Nghe An reduced tax debt by more than VND2,300 billion compared to the same period

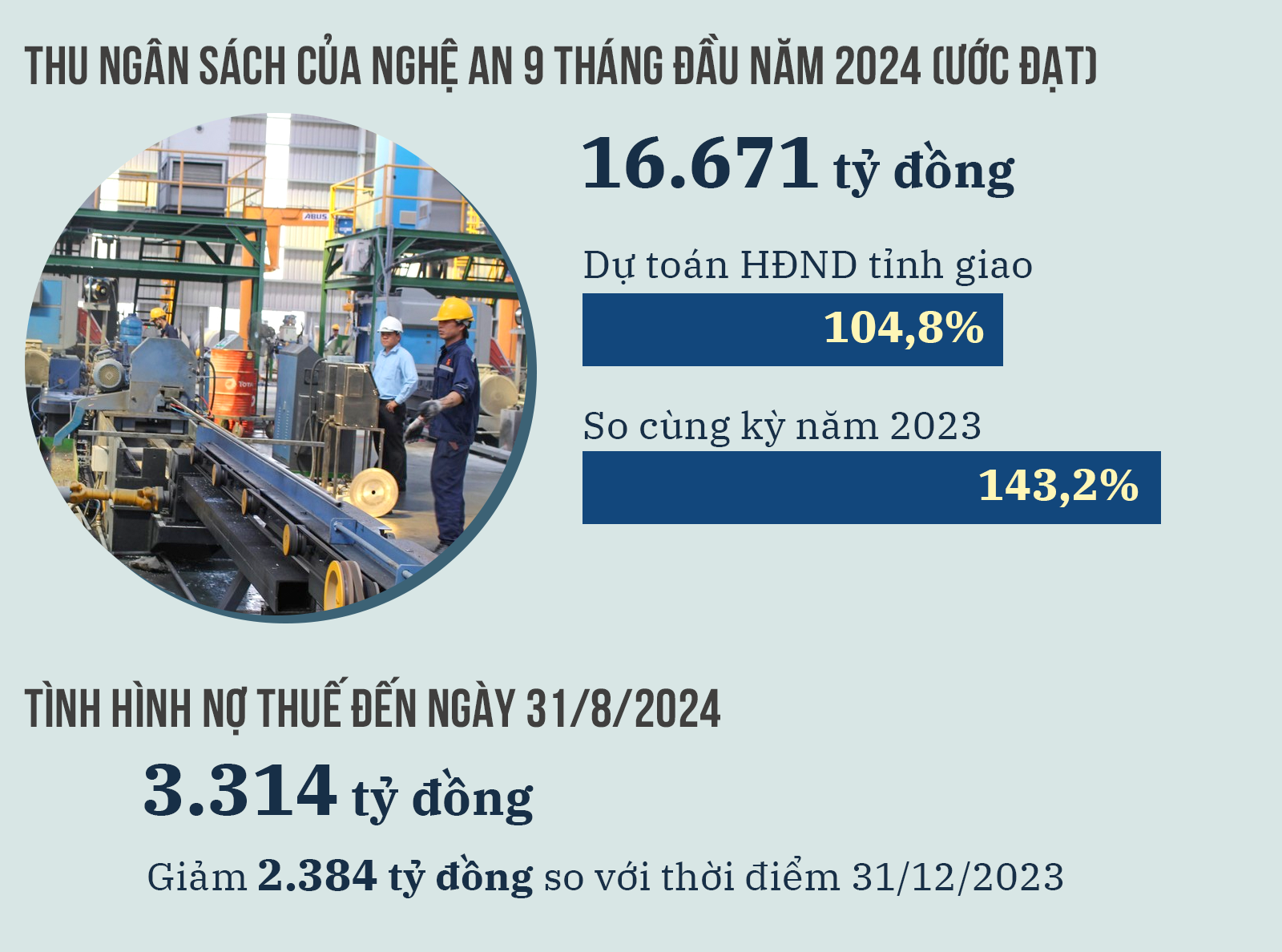

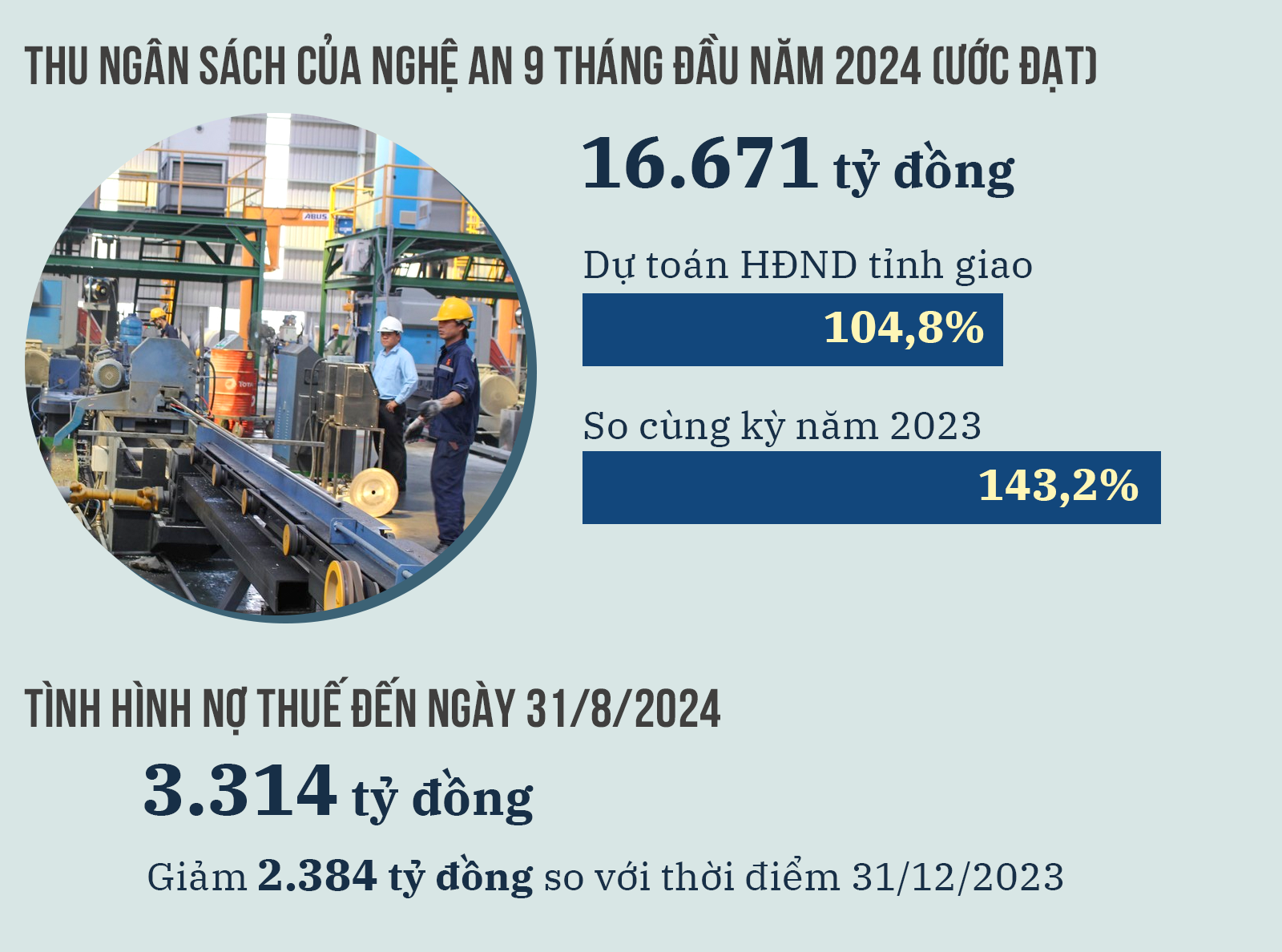

In the first 9 months of the year, Nghe An's budget revenue is estimated at 16,671 billion VND, reaching 104.8% of the estimate assigned by the Provincial People's Council, equal to 143.2% of the same period in 2023. Tax debt as of August 31, 2024 is 3,314 billion VND, down 2,384 billion VND compared to the same period in 2023.

Many effective solutions

In the context of the economic situation still having difficulties, the tax debt collection work in the first 9 months of the year in Nghe An has achieved many results. Right from the beginning of the year, Nghe An Tax Department has deployed the task of collecting the State budget, the task of collecting tax debt. Continuing to implement the topic of managing and preventing tax loss for types of businesses such as transportation, e-commerce... In addition, setting out emulation targets on inspection, examination, debt collection... for departments and Tax Branches to implement.

The Tax sector proactively grasps the production and business activities of enterprises. Focus on collecting tax debts in cases of large, long-term, and procrastination; continue to closely coordinate with local Party committees, authorities, relevant departments, branches and sectors such as: Police, commercial banks, Department of Planning and Investment, Market Management Department, Department of Natural Resources and Environment... in debt collection, especially handling and recovering debts related to land, fees for granting mineral exploitation rights...

Head of the Department of Tax Debt Management and Tax Debt Enforcement (Nghe An Tax Department) - Mr. Nguyen Canh Huong said: The total debt of the whole industry as of the debt closing date of August 31, 2024 is 3,314 billion VND, a decrease of 2,448 billion VND, equivalent to 42% compared to December 31, 2023.

The total tax debt mainly focuses on real estate businesses (land use tax debt), petrol and oil key businesses (environmental protection tax debt) and dissolved, bankrupt, and difficult-to-collect units...

To reduce tax debt in the past 9 months, the Tax sector has strengthened the direction and management of tax debt. The first solution is that from the beginning of the year, the Tax Department assigned the tax debt collection target for 2024 to each department and branch with many official dispatches such as Official Dispatch No. 539/CT-QLN dated January 23, 2024, Official Dispatch No. 669 dated January 25, 2024 on strengthening debt management and tax debt enforcement; Official Dispatch No. 1019 dated February 16, 2024 on implementing enforcement measures... Directing to focus on handling debts from land, this debt as of December 31, 2023 accounts for nearly 60%. In this group, Nghe An Tax sector has focused on classifying each debt group for handling.

The second group of solutions, the Tax Department consolidates and assigns tasks of monitoring and directing specific debt management work to each officer, civil servant, and debt management department leader for each tax branch. This is an important measure to act as a focal point to connect and handle work that is linked from branches to the department, to promptly urge and monitor the contents and policies in debt management work that the General Department and the Tax Department have deployed.

After assigning tasks, the debt management department leader monitors and supervises the work interaction process of each officer to promptly make appropriate adjustments.

The third group of solutions is the most effective group of solutions: Develop plans and programs to organize working groups led by department leaders to directly work at the branches on debt management and tax debt enforcement. Improve the effectiveness of leadership and direction for tax branches on tax management in general and debt management in particular. From there, promptly grasp and thoroughly handle long-standing problems and difficulties in debt management at tax branches. Specifically, such as handling more than 100 billion VND of recorded revenue and expenditure debts at the Bac Vinh Tax Branch; Urge the coordination of sectors to complete documents to have a basis for adjusting the handling of land use debt at the Song Lam II Regional Tax Branch; Urge branches to focus on debt freezing and timely tax debt enforcement...

Strengthen the "sprint" phase

Nghi Loc district is a locality that has done well in budget collection and tax debt collection. In the first 9 months of 2024, the total debt collected by Nghi Loc district was 13 billion VND/21 billion VND, reaching 61% of the debt collection target. The district has coordinated with communes to broadcast on loudspeakers businesses with lingering tax arrears; publicized tax debt information on the electronic system of the Tax sector, coordinated with the Tax Department to send debt messages to business owners and directors to urge debt collection.

The district also conducts review and classification of tax debtors, closely monitors and supervises the tax debt situation in accordance with the instructions in the Tax Debt Management Process, and regularly compares tax debts and standardizes tax debt data to ensure that there is no virtual debt. In addition, strengthen the implementation of measures to urge payment to the State budget for taxpayers with tax arrears of less than 90 days, avoid tax debt being prolonged, and limit the occurrence of new debts. Coordinate with departments and branches in the district, local authorities at commune and town levels to publicize tax debt information and coordinate debt collection.

Currently, a strong measure that the Tax sector has implemented is to announce a temporary suspension of exit for business owners with long-term tax debts. As of September 30, the Tax sector issued 38 official dispatches on temporary suspension of exit for business owners. In addition, money is withdrawn from the business's account, forcedchemicalApplication for tax arrears that are subject to enforcement in accordance with the provisions of the Law on Tax Administration and its implementing guidelines.

The Tax Department also closely monitors the production and business situation of enterprises to apply appropriate and effective tax debt enforcement measures. Implement enforcement measures against taxpayers when there are signs of procrastination or non-payment of taxes. For land use fee debts, classify debts according to the correct debt type and nature to have effective debt handling measures. For debts over 90 days old for auction documents, review and cancel auction winning results to update debt adjustments.

It is forecasted that in the coming time, the regional and world situation will continue to be complicated. Besides the advantages, the economic growth prospects in the province in the last 6 months of the year still face difficulties and challenges. The Government has directed the Ministry of Finance to urgently advise competent authorities on regulations affecting the State budget revenue in the area in the coming time, such as: extending the time for payment of value added tax, corporate income tax, personal income tax, land rent and special consumption tax for domestically manufactured and assembled cars; continuing to reduce fees and charges applicable in the last 6 months of 2024; reducing registration tax for domestically manufactured and assembled cars, etc.

Therefore, the budget collection work in general and the tax debt collection work in particular will face certain difficulties, requiring flexibility, timely grasp and besides, also creating the best conditions for businesses to expand their revenue sources. Localities, in conditions, need to set up inspection teams to urge the collection of tax debt in the area.

For Nghe An Tax Department, continue to promote the implementation of electronic invoices generated from cash registers and issue electronic invoices after each sale for retail business of gasoline and oil to taxpayers across the province, promote tax administrative reform, create maximum conditions for taxpayers to fulfill their obligations to the State budget.

Continue to vigorously implement debt management and tax debt enforcement. Strengthen inspection, supervision, and tax declaration management. Strengthen measures to prevent tax losses through inspection, examination, and supervision. Strictly control tax exemption, tax reduction, and tax refund, ensure tax exemption, tax reduction, and tax refund for the right subjects and in accordance with policies; focus on urging the collection of tax arrears.

Currently, the measure of temporary suspension of exit for individuals and legal entities with tax debts is implemented by the tax authority according to the procedure. After reviewing, comparing, and accurately determining the tax payment obligations of individuals, the tax authority directly managing the taxpayer makes a list of individuals subject to temporary suspension of exit and sends a document to the immigration authority, and at the same time, sends it to the taxpayer to complete the tax payment obligation before leaving the country.

Immediately on the day of receiving the document from the tax authority, the immigration authority is responsible for implementing the temporary suspension of exit according to regulations and posting it on the immigration authority's website.

In case the taxpayer has fulfilled his/her tax payment obligation, within 24 working hours, the tax authority must issue a document canceling the temporary exit suspension and send it to the immigration authority to cancel the temporary exit suspension according to regulations.