Nghe An: Outstanding loans increased by nearly 1,500 billion VND

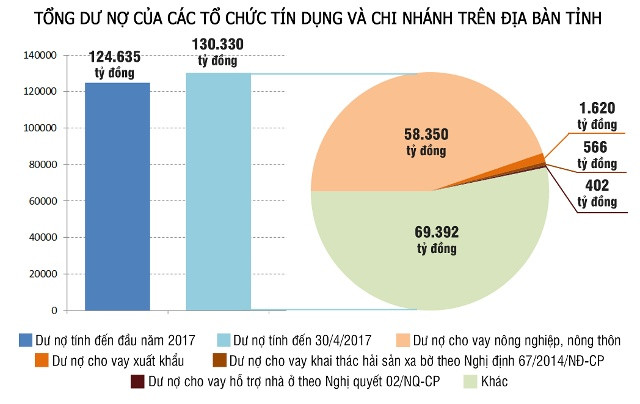

(Baonghean.vn) – To30/4/2017Total outstanding debt of credit institutions and branches in the area is estimated at 130,330 billion VND, an increase of 1,467 billion VND compared to the previous month; compared to the beginning of the year, an increase of 5,695 billion VND, equal to 4.6%.

Since the beginning of 2017, a number of commercial banks in the area have disbursed a large amount of loans to major investors such as Hoang Mai Cement Company, Traffic Construction Corporation No. 4, etc. In addition, the provincial social policy bank has disbursed loans for lending programs for poor and near-poor households and clean water (with an amount of nearly 300 billion VND).

|

| Outstanding balance chart30/4/2017in Nghe An. Graphics: Huu Quan |

In particular, some priority credit sectors have good outstanding loans such as: agricultural and rural loans reached about 58,350 billion VND, an increase of 1,320 billion VND compared to the beginning of the year, accounting for 38.5% of total outstanding loans. Export loans reached 1,620 billion VND, an increase of 150 billion compared to the beginning of the year.

Loans for offshore fishing according to Decree 67/2014/ND-CP: Disbursed to 72 ship owners/101 ships approved by the Provincial People's Committee with outstanding loans of 566 billion VND/total loan commitment of 612 billion VND (37 ships have disbursed 100% of capital; 32 ships have disbursed over 50%, 3 ships have disbursed under 50%), in terms of materials, there are 59 wooden-hulled ships, 9 iron-hulled ships, 4 composite-hulled ships, ranking 4th nationwide in terms of the number of ships receiving loans under the program (after Quang Tri, Quang Binh, Binh Thuan provinces).

Outstanding loans for housing support under Resolution 02/NQ-CP: up to30/4/2017In the area, there are 13 banks lending for housing support packages with outstanding loans of 402 billion VND.

|

| Transaction at Vietinbank Nghe An branch. Photo by Thu Huyen |

Currently, the common lending interest rate for priority sectors is 6-7%/year for short term. The lending interest rate for normal production and business sectors is 6.8-9%/year for short term; 9.3-11%/year for medium and long term.

USD loan interest rates are relatively stable: Currently, USD loan interest rates are commonly at 2.8-6%/year.

Thu Huyen

| RELATED NEWS |

|---|

.jpg)