Bad bank debt can be up to 10%

Experts say that bad debt of the entire system in the second quarter will not stop at the rate of 8.6% as announced by the State Bank as of March 31, mainly due to economic difficulties and businesses not being able to repay bank loans.

Among the 6 listed banks that have announced their individual financial reports for the second quarter, the Export-Import Commercial Joint Stock Bank (Eximbank) and the Military Commercial Joint Stock Bank (MB) have seen a slight decrease in bad debt ratios compared to the first quarter. These are also the 2 units with high profit growth (nearly 10-30%) compared to the same period in 2011.

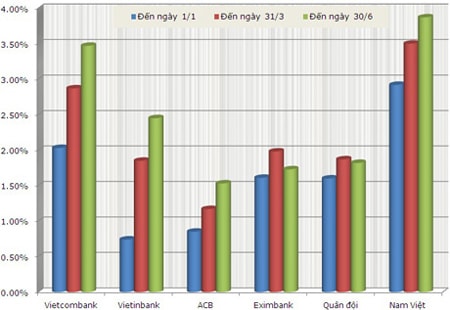

However, compared to the beginning of the year, bad debts at all 6 banks that have announced have increased sharply (see chart). In particular, the Bank for Foreign Trade of Vietnam (Vietcombank) and Nam Viet Joint Stock Commercial Bank (Navibank) have seen bad debts increase by nearly 4%.

Compare bad debt ratio at 3 points in time: Beginning of the year, end of first quarter and end of second quarter.

Data: Financial statements.

Specifically, compared to January 1, 2012, Vietcombank's bad debt ratio increased from 2.03% to 3.47%, Vietinbank's also increased from 0.74% to 2.45%. Debt with the possibility of losing capital (group 5 debt - the group with the highest risk) also increased by nearly 2,000 billion VND. In the case of Navibank, bad debt as of June 30 was 511 billion VND, of which 45% was debt with the possibility of losing capital (equivalent to 231 billion VND). Meanwhile, according to the State Bank Inspectorate, as of the end of March, group 5 debt of the whole industry accounted for about 40% of total bad debt (equivalent to 117.7 trillion VND).

Many experts believe that the stronger a bank is, the more it has lent in the past, the higher its bad debt is now. Therefore, according to them, proportional to its size, the two "big guys" Vietcombank and Vietinbank have such a rapid increase in bad debt.

Commenting on the bad debt figures of nearly 3% of Vietinbank and 4% of Vietcombank, expert Bui Kien Thanh said that for a large state-owned bank, a bad debt ratio of nearly 4% is "worrying". He also speculated: "It is possible that bad debt of state-owned banks is increasing because they have to lend on a directive basis to many state-owned enterprises".

According to Dr. Le Xuan Nghia - former Vice Chairman of the National Financial Supervision Committee - the rapid increase in bad debt should not be blamed entirely on banks. According to him, businesses cannot survive in the current situation, so they let bad debt increase.

"The failure of the economy to recover affects businesses, not banks. The longer it takes, the more the economy stagnates, the more businesses decline, and the more bad debt increases. Bad debt will increase even faster than in previous years," Mr. Le Xuan Nghia predicted.

Many experts fear that bad debt will increase at an even higher level.

Illustration: Hoang Ha.

For their part, bank leaders also "explained" that the increase in bad debt is inevitable because businesses are facing too many difficulties. Talking to VnExpress.net, Mr. Nguyen Thanh Toai - Deputy General Director of ACB analyzed that the economic downturn, the payment and trading capacity of businesses is also lower, leading to an increase in bad debt. ACB's bad debt ratio has increased from 0.85% to 1.53% after the first 6 months of the year, although ACB's representative affirmed that there is no bad debt in real estate and securities like in many other banks. However, this person admitted that bad debt falls heavily on the group of manufacturing businesses, including many large businesses.

However, according to Mr. Bui Kien Thanh, another reason why the bad debt figure in the second quarter increased compared to the first quarter is because banks have not previously declared the bad debt correctly, completely and honestly. "Bad debt may be much higher than what banks are announcing. Banks do not want to set aside provisions so they do not declare honestly," he worried.

Acting Chief Inspector of the State Bank Nguyen Huu Nghia also admitted that it was not possible to check all bank contracts and that there were many banks violating and concealing bad debts. "Detecting violations in debt classification can only be done through on-site inspection teams. However, with more than 100 credit institutions, it is impossible to conduct inspections simultaneously in one year," said Mr. Nghia.

The bad debt of the whole industry, according to the State Bank Inspectorate, was VND202,000 billion (accounting for 8.6% of outstanding debt) as of March 31. Banking and finance expert Nguyen Tri Hieu is concerned: "With the rate of increase in bad debt from the first quarter to the second quarter, the actual bad debt figure of the industry will certainly jump above 10%. And 10% is clearly alarming and dangerous." Previously, in March, at the National Assembly forum, Governor Nguyen Van Binh also reported that bad debt could be above 10%.

Commercial banks have set aside 67,000 billion VND in risk provisions to handle bad debts. However, Mr. Nguyen Tri Hieu said that such provisions are too little. "The assessment of debts to set aside risk provisions may be inaccurate and too low. According to my calculations, the provisions must be from 100,000 to 130,000 billion VND to be adequate," Mr. Hieu estimated.

According to (ebank.vnexpress.net)-LT