Nghe An: Risk of bad debt when borrowing to build "ship 67"

(Baonghean.vn) - Up to now, commercial banks in Nghe An have disbursed loans of VND860 billion to fishermen to build ships according to Decree 67. However, overdue debt has now arisen of more than VND8 billion and is expected to increase in the coming time.

|

| Iron-hulled boats 67/CP of fishermen in Tien Thuy commune, Quynh Luu district. Photo courtesy |

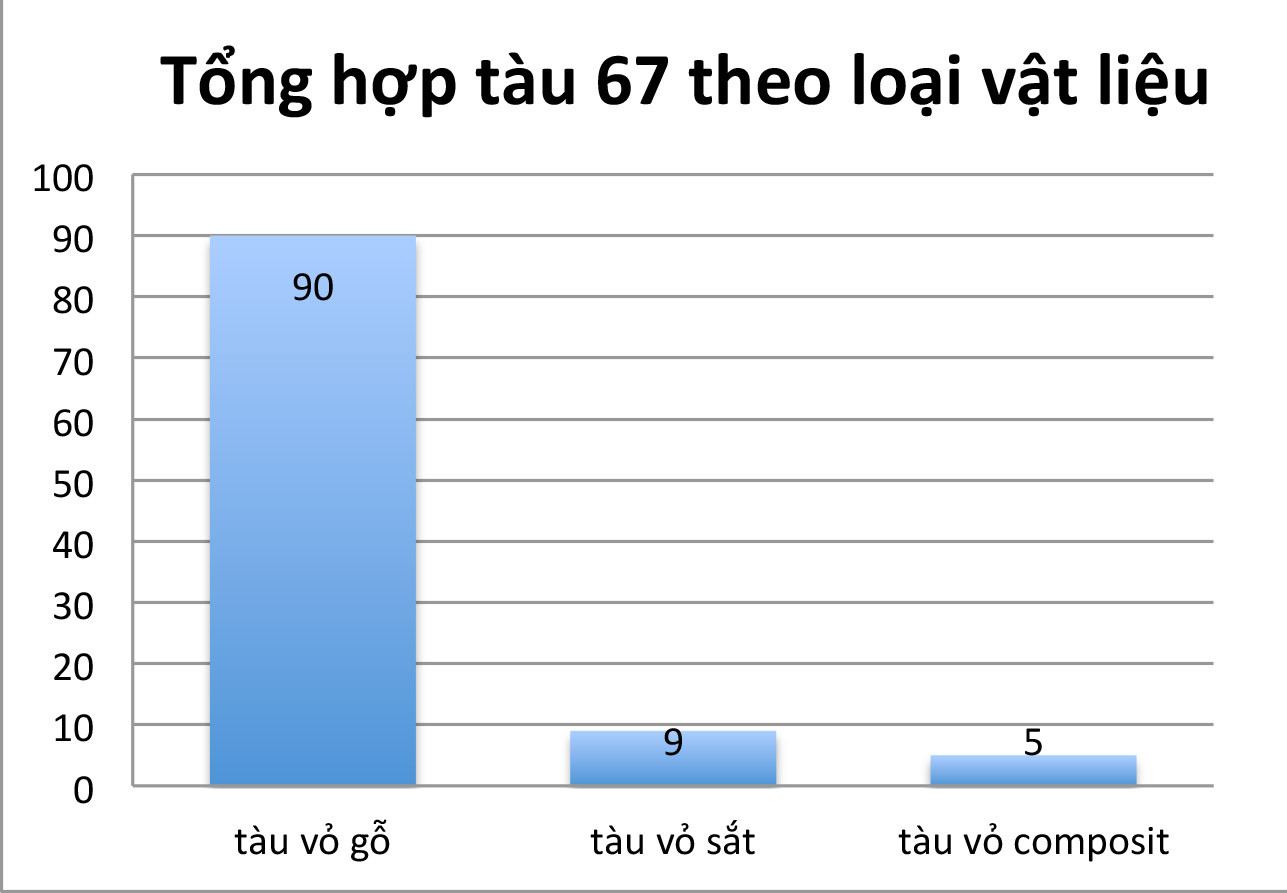

As of May 30, 2018, 104/110 ships had received capital disbursement from the bank, with total loan turnover reaching over VND 860 billion, including 90 wooden-hulled ships, 9 iron-hulled ships, and 5 composite-hulled ships. Nghe An is the third province in the country in terms of the number of newly built ships supported by the bank.

After more than 2 years of implementing Decree 67, there have been many cases of fishermen delaying debt repayment, causing many difficulties for banks, with the risk of difficulty in recovering capital.

|

| Graphics: TH |

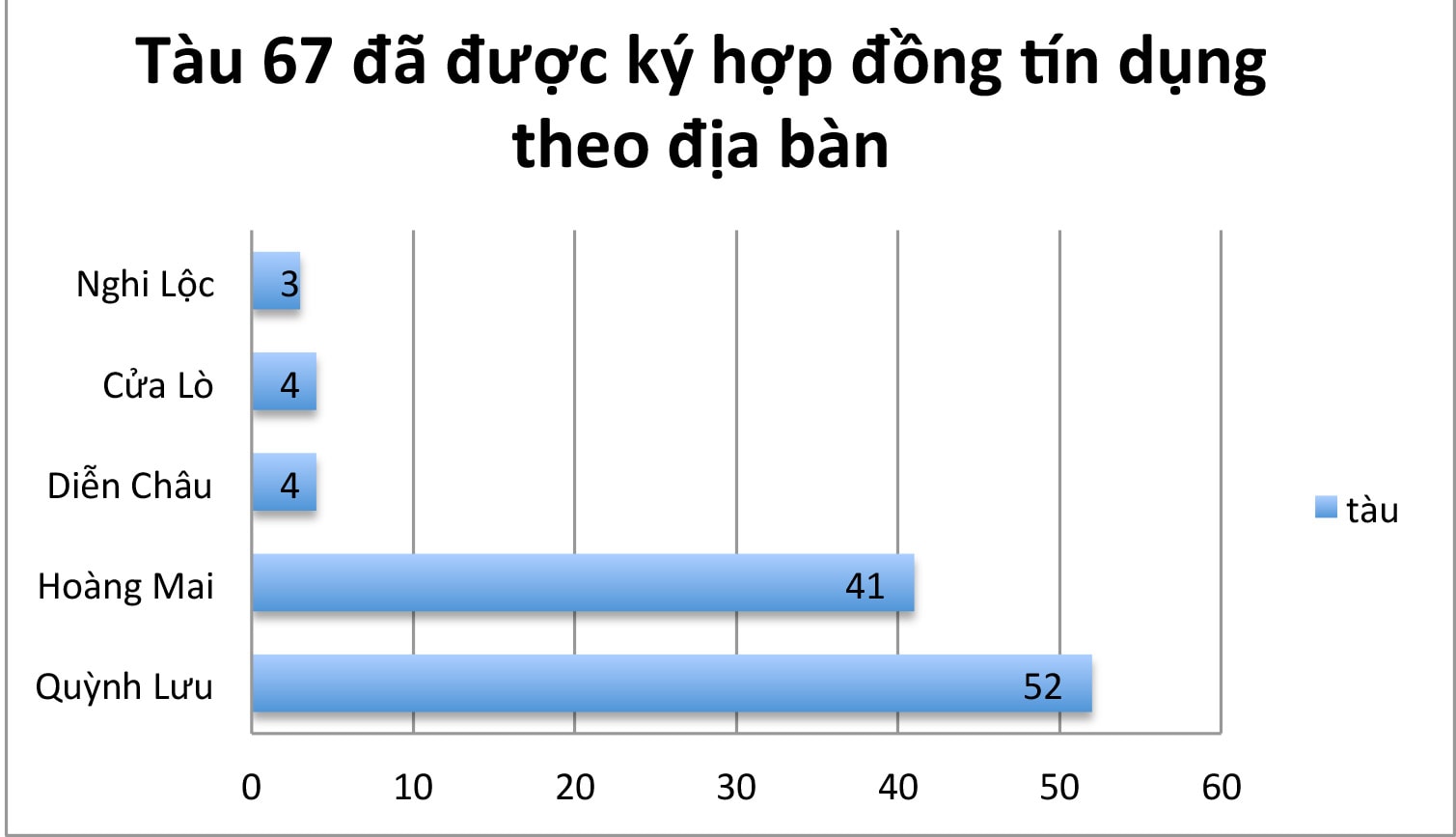

Banks with large loan turnover include: Vietinbank Bac Nghe An nearly 179 billion VND; BIDV Phu Dien more than 161 billion VND, Agribank Nghe An 321 billion VND, Vietinbank TP. Vinh more than 99 billion VND, BIDV Nghe An 26 billion VND; Vietinbank Nghe An nearly 30 billion VND; Vietcombank Nghe An more than 43 billion VND. After the first year without interest, this is the first year that customers borrowing to build ships 67 have to pay, but overdue debts have arisen and show signs of increasing if there are no measures to manage fishermen's cash flow, propagate and encourage them to pay their debts on time.

According to the State Bank of Vietnam, Nghe An branch, up to now, there have been 17 ships with overdue debts, accounting for 16% of the total number of 67 ships in the area, of which 8 ships have not paid their debts; 7 ships said that they were operating inefficiently and 2 ships had objective reasons. Notably, 1 ship refused to cooperate with the bank, moving the whole family and ship to another place to live. By May 31, 2018, overdue debts have arisen of more than 8 billion VND, of which principal debt is 5.3 billion VND, interest debt is 3.2 billion VND.

|

| Graphics: TH |

Mr. Cao Van Hoi - Deputy Director of the State Bank of Vietnam, Nghe An branch, said: Nghe An is among the top in the country in terms of the number of ships built under Decree 67 and is also among the top in the country in terms of the risk of bad debt from the program. It is worth mentioning that thousands of ships borrowed to build under the commercial program with mortgaged assets have been fully repaid, while loans to build ships under Decree 67 have generated bad debt. This phenomenon creates negative public opinion, affecting the entire program, requiring retroactive appraisal responsibility because all borrowers are assessed for financial capacity, fishing experience, qualifications, etc. by district and commune authorities and professional associations.