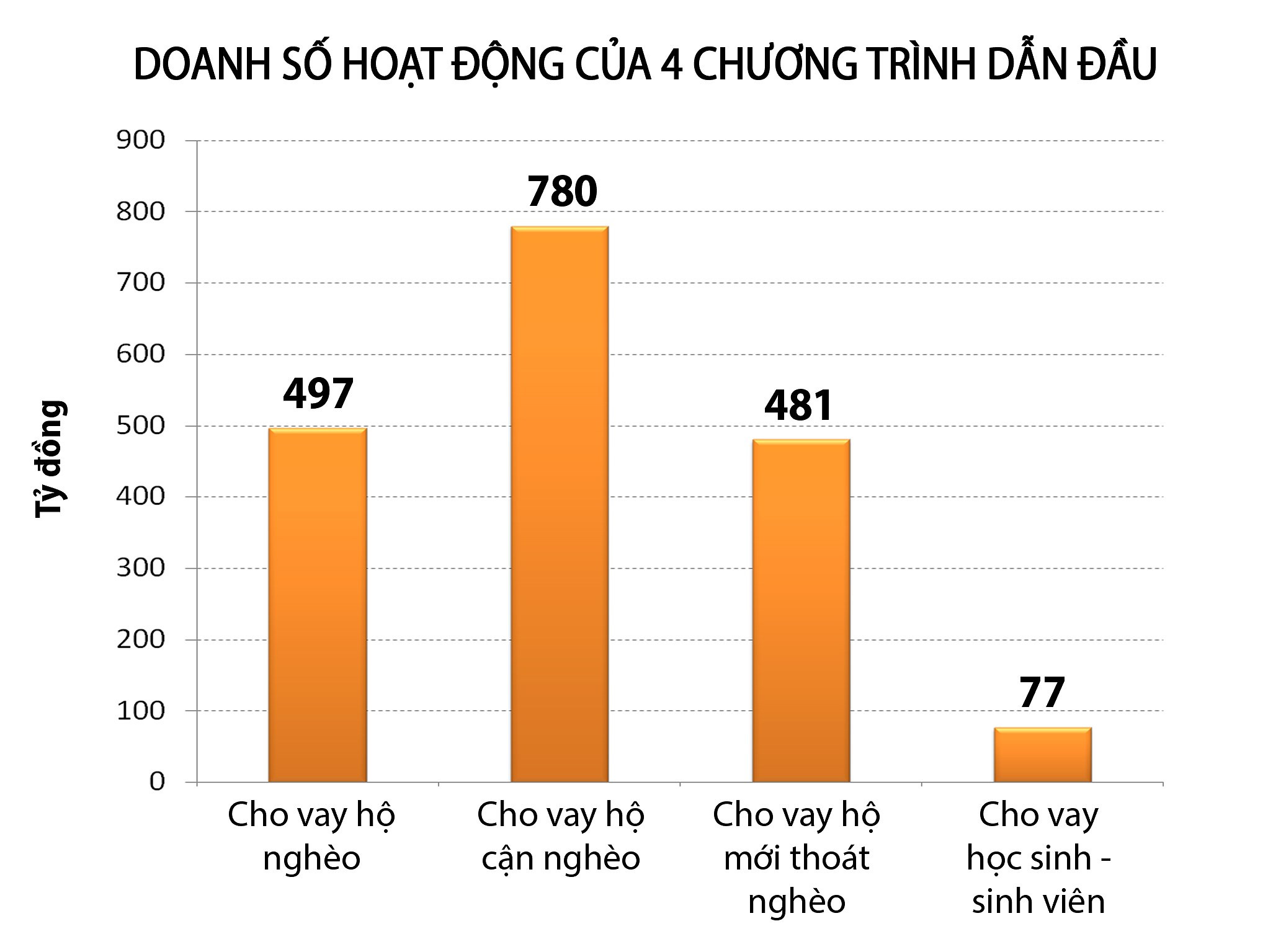

By December 31, 2017, total outstanding loans reached VND 7,200 billion, an increase of 7% compared to the previous year. Outstanding loans of 03 programs for poor households, near-poor households and households escaping poverty continued to lead the total of 17 programs, reaching VND 4,373 billion (accounting for 60.7%). This was the year with the highest loan turnover and debt collection in the past 15 years, of which: loans reached VND 2,517 billion, an increase of 14.3% compared to 2016; debt collection reached VND 2,046 billion, an increase of 6% compared to the previous year. Overdue debt accounted for 0.17%; debt handling quality was significantly improved. Entrustment activities and the network of Savings and Loan groups changed dramatically in both quantity and quality.The number of good groups increased, the number of weak groups decreased sharply.

|

| Director of the Provincial Social Policy Bank reports on the evaluation of work in 2017 and deployment of tasks in 2018. Photo: Thu Huyen |

At the meeting, the opinions of the delegates representing the organizations highly appreciated the outstanding results in 2017, the role of the Board of Directors at all levels. In general, the credit quality of the branches has changed quite comprehensively, especially some transaction offices have had remarkable changes compared to previous years.

However, the level of change between units is not uniform, some units have not narrowed the gap compared to the general level, overdue debt has increased, debt handling quality is still limited, the quality of the network of entrustment and delegation is still low... In which, some units have overdue debt increased compared to the beginning of the year such as: Ky Son 1,316 million, Quynh Luu 273 million VND, Que Phong 202 million VND.

The situation of appropriation and borrowing has tended to decrease in 2017. However, many cases have been discovered but have not been completely handled and recovered, and some areas still have potential debts of appropriation and borrowing...

|

| Graphics: Huu Quan |

In 2018, the Nghe An branch of the Vietnam Bank for Social Policies strives to complete the growth target of 20 billion VND of capital entrusted from the local budget. Capital and outstanding loan growth from 7-10% compared to 2017. Complete 100% of the capital mobilization plan assigned by superiors (including: savings deposits through groups, mobilization at commune transaction points and mobilization from organizations and individuals), complete the minimum outstanding loan plan target of 99.5% or more; strive to complete the inspection plan of channels and levels with high quality and efficiency.

|

| People in Dien Ngoc, Dien Chau borrow capital from the Vietnam Bank for Social Policies to process seafood. Photo: Thu Huyen |

Speaking at the conclusion of the meeting, Mr. Le Xuan Dai, Standing Vice Chairman of the Provincial People's Committee, acknowledged and highly appreciated the results achieved by the Board of Directors in the past year; At the same time, he proposed to well implement the goals set out in 2018,The Board of Directors at all levels shall maximize their role and responsibility in leading and directing policy credit, while paying attention to allocating more local resources entrusted to the VBSP. Continue to maximize the combined strength of the entire society to participate in the management and supervision of policy credit.

Comrade Le Xuan Dai requested that the association organizations make the most of the central and local budgets, further strengthen the mobilization of capital from organizations and individuals in the area and at the same time do a good job of debt collection, including debt installments to proactively source capital to fully meet the demand for debt growth. Direct the transaction offices to strengthen strict control of loan quality, strictly and thoroughly comply with the debt handling process, end debt extension beyond the prescribed time; continue to implement effective solutions to improve and enhance the quality of operations in Ky Son, Que Phong and Quynh Luu...