Nghe An effectively implements year-end budget collection solutions

(Baonghean.vn) - In 2020, the whole society focused all resources on disease prevention and control; Production and business activities encountered many difficulties, so many businesses had no revenue and no taxes. Therefore, focusing on budget collection at the end of the year is still an urgent solution.

Many efforts

At the Bac Nghe II Regional Tax Department, in the first 10 months of the year, revenue from a number of key enterprises was lower than the same period last year, affecting the State budget revenue of the entire department.businesses with large tax debts, in fact no longer in production or business but do not carry out dissolution or bankruptcy procedures or still exist but are slow to pay tax debts.

In addition, the Government issued policies to support people and businesses during the epidemic period, which had a major impact on reducing the state budget in 2020.

|

| Customers come to do transactions at Bac Nghe II Tax Branch. Photo: Tran Chau |

With a spirit of solidarity and high determination, along with the direct and timely direction and leadership of the Tax Department, Dien Chau and Yen Thanh districts, the coordination of communes and towns and the support and companionship of businesses and business households, the budget collection task in the first 10 months of 2020 of the Bac Nghe II Regional Tax Department achieved remarkable results. The total budget revenue of the entire department in 10 months reached 927,047 million VND, equal to 165.6% of the Ordinance estimate; 123% of the District People's Council estimate and equal to 145.8% compared to the same period in 2019.

In there:Budget revenueLand use fee deduction for 10 months reached 300,247 million VND, equal to 111.3% of the Ordinance estimate and the District People's Council estimate, equal to 114.2% over the same period in 2019; Non-state industrial, commercial and service tax (CTN&DVNQD) for 10 months reached 83,453 million VND, equal to 88.8% of the Ordinance estimate and the District People's Council estimate, equal to 102.5% over the same period in 2019.

In Dien Chau district, the total budget revenue for the first 10 months reached VND 536,402 million, equal to 172% of the Ordinance estimate; 135.5% of the District People's Council estimate and 132.7% compared to the same period in 2019. In Yen Thanh district, the total budget revenue for the first 10 months reached VND 390,665 million; equal to 157.6% of the Ordinance estimate; 109.2% of the District People's Council estimate and 168.7% compared to the same period in 2019.

|

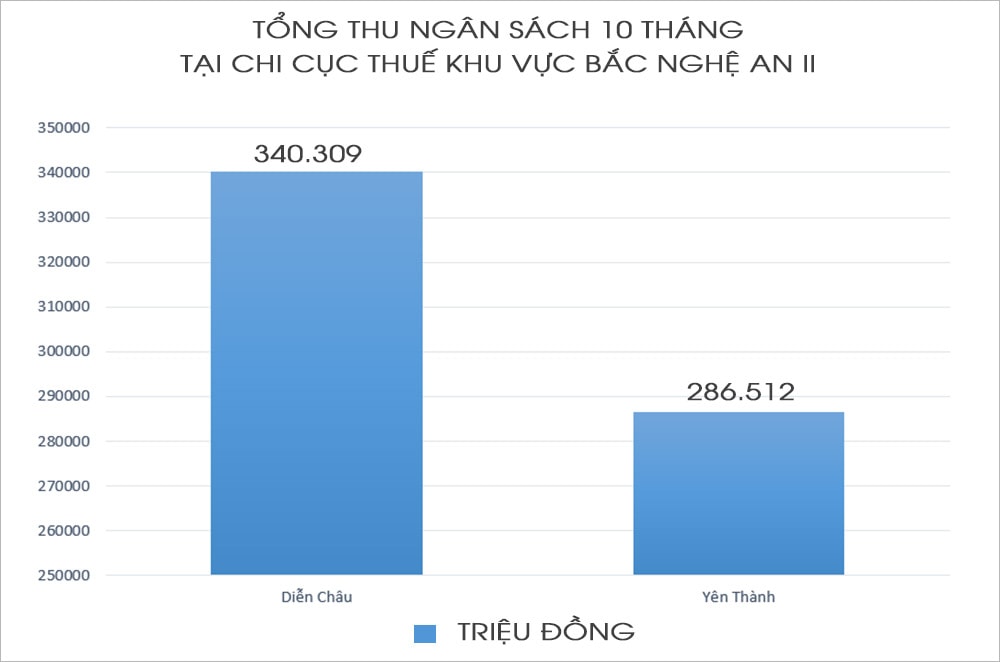

| Graphics: Lam Tung |

Total budget revenue in 10 months reached the highest ever due to the increase in land use fees in both localities (Dien Chau 340,309 million VND, Yen Thanh 286,512 million VND), total budget revenue minus land use fees in 10 months exceeded 11.3% of the 2020 estimate. Tax collection for private enterprises and public services was quite good, increasing over the same period in 2019 with an amount of 2,050 million VND; collection from business households in 10 months reached 62.6% of the estimate, equal to 77.4% of the same period in 2019; land rent collection reached 92.1% of the estimate and equal to 32.5% compared to the same period in 2019...

There are 8 revenue items higher than the first 10 months of 2019 and have completed the estimate such as: Central State-owned enterprise revenue; local State-owned enterprise revenue; non-agricultural land use tax; personal income tax; land use fee; other budget revenue; mineral exploitation right fee; fixed revenue at commune level. Mr. Bach Hung Dai added.

The locality also owes 83 billion VND in taxes, the reason for the debt is that production and business in the year faced many difficulties due to the Covid-19 epidemic affecting businesses, many businesses fell into a state of loss and insolvency.

In addition, some businesses and business households deliberately delay and evade taxes. Large land rental debts are mainly owed by businesses renting land in Yen Thanh district, including: Xuan Truong One Member Co., Ltd.; Binh An Mineral Co., Ltd.; Dong Duong Nghe An Investment and Construction Joint Stock Company; Tuong Nguyen Co., Ltd.; Nghe An Testing and Production Combination Center; Le Doan Nha Private High School; Chinh Phong Construction and Trading Joint Stock Company, the debt situation has not improved.

At the Song Lam I Regional Tax Department (including Do Luong, Thanh Chuong, Tan Ky districts), the budget revenue for 10 months reached 498 billion VND, of which Tan Ky reached 76.6 billion VND, Do Luong reached 270.6 billion VND, Thanh Chuong reached 150.8 billion VND...

Ms. Nguyen Thi Quynh Trang - Head of the General Department of Taxation's Budget Estimates said: Total domestic revenue in Nghe An province in 10 months reached 12,678 billion VND, equal to 98% of the Central budget estimate, 94% of the Provincial People's Council's budget estimate and 109% over the same period. Excluding land use fees, in 10 months it reached 8,930.5 billion VND, equal to 82% of the budget estimate and 100% over the same period. Domestic revenue mainly increased in the following items: Land use fees (equal to 150% of the budget estimate and increased by 39%, equivalent to an increase of more than 1,000 billion VND over the same period in 2019); environmental protection tax (equal to 95% of the budget estimate and increased by 25%, equivalent to an increase of more than 400 billion VND over the same period in 2019); Land rent collection (equal to 111% of the estimate and increased by 16%, equivalent to an increase of more than 40 billion VND compared to the same period in 2019)...

|

| Production and business activities are lower than estimated due to the impact of the Covid-19 epidemic. Photo: Lam Tung |

Strengthening solutions

In the context of the budget revenue being withdrawn at the end of the year, creating momentum for next year's revenue, the leader of the Tax Department of Song Lam 1 area said that he will strengthen the propaganda of new tax policies; urge taxpayers to pay tax and land rents extended according to Decree No. 41/2020/ND-CP of the Government. Continue to effectively implement measures to urge debt collection and enforce tax debt according to regulations and strengthen measures to prevent loss of State budget revenue.

Meanwhile, the Bac Nghe II Regional Tax Department focuses on reviewing revenue sources in the area, promptly urging units to declare taxes when there is tax payable and units whose extension period has expired according to Official Dispatch No. 1307/TCT-CS dated March 27, 2020 of the General Department of Taxation. In particular, focusing on exploiting the 2% extra-provincial tax revenue source in the area of some large projects (Dien Ky project, Dien Truong Leather Shoes project,...) to make up for the revenue shortfall due to the impact of the Covid-19 epidemic.

|

| The tax sector coordinates with commercial banks in tax payment. Photo: Tran Chau |

Strengthen the work of collecting tax arrears, fully apply tax debt enforcement measures to collect tax arrears to the State budget. In particular, promote the program of activities of the Steering Committee for preventing revenue loss and recovering tax arrears issued by the District People's Committee. Closely coordinate with departments, branches and People's Committees of communes and towns in budget collection. Strengthen the work of monitoring declarations, promote inspection work according to the risk analysis method, focusing mainly on units less affected by the Covid-19 epidemic.

To successfully complete the year-end budget collection task,Nghe An Tax DepartmentFocus on guiding and processing records quickly, promptly, and correctly for taxpayers who are granted tax and land rent payment extensions according to Decree 41/2020/ND-CP.

|

| Leaders of Nghe An Tax Department answered some of the problems of enterprises in the process of implementing electronic invoices. Photo: Lam Tung |

Instruct and process the dossiers of individual business households with taxable revenue under 100 million VND/year that temporarily suspend business from April 1, 2020 to receive support of 1,000,000 VND/household/month according to the provisions of Resolution 42/2020/NQ-CP; reduce 30% of corporate income tax payable in 2020 for small and micro enterprises; reduce 30% of environmental protection tax on aviation fuel according to the tax rate prescribed in Resolution No. 579/2018/UBTVQH14 dated September 26, 2018 until December 31, 2020; Reduce 15% of land rent payable in 2020 for enterprises, organizations, households and individuals who are directly leasing land from the State according to Decisions and Contracts of competent State agencies in the form of annual land rent payments and have to stop production and business due to the impact of the Covid-19 epidemic. In addition, focus on collecting tax arrears and reviewing revenue sources, analyzing revenue sources, focusing on supporting businesses to create momentum for revenue sources next year.