Nghe An achieves credit growth of over 7%

According to data from the State Bank of Vietnam, Nghe An branch, as of October 31, credit growth in the area reached more than 7%, higher than the same period in 2023.

In the first 10 months of the year, Nghe An's banking sector continued to lead the North Central region in terms of capital mobilization results; effectively implementing monetary, credit and banking activities in the area. In the third quarter of 2024, bank credit growth showed signs of recovery, reflecting an improvement in the economy's credit demand.

.jpg)

According to the report of the State Bank of Vietnam, Nghe An branch, by October 31, 2024, the capital mobilized in the area (excluding the Development Bank) is estimated at VND 256,740 billion, an increase of VND 24,396 billion compared to the beginning of the year, equal to 10.5%; the same period in 2023 was 10.8%.

By October 31, 2024, the total outstanding debt of credit institutions in the area is estimated at VND 317,011 billion, an increase of VND 21,232 billion compared to the beginning of the year, equal to 7.18% (the same period in 2023 was 5.7%).

By term: short-term debt reached VND 187,854 billion (accounting for 61.6% of total debt), medium and long-term debt reached VND 117,332 billion (accounting for 38.4% of total debt).

Outstanding loans for policy programs through the Social Policy Bank are 13,407 billion VND, accounting for 4.3% of outstanding loans in the whole area.

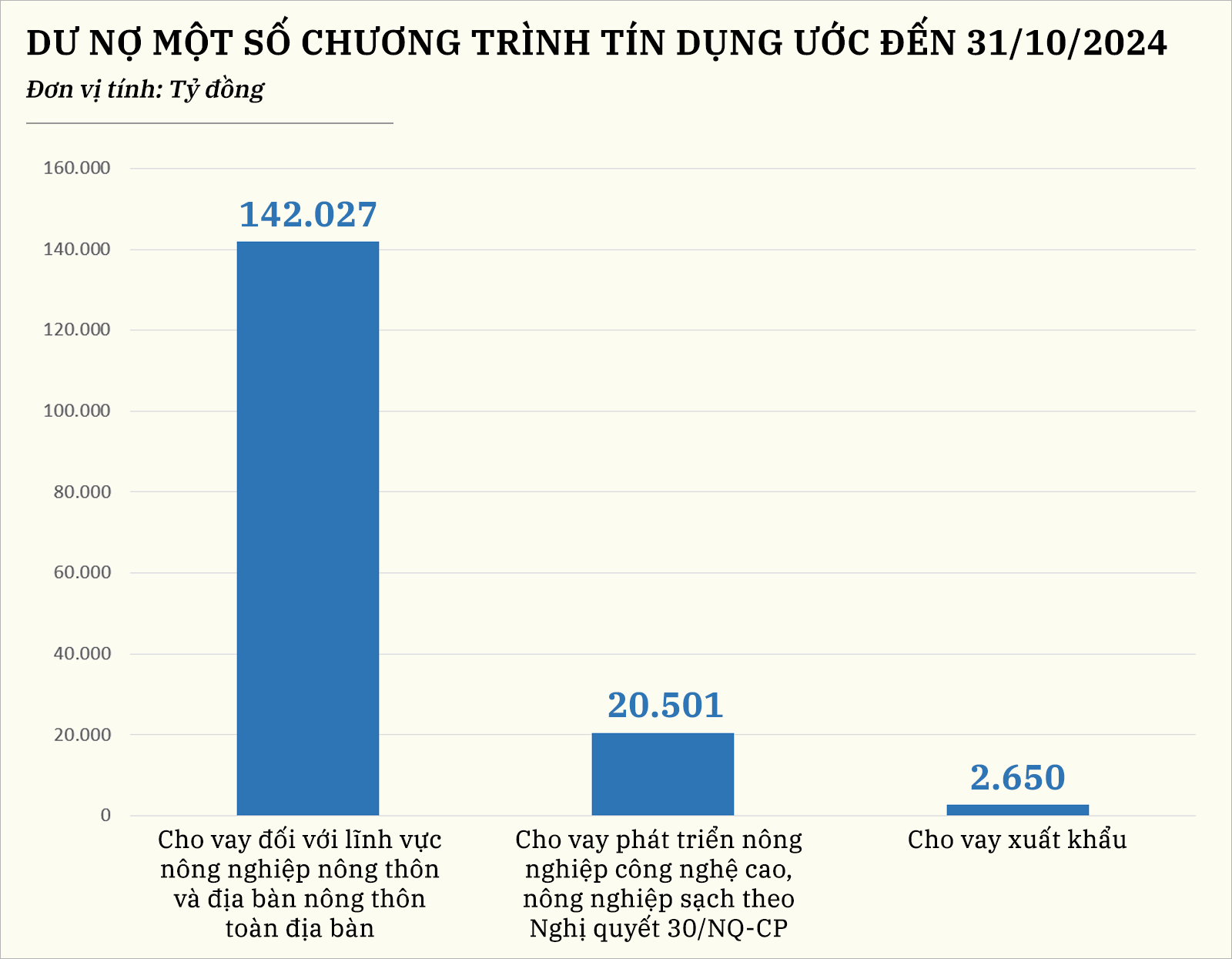

Outstanding balance of some credit programs estimated as of October 31, 2024

+ Loans for the rural agricultural sector and rural areas in the whole area are estimated at 142,027 billion VND, accounting for 45% of outstanding loans in the whole area.

+ Loans for high-tech agricultural development and clean agriculture according to Resolution 30/NQ-CP are estimated at 20,501 billion VND, accounting for 6.5% of total outstanding loans in the whole area.

+ Export loans are estimated at 2,650 billion VND, down 7.3% compared to the beginning of the year.

+ Housing support loans according to Resolution 02/NQ-CP dated January 7, 2013 of the Government are estimated at 71 billion VND, down 34.8% compared to the beginning of the year.

+ Loans for shipbuilding according to Decree 67/2014/ND-CP are estimated at 79 billion VND, down 37.4% compared to the beginning of the year.

According to the leader of the State Bank of Vietnam, Nghe An branch, credit is expected to increase better in the last months of the year. The banking industry will continue to implement solutions to support difficulties for businesses and people affected by natural disasters and epidemics. Deploy credit packages to meet the capital needs for production and business in a timely manner, serving the living needs and legitimate consumption of people and businesses, and strive to increase credit growth while controlling credit quality.