Vietnamese

People are not used to getting receipts when buying gasoline.

Regulations on issuing electronic invoices for each sale of gasoline and oil will be implemented from July 1, 2022. Decree 80 on gasoline and oil trading, which has just been issued and will take effect from November 18, 2023, also clearly states that retail stores of gasoline and oil traders: "Implement regulations on electronic invoices and provide electronic invoice data according to the provisions of the Law on Tax Administration, guiding documents of the Ministry of Finance and Tax authorities".

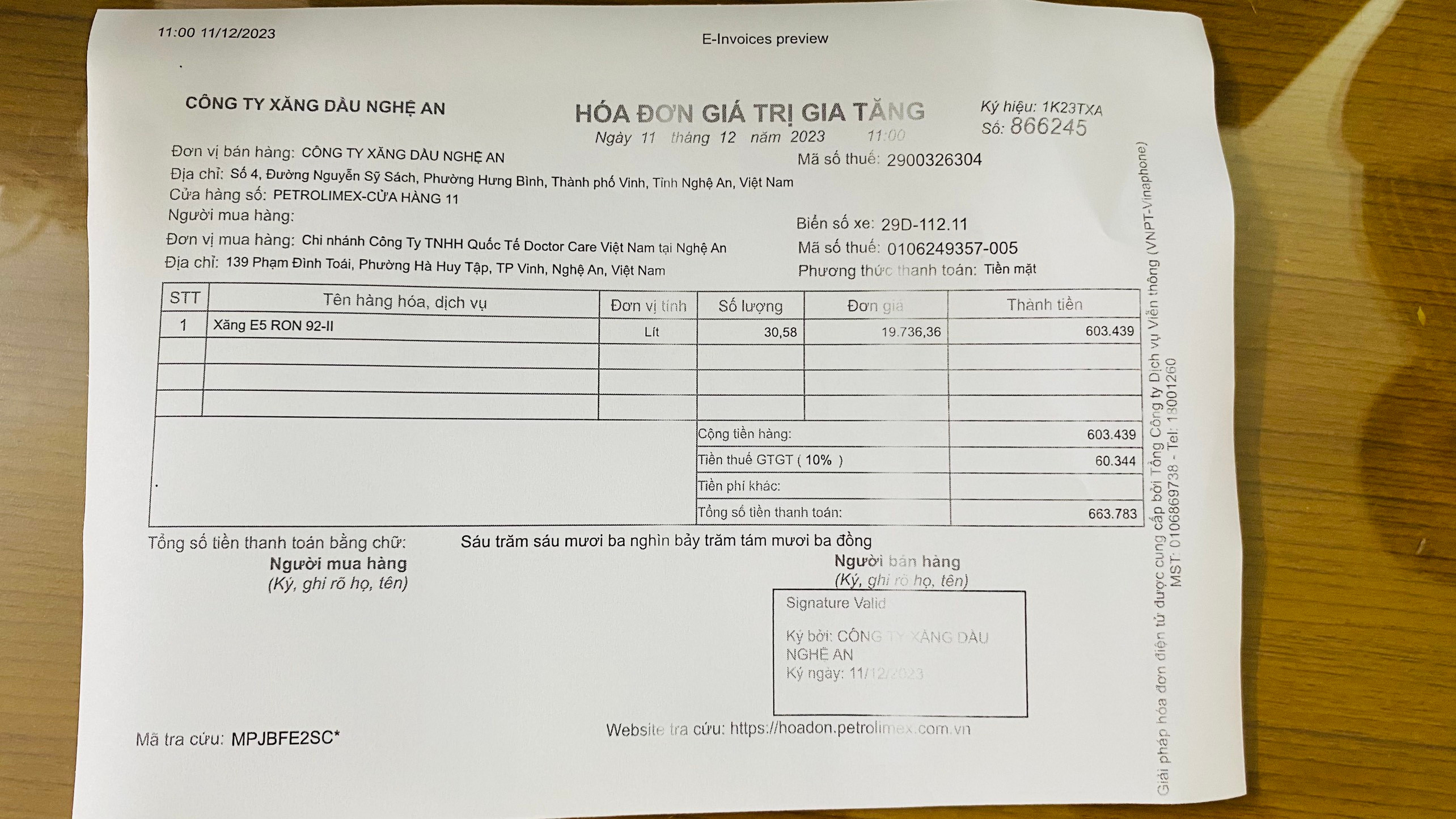

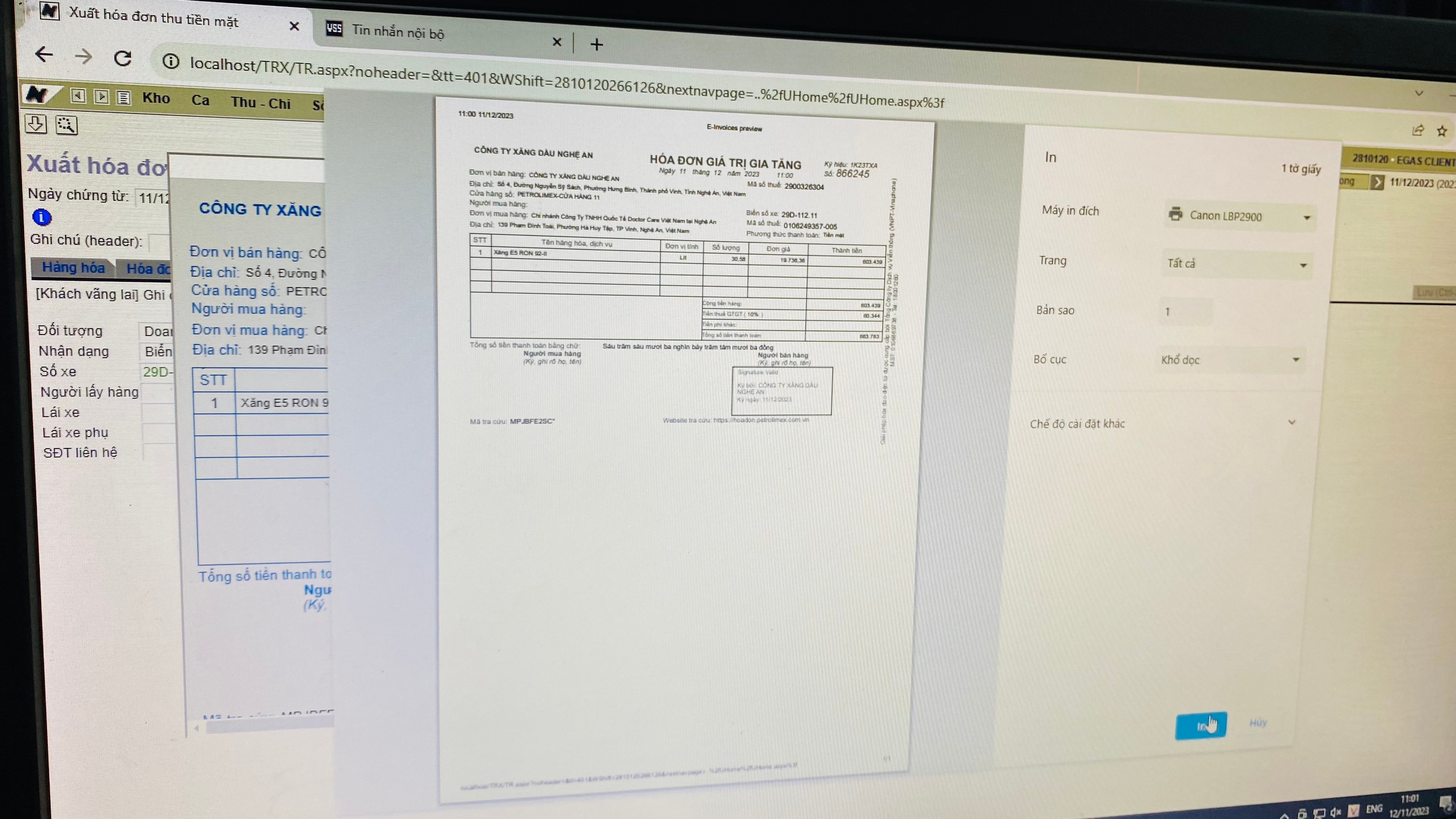

However, according to the reporter's records, at gas stations in Nghe An province, although the number of people coming in to fill up is very high during rush hours, the number of people waiting to get a receipt after each filling up are mainly businesses, units, and public vehicle drivers. For individual customers, after each filling up, people just leave without asking for this receipt.

For example, at the Petrolimex gas station at the roundabout of Le Hong Phong, Nguyen Thi Minh Khai, Hong Bang streets in Vinh City - one of the big gas stations in Vinh City, the issuance of invoices after each sale of gas is mainly for customers who are businesses and units. The number of people who come to fill up gas and wait to get invoices is very small.

Mr. Dinh Tri Dung, representative of this gas station, said: The store clearly understands the regulations and strictly implements the application of electronic invoices for each sale as directed by the competent authority. However, in reality, during peak hours, when the number of people filling up gas is large, the number of people who actually request invoices is very small. Mostly, customers are businesses and units that take invoices for payment, but if the customer is an individual, they almost do not take them even though the unit is willing to provide them. Therefore, it is very difficult to implement synchronously.

According to petrol station owners, applying the regulation of issuing invoices after each sale is completely reasonable. However, to implement it consistently, it still takes time and needs to create habits for consumers.

In addition, for a long time, most customers who buy gasoline and oil have not needed to get invoices, except for a few companies and businesses that need invoices for payment and settlement. In the past, gasoline and oil business was ineffective, discounts were unstable, while a large amount of money had to be spent to invest in infrastructure and equipment to serve the application of electronic invoices for each sale.

Direction of the General Department of Taxation

According to Decree 123/2020 of the Government regulating invoices and documents effective from July 1, 2022, petrol stations must issue electronic invoices for each sale. Sellers must ensure that electronic invoices are fully stored when selling petrol to individual customers, ensuring that they can be looked up when requested by competent authorities. This is the regulation, but in reality, many petrol businesses up to this point have not yet equipped with machinery and equipment to serve the issuance of electronic invoices.

Currently, Nghe An Petroleum Company is promoting and mobilizing stores to understand the regulations and seriously apply electronic invoices for each sale as directed by the functional sector. To implement mandatory electronic invoices for each sale of gasoline and oil, businesses will have to invest in hardware and software systems, at a considerable cost. In Nghe An, many gasoline and oil stores are worried that it will be difficult to meet the regulations in a short time.

On December 1, 2023, the Prime Minister issued Official Dispatch No. 1284/CD-TTg on strengthening the management and use of electronic invoices for petroleum business and retail activities.

To effectively implement the Prime Minister's direction in the above-mentioned Official Dispatch, the Ministry of Finance issued Directive No. 04/CT-BTC dated November 24, 2023 requesting heads of tax agencies at all levels to strengthen the management and use of electronic invoices to contribute to promoting national digital transformation; At the same time, the General Department of Taxation issued Official Dispatch No. 5080/TCT-DNL dated November 13, 2023 directing local tax departments to urgently strengthen management, inspection, supervision, and promote the issuance of electronic invoices for each sale of gasoline and oil retail activities.

On December 5, 2023, the General Department of Taxation continued to issue Official Dispatch No. 5468/TCT-DNL on the implementation of regulations on electronic invoices for each sale for retail gasoline business activities, accordingly:

The Tax Department of localities shall organize to fully and promptly disseminate to each leader and civil servant in the unit the viewpoints and directions of the Prime Minister and the Minister of Finance in the above documents to further raise awareness of the organizational and individual responsibilities of cadres and civil servants in the unit in organizing the implementation of legal provisions on invoices and documents in the Tax Administration Law No. 38/2019/National Assembly 14, especially the provisions on issuing electronic invoices after each sale at retail stores of gasoline and oil as prescribed in Decree No. 123/2020/ND-CP, which is one of the mandatory and important tasks that must be performed.

The Tax Department will rectify tax management for businesses and retail stores of petroleum in the area and deploy effective management solutions to strengthen management to ensure correct and full collection; Promote solutions to combat fraud and tax losses according to the provisions of law; Deploy synchronous, effective solutions, resolutely requiring retail businesses of petroleum to issue electronic invoices after each sale at retail stores of petroleum in accordance with the provisions of law, the direction of the Prime Minister and the Ministry of Finance.